Evaluating Mutual Fund Performance Amateur Asset Allocator

Post on: 4 Май, 2015 No Comment

This is a guest post by Mike Piper, who blogs at The Oblivious Investor .

Like Kyle. Im a big proponent of index funds. And Im not shy about suggesting that investors steer clear of actively managed mutual funds.

With 2009 recently concluded (and performance numbers just posted), I received an email from an investor informing me how misguided I am in my attempts to discourage people from trying to pick market-beating funds.

The investor presented as evidence a fund hed invested in and the degree to which it had outperformed the S&P 500 in 2009. (For the moment, lets set aside the fact that one year of performance is essentially meaningless from a statistical point of view.) Unfortunately for this investor, hisor his financial advisorsfund-picking prowess isnt quite what hed thought.

His fund actually under performed a comparable index fund by just over 23% for 2009.

You see, the fund in question (American Funds New World Fund) can most accurately be classified as an emerging markets fund, not a U.S. stock fund. So it doesnt make any sense to compare its performance to that of the S&P 500.

And when you compare its performance to that of Vanguards Emerging Markets Stock Index Fund, the fund has actually underperformed over the last year, 3 years, 5 years, and 10 years. Not particularly impressive.

Making Fair Comparisons

In attempting to determine whether a fund manager has achieved his goal of providing above-market returns, its important to compare his performance to that of an appropriate benchmark. Otherwise (as in the example above) we may make the mistake of thinking hes achieved something impressive, when in reality, he was just in the right place at the right time.

An easy way to find an appropriate benchmark for comparison is to look up a fund at Morningstar . For example, on this page. we can see that Fidelitys Magellan fund is a Large Growth fund. So, when making comparisons regarding Magellans performance, its important to use a large-cap growth index.

Dont Put Much Faith in Past Performance

However, even more important than making proper past performance comparisons is to remember that past performance answers the question how did this fund do? not how will this fund do? When attempting to find future top performers, past performance has been shown to be a very poor predictor. (Theres a reason that such a disclaimer is required on mutual fund ads!)

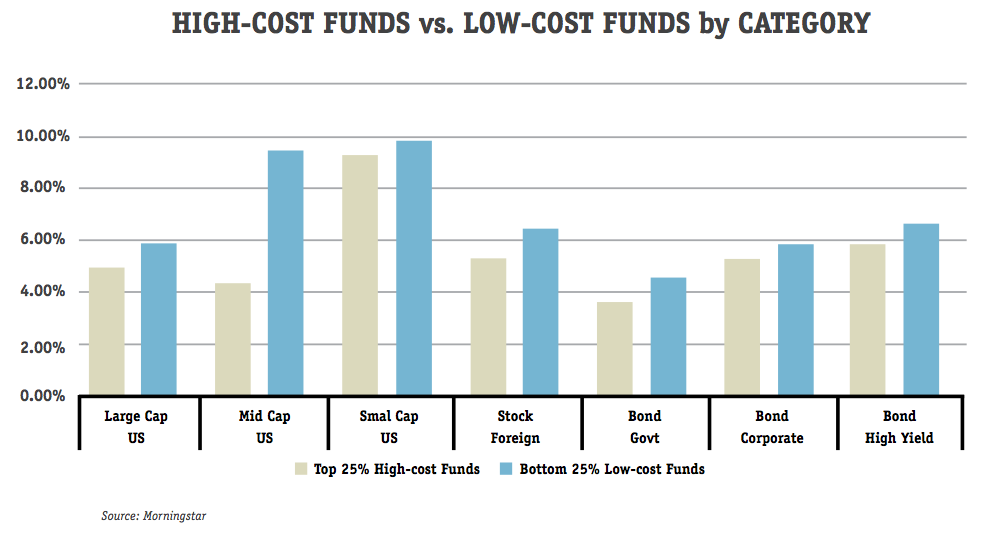

Two far more reliable predictors of future performance are low expense ratios and low portfolio turnover. And those point us in one direction every time: low-cost index funds and ETFs .

About the Author: Mike Piper is the author of Investing Made Simple . He also blogs at The Oblivious Investor .