ETNs Are Riskier Than ETFs but Possess Some Attractive Qualities

Post on: 4 Май, 2015 No Comment

Exchange-traded notes are far less popular than ETFs, largely because of a big added risk. But ETNs also have special benefits that can make them attractive.

The Journal Report

ETNs are far fewer in number and have attracted only about 1% of the dollars in ETFs. A key reason is that they entail an extra risk that was clearly on display during last year’s credit crisis.

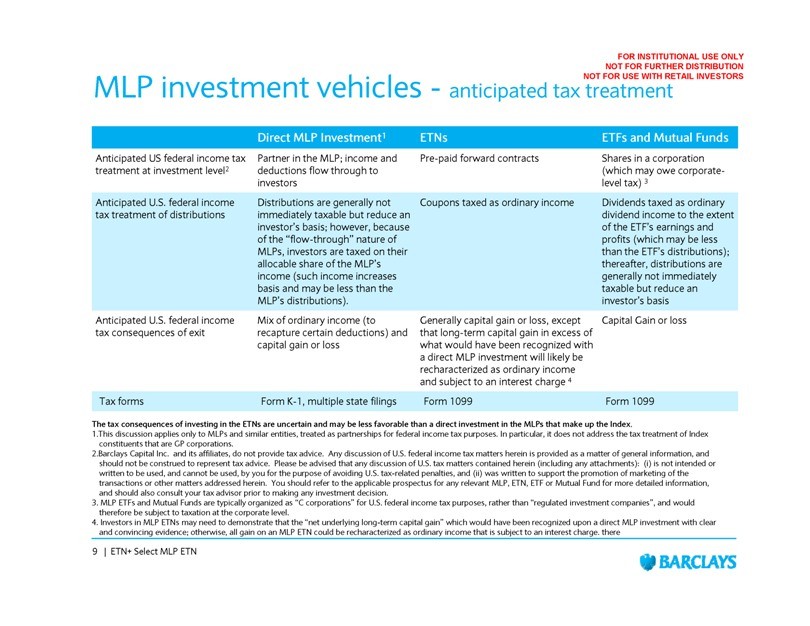

Still, the notes have advantages that make them worth considering for some uses. In particular, more favorable tax treatment makes them attractive for investors who want commodities exposure in their taxable accounts. It’s a lot more tax-efficient to own commodity ETNs than commodity ETFs, says Scott Burns, head of ETF analysis at researcher Morningstar Inc. Also, ETNs may offer access to investment strategies that aren’t available in other vehicles.

Unlike traditional mutual funds, both types of exchange-traded products can be bought and sold all day long like individual stocks. But beyond that, they offer investors a stark choice: between owning a portfolio or owning a promise.

Most ETFs, like ordinary mutual funds, give investors a stake in a basket of securities, such as stocks, bonds or futures contracts. A few ETFs hold physical assets, such as precious metals.

ETNs, by contrast, are unsecured debt obligations issued by a corporation, such as a bank. Rather than paying a fixed rate of interest, like an ordinary bond, they deliver a return based on the performance of a benchmark, minus expenses.

All you have is the promise of the issuer to pay, says Christopher Cordaro, chief investment officer at financial adviser RegentAtlantic Capital LLC in Morristown, N.J. As such, the ETN introduces a whole other layer of risk you have to be cognizant of.

That risk was front and center last year, when ETN issuers Bear Stearns and then Lehman Brothers were caught up in the credit crisis. When Lehman went under, it had three ETNs outstanding, with very few dollars in them. Anyone who held those notes at the time ended up as an unsecured creditor of the firm.

ENLARGE

Sergio Ruzzier

Bear Stearns had one ETN when it was acquired by J.P. Morgan Chase & Co. J.P. Morgan stands behind the ETN, but withdrew the notes’ exchange listing in June of this year, citing the limited availability of the security. There is about $10 million outstanding.

Smaller Tax Bite

Interest in ETNs plummeted last year amid the credit woes. But in recent months, with the financial system seemingly on the mend, some newer ETNs have attracted a fair amount of interest and investor dollars.

Still, ETNs are like the forgotten stepchildren of the ETF industry: unloved and overlooked, Matt Hougan, editor of IndexUniverse.com. wrote on that Web site in late October. Investors (particularly taxable investors) are missing out.

He explains that he believes the credit risk of buying an ETN issued by a highly rated bank such as Barclays PLC or Deutsche Bank AG is fairly low. By contrast, with a commodity ETF, the risk of getting hit with a bigger tax bill is 100%, he says.

To understand the tax advantages of commodity ETNs, investors first have to grasp how commodity ETFs are taxed. Most of those ETFs buy futures contracts. Under tax rules, taxable investors in most futures owe tax on any appreciation each year, even if they don’t sell. Sixty percent of any gain is taxed as a long-term capital gain; 40% is taxed as a short-term gain, at ordinary-income rates.

Further, those futures-owning ETFs are generally structured as limited partnerships, which report their taxable income to investors on K-1 forms, rather than the 1099s associated with most other investments. Many do-it-yourself tax filers don’t know how to handle the K-1s, and those who use accountants can face higher charges because of the K-1s, says Louis Stanasolovich, president of Legend Financial Advisors Inc. in Pittsburgh.

ETNs are more tax-friendly. While the Internal Revenue Service hasn’t specifically addressed the tax treatment of commodity ETNs—adding an element of tax uncertainty—the accepted practice, based on opinion letters from law firms, is to treat the notes as prepaid financial contracts, issuers and financial advisers say.

ENLARGE

That means gains are taxed only upon sale, and gains on commodity ETNs held longer than a year are considered long-term, currently subject to a maximum 15% tax rate. (Single-currency ETNs are one category of ETN subject to different tax treatment.)

Another potential advantage of ETNs is that investors don’t have to worry about tracking error—or the risk that the managers of an index-linked portfolio can’t deliver results in line with the benchmark. With an ETN, the investor is promised an index-based return and the issuer takes the risk of investing the dollars.

Attracting Assets

Lane Jones, chief investment officer at Evensky & Katz Wealth Management in Coral Gables, Fla. says he generally prefers ETFs to ETNs because of ETNs’ credit risk, but he will use ETNs to get exposure that isn’t available in other forms. For instance, his firm has used the largest ETN, iPath Dow Jones-UBS Commodity Index Total Return. because the firm prefers that ETN’s index to the indexes used by some commodities ETFs.

With some types of underlying securities or investment strategies, it can be easier or quicker for financial firms to bring the product to market as an ETN than as an ETF that has to manage a portfolio.

That’s why Barclays chose the ETN structure for two products it introduced in January that are linked to measures of stock-market volatility, says Noel Archard of BlackRock Inc. He is the head of U.S. research and development for the iShares ETF business that BlackRock last week purchased from Barclays. The iShares unit has worked with Barclays Capital to distribute Barclays’ iPath ETNs and will continue in that role, BlackRock and Barclays say.

Before the sale of the iShares unit to BlackRock, Barclays was by far the biggest player in both ETFs and ETNs.

Mr. Stanasolovich, the Pittsburgh adviser, recently bought and then sold the new Barclays iPath S&P 500 VIX Short-Term Futures ETN in a short-term bet on rising stock-market volatility. That ETN has grown to be the third-largest ETN in less than one year of existence.

RegentAtlantic’s Mr. Cordaro, meanwhile, is using another new ETN that has attracted considerable assets. JPMorgan Alerian MLP Index offers a return linked to an index of energy master limited partnerships, income-producing vehicles that typically own pipelines. The ETN, introduced by J.P. Morgan Chase in April, has the same focus as the earlier Bear Stearns ETN.

There are limits on how much money certain types of portfolios can invest in master limited partnerships, Mr. Cordaro says, and investors who buy MLPs directly are socked with K-1 tax forms. With the ETN, you get exposure to the index without having any K-1s, he says.

One of Morningstar’s favorite ETNs is Elements S&P Commodity Trends Indicator Total Return. issued by a unit of HSBC Holdings PLC. While Morningstar’s Mr. Burns says the iPath Dow Jones-UBS Commodity ETN is a solid choice for broad commodities exposure, he prefers this product’s additional strategy of buying commodities that are rising in price and betting against those that are falling. It’s like a commodities fund with a brain, he says.

Ms. Damato is a news editor for The Wall Street Journal in South Brunswick, N.J. She can be reached at karen.damato@wsj.com .