ETFs vs mutual funds

Post on: 4 Май, 2015 No Comment

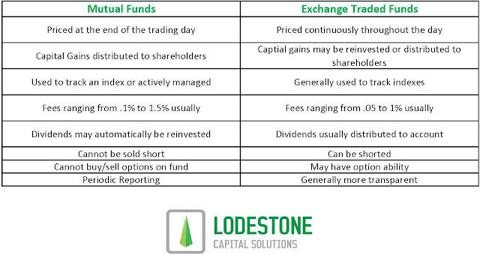

Exchange-traded funds (ETFs) and mutual funds are two different investment products that one can use to hold a diversified portfolio of stocks. bonds or other assets. There is frequent discussion in the Bogleheads forum on the comparative merits of each. Below is a comparison ordered by the various factors, in the rough order of importance.

Overall, there is no clear winner: it is up to each investor to consider the tradeoffs, like ease of use vs intraday tradeability, and how applicable they are to their situation and goals.

The choice might not be very important: the contrast as presented in media and literature is usually between ETF investing and traditional, high-cost, active mutual funds, which ETFs easily win on cost. If, on the other hand, the funds under consideration are all low-cost index funds. then an investor is probably fine either way.

Contents

Expense ratios

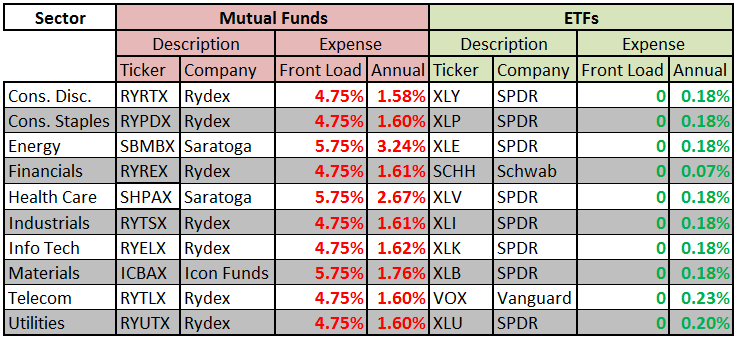

Expense ratios (ERs) are the annual management expenses paid on an ongoing basis. Because they reduce investor returns, ERs are among the most important factors in long-term performance.

ETFs generally have the lowest ERs available to small investors.

Mutual fund expenses can be somewhat higher, with the exception of Vanguard Admiral funds which are the same as their ETFs. The various fees of active mutual funds can be much higher, sometimes outrageous; see Mutual funds and fees for more details.

Examples:

- VTI (Total stock market ETF): 0.05%, versus VTSMX at 0.17%, but also VTSAX (Admiral shares) at 0.05%.

- SCHZ (Total Bond Market ETF): 0.06%, versus SWLBX 0.29%.

- DODGX (large active stock fund): 0.52%.

Advantage: ETFs or tie.

Trading costs

These are costs paid once for each trade, whether a sale or a purchase. They are most important for smaller portfolios and/or frequent investments.

ETFs usually incur a small brokerage commission, the same as for stocks, typically in the $5 — $10 range. Most brokerage houses have in-house or favored ETFs which can be traded at no commission.

ETFs also incur a penalty from bid/ask spreads in the market, typically in the 0.01% — 0.1% range (varying with fund size and popularity) and a premium/discount to net asset value (NAV) that can vary from negligible to highly significant. In some illiquid sectors like municipal bonds. persistent ETF discounts can prevent an investor from selling at a fair price for an extended period. [1]

Mutual funds are more often bought at their originating firm, where they incur no commission. When bought at a different brokerage, fees can be much higher, for example $50 / transaction; however, zero fee arrangements are even more widespread than with ETFs. It’s very important to select either the account location or the fund so as to avoid the large transaction fees.

Mutual funds always trade at NAV and are not subject to bid/ask spreads or premium/discounts.

Advantage: Mutual funds, if bought directly from a fund provider or a brokerage that offers the fund in their no transaction fee selection.

Trading frequency

This refers to timing restrictions and the customary use of the two types of instruments.

ETFs can be traded at any time during the day, more or less instantaneously. The downside is a three day settlement time during which sale proceeds cannot be removed from the account. ETFs are the vehicle of choice for frequent traders.

Mutual funds can only be bought at the end of the day. The settlement time is shorter, however: one day or even immediately by routing sale proceeds to an external account.

Most mutual funds also have additional fees or restrictions for back-and-forth trades less than a few months apart. For example, Vanguard will restrict purchases of the same fund for two months after a sale, see Frequent trading policy for the policy and workarounds. Other funds charge a redemption fee for shares held less than 90 days. Because of these restrictions, mutual funds are only suitable for longer term holdings.

Advantage: ETFs are more flexible.

Tax efficiency

Funds of both kinds sometimes distribute capital gains due to trading activities, which is undesirable in a taxable account (for stocks, at least). For more details, see Tax efficiency of stocks .

ETFs have an inherent tax efficiency advantage due to their share redemption process (see ETF Taxes ). Other things equal, an ETF can be expected to distribute less capital gains than its mutual fund equivalent, often none at all.

Mutual funds can only rarely eliminate capital gains in the same fashion. The exception is Vanguard’s dual-share fund structure. which allows their index funds to be just as tax-efficient as ETFs. In addition, index funds in general have very low turnover, limiting the extent of the problem.

Advantage: ETFs, or tie if Vanguard.

Trading mechanics

This refers to how easy it is to transact either type of fund.

ETFs tend to require more attention, because the bid/ask spread and premium/discount factors mentioned in Trading costs can turn highly unfavorable for short intervals. For example, one is advised to use limit orders instead of market orders. On the other hand, ETFs provide more sophisticated order options like long term stop-loss orders (the value of which is rather debatable). ETFs also allow the direct use of covered options.

Automatic investments can be problematic with ETFs; this includes things like dividend reinvestment and monthly deposits or withdrawals. Even when the broker offers this functionality for free, the execution price might not be favorable to the investor.

In addition, buying ETFs usually involves share number calculations.

Mutual funds can be bought and sold in a single, friction-less transaction, much like transferring from one bank account to another. They are much more suitable for automatic investment of all kinds.

Advantage: Mutual funds, for most investors.

Availability and portability

Access to the two types of instruments can vary greatly between accounts. For taxable investments, this can be an important factor if one plans to move assets in the future without incurring a taxable event.

ETFs are generally an all-or-none proposition: a brokerage will offer access to all ETFs in the market. When a brokerage option is not available (e.g. in retirement accounts), no ETFs can be purchased.

It is generally easier to make charitable donations of ETFs in-kind, because the brokerage of the charity should always be able to handle them.

Mutual funds tend to be more restricted; for example Schwab may offer easy, free access to Schwab funds but make Vanguard funds expensive or not available at all (such as Admiral shares). Charities and other brokers may not be able to receive a particular mutual fund in-kind.

However, Vanguard index funds offer an ETF conversion option that solves this problem for assets held at Vanguard.

Advantage: ETFs.

Intraday pricing

ETFs have price and related indicators (like yield) constantly updated throughout the trading day. This means it’s easier to make accurate decisions about rebalancing and tax loss harvesting, for example. However, when the market is closed the price is just as opaque; the next day’s opening price (at which a market order would be executed) could move up or down an arbitrary amount.

Mutual fund prices are only updated after the market close, typically 4 pm EST. A workaround for funds that are closely related to certain ETFs is to extrapolate the mutual fund price from the intraday movement of the ETF price. If precision is a goal, it’s best to place the order shortly before the market close to minimize the chance of market shifts during the remainder of the trading day.

Advantage: ETFs.

Fractional shares

ETFs can only be bought in whole share amounts. Typically, this results in small amounts of cash left over uninvested, which can be an annoyance. When starting with a dollar amount, one has to calculate the number of shares they can buy before placing an order.

Mutual funds can be bought and held in any fractional number. The order can be specified as either dollars or number of shares, and there are no leftover amounts.

Advantage: Mutual funds.

Coverage

This refers to the ability to get desired asset classes and strategies in either form. Because it can be inconvenient to move money between ETFs and mutual funds, coverage can be a factor even when an investor’s initial choices are equally available.

ETFs tend to offer the largest asset class selection and granularity in passive form. For example, there are ETFs available for Middle East indexing, or the solar sector, with no corresponding mutual funds.

Mutual funds offer more strategies, for example active funds, balanced funds or go-anywhere funds. Of these, balanced funds are the most interesting to passive investors.

Advantage: Depends on investor goals.

Vanguard funds

Vanguard ETFs are structured as another share class of a mutual fund, like Admiral or Investor shares. This is a process unique to Vanguard, protected by a patent until 2023, with two important consequences for the mutual fund investor:

- Tax efficiency: the mutual fund shares benefit from the disposition of capital gains through ETF shares, making Vanguard funds with ETF share classes as efficient as an ETF.

- Conversion: mutual fund shares can be converted to ETF shares without a taxable event. This helps when transferring assets to another broker, including charitable donations. Conversion in the other direction is not possible.

The second point is an argument to start with mutual fund shares at Vanguard, if unsure. One can always convert to ETF later if needed.

To find out whether a mutual fund has ETF shares, visit the fund page on vanguard.com and look for Also available as an ETF. Most or all index funds do have ETF shares and benefit from the above considerations. Note that a few bond funds cannot be converted in kind to their ETF shares, but in these cases converting through a normal, taxable transaction is not expected to cost much in taxes because of the very limited capital gains of such funds.

Vanguard’s Admiral shares of index funds generally have the same expense ratios as the ETF shares, which are themselves competitively priced in the ETF market. Therefore, if Admiral shares are available and one meets the required minimum (usually $10,000), there is no fee advantage for using ETFs. Before hitting the $10,000 mark, the cost difference is small in absolute terms, for example:

Emerging Markets Index Fund Investor Shares VEIEX