ETFs v Funds

Post on: 6 Август, 2015 No Comment

ETFs vs. Mutual Funds: Similarities

Mutual funds and exchange-traded funds (ETFs) share similarities and can serve similar purposes for investors. Both, for example, can provide the basic building blocks of investors’ portfolios. An ETF is similar to a mutual fund in that it offers investors a proportionate share in a pool of stocks, bonds, and other assets. ETFs are most commonly structured as open-end investment companies, like mutual funds, and are governed by the same regulations as mutual funds. Also, like a mutual fund, an ETF is required to post the marked-to-market net asset value (NAV) of its portfolio at the end of each trading day.

ETFs vs. Mutual Funds: Key Differences

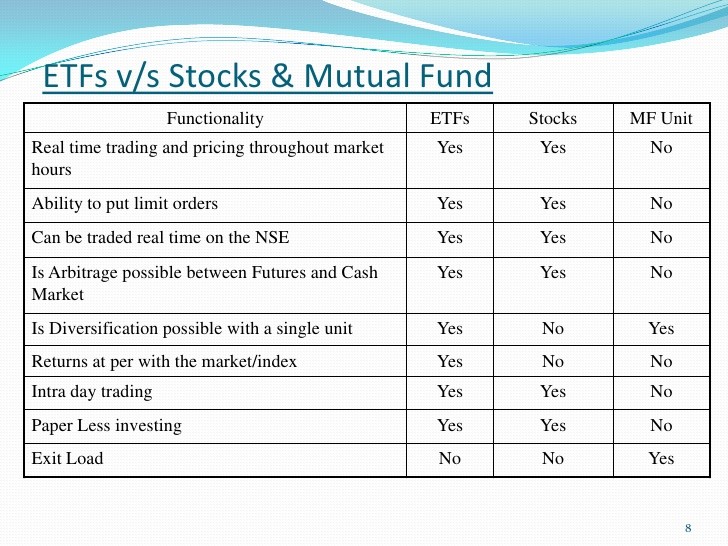

ETFs present several advantages over mutual funds, including their lower cost, greater transparency, liquidity, and tax efficiency:

The expense ratios of ETFs are generally lower versus active mutual funds and in some cases, even lower than index mutual funds. Also, ETFs often have lower trading costs versus actively managed funds, due to their low portfolio turnover. The ETF cost savings can be significant, especially for long-term investors. Investing in ETFs will usually result in a brokerage commission, but the savings from lower expense ratios can help to offset these transaction costs. Also, ETFs do not impose back end redemption charges like many mutual funds.

Fund Transparency and NAV

Actively managed mutual funds report their holdings on a quarterly or semiannual basis, whereas exchange-traded funds disclose their portfolio holdings on a daily basis. This provides ETF investors with a greater degree of financial transparency. The ETF performance and portfolio composition are a reflection of the underlying index. Consulting the index providers website is another way of easily identifying the underlying holdings of an index ETF.

Mutual funds are bought and sold at net asset value (NAV), which is determined by subtracting a funds liabilities divided by the number of shares outstanding from the value of a funds total assets. All buy and sell transactions are conducted directly with the fund company. In contrast, ETFs are bought and sold on a stock exchange based upon market prices, which fluctuate according to supply and demand.

ETFs generally trade close to their net asset value. Its rare to see ETFs trading at a large premium or discount to their NAV, but it can happen. Historically, institutions have seen this as an arbitrage opportunity by creating or liquidating creation units. This process keeps ETF share prices closely hinged to the NAV of the underlying index or basket of securities.

Taxes and Portfolio Turnover

Annually, both mutual funds and ETFs are required to distribute dividends and portfolio gains to shareholders. This is usually done at the end of each year and these distributions can be caused by index rebalancing, diversification rules, or other factors.

For U.S. investors, ETFs held in a taxable account with qualified stock dividends and long-term capital gains are typically taxed at 15 percent. Short term gains are levied at federal income tax rates. While ETF distributions tend to be infrequent, tax consequences can be incurred even if an investor decides to hold their shares.

ETFs are renowned for having low portfolio turnover, which is good for investors, because it reduces the possibility of tax gain distributions. Among other benefits, ETF investors are insulated from the activity of fellow shareholders, whereas mutual fund investors arent. Mutual fund managers are often forced to sell portfolio holdings to meet the redemption demands of exiting shareholders. Remaining fund shareholders are adversely impacted because they absorb the tax gains and losses triggered by these untimely sales. ETFs avoid this problem because they are bought and sold on an exchange, therefore investors dont affect the tax consequences of each other.

It should be noted that there are several ETF structures with different tax treatments. Both structure types and their tax treatments are addressed in greater detail within the Advanced ETF Concepts section of the Index Strategy Advisors Investor Education website section.

ETFs vs. Closed-End Funds

Its important for investors to understand the key differences between closed-end funds (CEFs) and exchange-traded funds (ETFs). Each has its advantages and disadvantages.

The expense ratios of ETFs are generally lower versus CEFs. Since ETFs are indexed portfolios, the cost of managing them is less compared to actively managed portfolios. Also, ETFs often have lower internal trading costs versus actively managed funds, due to their low portfolio turnover. The ETF cost savings can be significant, especially for long-term investors.

Fund Transparency and NAV

Because fund components are linked to an index, the transparency of ETF holdings is excellent. Investors can easily identify the underlying stocks, bonds, or commodities of a fund by consulting the index provider or fund sponsor. CEFs have less transparency because their portfolios are actively managed, but holdings can be uncovered by viewing quarterly or semiannually fund disclosures.

ETFs generally trade close to their net asset value (NAV). By contrast, CEFs are more likely to trade at a premium or discount to their NAV. The premium is usually a result of greater demand (more buyers than sellers) for a fund’s shares, whereas a discount would imply less demand (more sellers than buyers). The NAV is calculated by subtracting a fund’s liabilities from its total assets and dividing the figure by the number of shares outstanding.

Style Drift and Leverage

Active CEFs are more susceptible to style drift versus index ETFs. Style drift is common with actively managed portfolios as money managers will sometimes divert from their original investment strategy. On the other hand, ETFs are generally insulated from style drift because a portfolio managers freedom to hand pick securities outside the scope of an index is limited.

Taxes and Portfolio Turnover

Annually, both ETFs and CEFs are required to distribute dividends and capital gains to shareholders. This is usually done at the end of each year and these distributions can be caused by index rebalancing, diversification rules, or other factors.

ETFs are renowned for having low portfolio turnover, which is good for investors, because it reduces the possibility of tax gain distributions. By comparison, actively managed portfolios generally have higher turnover, which translates into more frequent tax distributions.

ETF Market Size vs. Mutual Fund Market Size

The combined assets of the nation’s mutual funds increased by $200.2 billion, or 1.6 percent, to $12.549 trillion in August, according to the Investment Company Institute’s official survey of the mutual fund industry. Thus, assets in ETFs accounted for 9.67 percent of the $13.764 trillion total net assets in long-term funds managed by investment companies by the end of August of 2012.

ETF vs. Mutual Fund Regulation

The vast majority of ETFs are registered with the Securities and Exchange Commission (SEC) under the Investment Company Act of 1940. Like mutual funds, these ETFs must comply with the applicable provisions of the Act. However, in order to operate, ETFs must receive SEC exemptive relief from certain provisions of the Act.

Different regulations apply to commodity-based ETFs, which hold about 12 percent of ETF assets. ETFs that invest in commodity futures are regulated by the Commodity Futures Trading Commission (CFTC), while those that invest solely in physical commodities are regulated by the SEC under provisions of the Securities Act of 1933.