ETFs Make a Play for 401(k) Market

Post on: 3 Май, 2015 No Comment

BGI Is Latest to Offer Target-Date Funds

John Spence

Updated Nov. 19, 2008 12:01 a.m. ET

The exchange-traded-fund industry is stepping up efforts to capture the crown jewel of the mutual-fund business: lucrative 401(k) retirement plans.

Barclays Global Investors has introduced a suite of target-date funds, a type of investment that has become enormously popular in employee-retirement plans. These mutual funds are designed to manage portfolios by directing the allocations to stocks and bonds as workers approach retirement.

BGI, a unit of British bank Barclays PLC, along with State Street Corp.s State Street Global Advisors, is one of the giants of the ETF business. However, BGI isn’t the first to market with target-date ETFs.

Last year, Amerivest Investment Management and XShares Advisors introduced the TDX Independence Funds. Amerivest is a subsidiary of TD Ameritrade Holding Corp.

The ETFs grow more conservative over time as the planned retirement date approaches. Typically, target-date funds do this by moving money from more-aggressive stocks into bonds.

The products aren’t structured as funds of funds like most target-date offerings. Rather, they invest in proprietary indexes designed by Zacks Investment Research.

The TDX Independence 2040 ETF is the most aggressive because it is designed for younger workers. The initial allocation was about 24% in international equities, 73% in domestic stocks and 3% in fixed income, according to its investment advisor, XShares Advisors. The balances then follow a glide path, from an estimated 97% equity exposure to 10% in the year 2040 as the ETF grows more conservative.

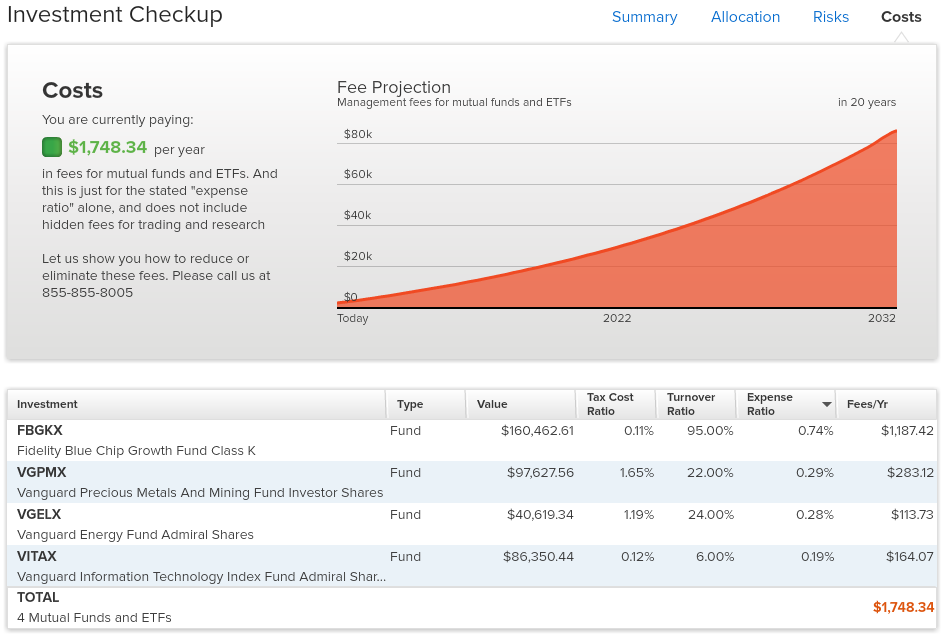

At the end of 2007, $3 trillion of total assets was held in 401(k) plans, $1.7 trillion of which was in mutual funds, according to the Investment Company Institute, a fund-industry trade group.

Retirement plans, which tend to have relatively steady flows, have been a windfall for the fund business: Mutual funds’ share of the 401(k) market increased from 9% in 1990 to an estimated 55% at the end of 2007, according to ICI.

Shining in Cloudy Market

ETFs also have posted impressive growth, even though some have liquidated because of lack of interest. Recent research shows ETFs actually have seen money coming in the door despite the difficult market.

As of September, ETFs had raked in an estimated $82 billion of net inflows year to date, according to investment researcher Morningstar Inc. Other evidence suggests the inflows continued despite October’s swoon.

At the end of the third quarter, there were more than 680 ETFs listed in the U.S. with collective assets of $542 billion, according to BGI.

Morningstar’s director of ETF analysis, Scott Burns, said institutional money managers could be using highly traded and broad-market ETFs such as SPDR S&P 500 ETF and PowerShares QQQ Trust to ride out the market’s wild swings. During Thursday’s snap-back rally, for example, the SPDR saw daily volume of more than 750 million shares, the third highest in its history.

ETFs also are benefiting from a trend to index funds and the fact that the financial advisors and investors who use them tend to be buy-and-hold investors, Mr. Burns said.

401(k) Barriers

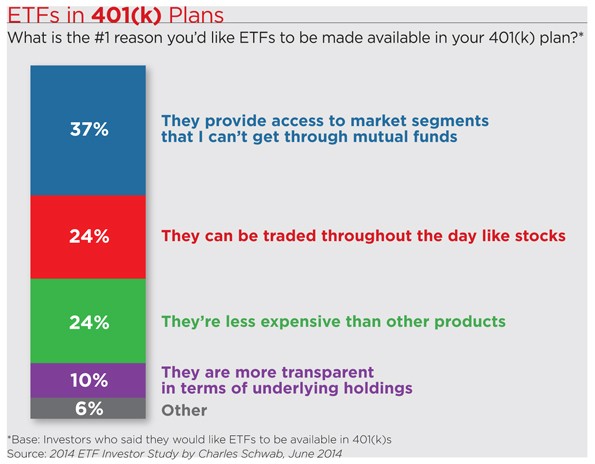

Still, ETFs haven’t managed to break into 401(k) plans, where traditional mutual funds are firmly entrenched. One hurdle is that the administrative and back-end office structures of the retirement-plan market are geared to mutual funds. ETFs are baskets of securities listed on an exchange that can be traded during the day.

BGI’s new target-date funds are well-suited to IRA rollovers or small-sized 401(k) plans who want to offer their participants an option that combines certain benefits of ETFs such as transparency, said Noel Archard, head of U.S. iShares product research and development.

Earlier this month, BGI listed iShares S&P Target Date Retirement Income Index Fund, iShares S&P Target Date 2010 Index Fund and others.

Some target-date funds have come under fire during the market crunch because of their exposure to stocks.

State Street has registered actively managed target-date ETFs, but the funds haven’t yet received regulatory clearance.