ETF versus Mutual Fund Fees

Post on: 29 Апрель, 2015 No Comment

Your e-mail has been sent.

For the most part, ETFs are less costly than mutual funds. There are exceptions – and investors should always examine the relative costs of ETFs and mutual funds that track the same indices. However — all else being equal — the structural differences between the two products do give ETFs a cost advantage over mutual funds.

Mutual funds charge a combination of transparent and not-so-transparent costs that add up. It’s simply the way they are structured. Most, but not all, of these costs are necessary to the process. Most could be a little cheaper; some could be a lot cheaper. But it’s nearly impossible to get rid of them altogether. ETFs have transparent and hidden fees as well—there are simply fewer of them, and they cost less.

Mutual funds charge their shareholders for everything that goes on inside the fund, such as transaction fees, distribution charges, and transfer-agent costs. In addition, they pass along their capital gains tax bill on an annual basis. These costs decrease the shareholder’s return on his investment. On top of that, many funds charge a sales load for allowing you the pleasure of investing with them.

Load

Most actively managed funds are sold with a load. Most of these funds are sold through brokers. The load pays the broker for his efforts and gives an incentive to suggest a particular fund for your portfolio.

Financial advisers get paid one of two ways for their professional expertise: by commission or by an annual percentage of your entire portfolio, usually between 0.5 percent and 2 percent, in the same way you pay an annual percentage of your fund assets to the fund manager. If you don’t pay an annual fee, the load is the commission the financial advisor receives. And if your broker gets paid by the load, don’t be surprised if he doesn’t recommend ETFs for your portfolio. That’s because the commission that brokers receive for buying ETFs is seldom as hefty as the load.

Investors often don’t realize that most financial advisers are stockbrokers, and stockbrokers are not necessarily fiduciaries. Fiduciaries are required to look after the best interests of their clients over their own profit. Stockbrokers aren’t obligated to look after your best interests. However, they are required to provide suitable recommendations for your financial status, objectives, and risk tolerance. As long as it’s an appropriate investment, a stockbroker isn’t obligated to give you the best investment in that category. A stockbroker who puts you into an S&P 500 index fund with a load is providing a suitable recommendation, but he or she is not looking out for your best interests, which would mean suggesting the lowest cost alternative.

To be fair, mutual funds do offer a low cost alternative: the no-load fund. True to its name, the no-load fund has no load. Every single dollar of the $10,000 that you want to invest goes into the index fund; none of it is whisked away by a middleman. The reason for this is that you do all the work that the stockbroker does for the average investor. You do the research and you fill out the forms to purchase the fund. In essence you are paying yourself the broker’s commission, which you invest.

Most index funds and a small group of actively managed funds don’t charge a load. No-load index funds are the most cost efficient mutual funds to buy because they have smaller operating costs. If there is one rule to investing in mutual funds, it is that you should try to avoid paying a load.

Expense ratio

In a mutual fund’s prospectus, after the load disclosure is a section called Annual Fund Operating Expenses. This is better known as the expense ratio. It’s the percentage of assets paid to run the fund. Well, most of them. Many costs are included in the expense ratio, but typically only three are broken out: the management fee, the 12b-1 distribution fee, and other expenses. And, it’s not that easy to find out what fees are contained in the other expenses category.

In addition to paying the portfolio manager’s salary, the management fee covers the cost of the investment manager’s staff, research, technical equipment, computers, and travel expenses to send analysts to meet corporate management. While fees vary, the average equity mutual fund management fee is about 1.40%.

12b-1 Fees

Most mutual funds, including many no-load and index funds, charge a special marketing fee called a 12b-1 fee, named after a section of the 1940 Investment Company Act. The 12b-1 fee is broken out in the prospectus as part of the expense ratio. It can run as high as 0.25 percent in a front-end load fund and as high as 1 percent in a back-end load fund. Many investor-right advocates consider these expenses to be a disguised broker’s commission.

One thing can be said for the front-end and back-end loads: They’re upfront about what the fee will be, and it’s a one-time charge. Essentially, you go to a broker, he or she helps you to buy a mutual fund, and you pay for the service.

This is not the case with the 12b-1 fee. While it is intended to pay for promotion and advertising, only 2 percent of the fees are used for that. The rest is paid to brokers for ongoing account servicing. Essentially, it’s paid to the broker who sold you the fund on an annual basis, for as long as you own the fund, even if you never see him again.

ETF Costs

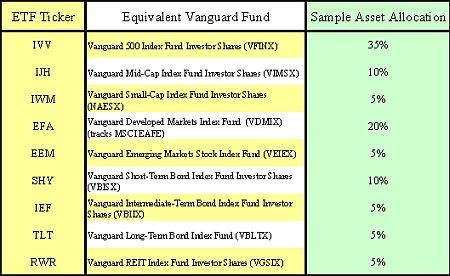

In contrast to mutual funds, ETFs do not charge a load. ETFs are traded directly on an exchange and are subject to brokerage commissions, which can vary depending on the firm, but generally are no higher than $20. While the absence of a load fee is advantageous, investors should beware of brokerage fees become a significant issue if an investor deposits small amounts of capital on a regular basis into an ETF. In many cases, an investor interested pursuing a “dollar cost averaging strategy” or similar strategy that involves frequent transactions, may want to explore closely alternatives offered by mutual fund companies to minimize overall costs.

ETFs expense ratios generally are lower than mutual funds, particularly when compared to actively managed mutual funds that invest a good deal in research to find the best investments. And ETFs do not have 12b-1 fees. That said, according to Morningstar, the average ETF expense ratio in 2010 was 0.6%, which compares with 0.73% for index mutual funds and 1.45% for actively managed mutual funds.