ETF Trading Realtime Pricing and Intraday Liquidity are Two Benefits that ETFs Offer over Mutual

Post on: 2 Май, 2015 No Comment

Insight

ETF Trading — Real-time pricing and intraday liquidity are two benefits that ETFs offer over mutual funds

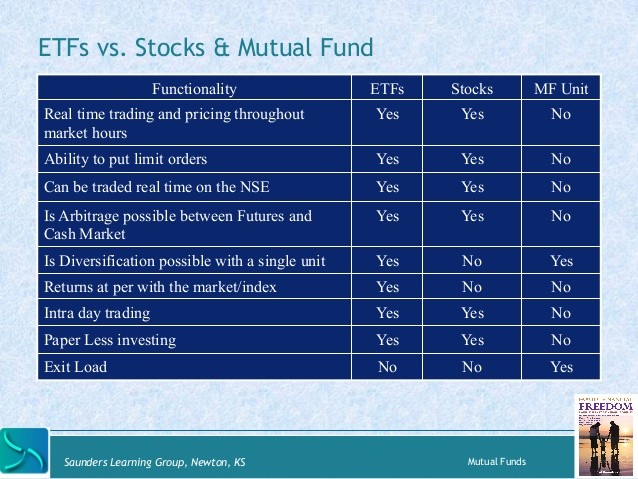

Exchange Traded Funds “ETFs” are similar to mutual funds in many ways but they have many significant differences. Real-time pricing and intraday liquidity are two of the most obvious differences between exchange-traded funds with their mutual fund cousins. Mutual funds create their price or NAV (net asset value) once a day at the end of the day based on pricing the underlying holdings after the close of trading when the fund has priced its assets and hence created its price or NAV for that day. Once the mutual fund has been priced, the mutual fund company transacts all fund unit buy and sell orders that have been accumulated during the day. This pricing process does not allow investors to know beforehand the price at which their buy or sell order will be transacted at. Many mutual funds will often charge front load fees, pay rebates and often back end loads.

As with ordinary equity shares, investors have the ability to invest in ETFs at any time during the trading day, which is a significant benefit over mutual funds, especially in volatile environments when markets can experience significant intraday movements. They are priced continuously based on the value of their underlying portfolio and can be bought and sold any time the market is open. This means you know exactly the price you will receive when you place your order to trade. It also means you can use all of the trading strategies which apply to trading stocks such as limit orders, stop loss orders, short selling, margining, and in some cases even option strategies.

ETFs are bought and sold on a commission basis, just like shares. They do not have any sales loads, the total annual expense ratios “TERs” range from 0.0% (it is important to look at the total cost of investing) to 1.60% and average 0.30%. ETFs have some of the lowest expense ratios among registered investment products. The annual expenses are usually deducted on a prorate basis from dividend payments paid into the fund. In the US all ETFs and funds are required to distribute income at least once a year while ETFs in Europe can select to reinvest income or pay it out.. This means that each investor usually pays only the cost of their own fund share transactions and is protected by the ETF structure from the cost of other investors’ purchases and sales of fund shares.

ETFs provide a landscape of opportunities. Since the first ETF; the SPDR (or Standard and Poor’s Depository Receipt) was launched in the US in January 1993, ETFs have opened a new panorama of investment opportunities. According to our ETFGI monthly report on the global ETF and ETP industry at the end of October 2012 there were 4,694 ETFs and ETPs, with 9,646 listings, assets of US$1.9 trillion, from 203 providers with official listings on 56 exchanges around the world (see exhibit 1).

Exhibit 1: ETFs/ETPs listed globally by region/country as at the end of October 2012

Source: ETFGI Global ETF and ETP Industry monthly report October 2012, ETFGI, Bloomberg, ETF/ETP providers, Bank of Israel, WIND.

ETFs are essentially index funds that are listed and traded on exchanges like shares, they allow investors to gain exposure to specific segments of the equity, fixed income, commodity markets’ with relative ease, on a real-time basis, and at a lower cost than many other forms of investing. ETFs trade during exchange market hours and are bought and sold on a commission basis like shares. Most ETFs can be sold short and are lendable and marginable.

ETFs possess characteristics that make them an alternative to futures and portfolios of shares for investors who are seeking to gain or reduce country, regional, sector and style as well as fixed income and commodity exposure. ETFs are set up using the fund regulations that are common in the local jurisdiction such as Undertakings for Collective Investment in Transferable Securities “UCITS” in Europe or 1940 Act in the US (with some exemptions to allow for trading, and in-kind creation/redemption etc.) and are not synthetic derivatives. They trade and settle like single shares and are typically backed by baskets of securities designed to track indices.

ETFs afford investors two forms of liquidity. The first is through trading the shares on a secondary basis on the exchange. The second is on a primary basis via the unique ‘creation’ process, whereby an Authorised Participant “AP” purchases the underlying basket of securities in the local market and deposits the basket ‘in kind’ into the ETF, creating more shares in that ETF. The unique daily creation/redemption process means that the liquidity in the ETF is driven by the liquidity in the underlying securities.

The creator of ETF shares deposits into the applicable fund a portfolio of securities closely approximating the holdings of the index in exchange for an institutional block of ETF shares (usually 50,000+). Similarly, they can only be redeemed in redemption units, mainly ‘in-kind’ for a portfolio of securities held by the fund. The redemption and creation processes are very similar.

Through the end of October ETFs and ETPs have gathered US$202 billion in net new asset “NNA” flows (net creations minus net redemptions) which is US$32 billion more than in all of 2011 when the NNA for the year was US$170 billion. As you can see below in exhibit 2, the majority of ETFs and ETPs globally by both number of products (2,321) and assets

(US$1.2 trillion) provide exposure to equity benchmarks. The average daily volume “ADV” traded in these products during the month of October 2012 was US$46 billion, while NNA flows year to date have been US$114 billion which is US$23 billion more than all of last year’s US$91 billion. ETFs and ETPs providing exposure to fixed income have been the second most popular category based on NNA with US$57 billion. Commodity products rank number two in terms of number of products (764) and ADV (US$4.1 billion) and third based on NNA with US$20 billion year to date through the end of October.

Exhibit 2: ETFs/ETPs globally by asset class at the end of October 2012

Source: ETFGI Global ETF and ETP Industry monthly report October 2012, ETFGI, Bloomberg, ETF/ETP providers, Bank of Israel, WIND. Note: Israel ETP assets and flows are included in the total figures but are not reflected in the asset class breakdown.

ETFs tend to trade at, or close to, their underlying NAVs. This is because there are arbitrageurs waiting to take advantage of a significant premium or discount relative to the underlying index. An arbitrageur will buy/sell the ETF and place an offsetting buy/sell transaction in the underlying basket of component securities.

A key benefit of the in-kind distribution of securities is that it does not typically create a tax event in the United States, which could occur if the fund sold securities and delivered cash. This is a special advantage of ETFs versus an open-end indexed mutual fund, which would have to sell securities to meet cash redemptions.

Divergence in the performance of an ETF, relative to the index it tracks, is possible. Differences tend to be caused by fund fees and expenses, tracking error when optimisation strategies are used to track the index, rebalancing due to corporate actions and index changes, or the dividend reinvestment policy of the fund.

Major players in the ETF market were initially large institutional investors. Historically, institutions used ETFs as trading tools to equitise cash and to implement long and short strategies. They then used ETFs for market access and now also use ETFs for tactical and strategic investments especially when implementing multi asset strategies. However, one of the unique features of ETFs is that they are a very democratic investment product offering the same tool box of exposures at the same annual TERs to both institutional investors and financial advisors with a minimum investment of typically one share (or less than $500). This is highly unusual in finance where retail and financial advisors typically have a much smaller array of products offered to them with much higher TERs than what is offered to institutional investors.

As the job of most portfolio managers has become broader and deeper, covering developed, emerging and frontier markets as well as looking at sectors and countries, we have found that many are admitting that they do not have the time nor resources to try to add value in all markets and are embracing the use of ETFs to gain international market exposure. This allows them to pick stocks in the markets that they feel can they can add value in. In other cases, these ETFs are used to equitise cash or to establish an over or underweight position. ETFs make it easier for investors to participate in all domestic asset classes, global regions and industry sectors. Most importantly, ETFs give investors the opportunity to participate where markets have been showing promise.

ETFs can be effective tools for both active and passive institutional managers and for retail investors. They are a flexible tool that is not a derivative that allows investors to quickly react to short and long term needs or opportunities. As such, they are an alternative to futures, trading baskets of shares trades and the use of traditional active and passive funds.

ETFs provide low-cost, liquid trading vehicles. They can be used by market timers wishing to gain or reduce exposure to entire market segments or sectors throughout the trading day. They also can be used for targeted asset allocation or sector rotation strategies. ETFs can be shorted throughout the trading day subject to the availability of applicable stock borrows.

As shown in exhibit 3, trading volumes were highest on NYSE Arca during October 2012 with US$52,106 Mn average daily turnover in ETFs and ETPs, representing 85.5% of all ETF and ETP turnover globally. In second place was NASDAQ with US$3,454 Mn average daily turnover and 5.7% market share, followed by London Stock Exchange with

US$869 Mn and 1.4% market share.

Exhibit 3: Top 20 exchanges globally ranked by ETF/ETP average daily trading volume: as of the end of October

Source: ETFGI Global ETF and ETP Industry monthly report October 2012 ETFGI, Bloomberg, ETF/ETP providers

When we look at ADV reported on various exchanges around the world it is important to understand that under the Markets in Financial Instruments Directive (MiFID), ETF trades currently do not have to be reported in Europe, meaning investors cannot accurately measure the true volume of shares traded. It is estimated only about 30% of all ETF trades in Europe are reported.

Investors would benefit from more reporting to the exchange. It would increase price formation transparency, which will have a knock-on effect on exchange spreads and order-book depth. This would in turn result in more transactions taking place on exchange. Some steps have already been made in the right direction.

The London Stock Exchange and Swiss Stock Exchange already require all trades of ETFs to be reported, but they are the only exchanges in Europe to do so and 70% of ETF trades are over the counter and are often not reported. The visible volumes, therefore, only represent the tip of the iceberg and not the true liquidity of the market as viewed against the liquidity of the underlying constituents.

Conversely, at times, ETF trades are reported twice – once at the creation or redemption of new units and again when the corresponding secondary market trade is reported. If all trades were reported in this way it would imply a greater than actual liquidity. It therefore appears logical that only the secondary market trade should be reported in the case of a creation or redemption.

Another challenge to accurately calculating ETF trading volumes trade is fragmentation: the same ETF can be listed and cross-listed on 21 exchanges in Europe, and there no mechanism to consolidate or aggregate data across all exchanges.

MiFID II, which is set to be implemented in 2014, will likely require all European ETF trades to be reported and there is likely to be a consolidated tape, combining trades on the 21 exchanges in Europe where ETFs are listed and cross-listed.

ETFs, which have always been one of the most transparent types of funds, have continued to lead the charge in offering transparency on swap collateral and securities lending activity while other UCITS funds remain opaque in their use of the same practices.

In any considered analysis of ETF liquidity, it is the primary market liquidity (the ability to implement creations and redemptions) that is key, and that investors take comfort in the diligence of providers to ensure the fund will have capacity to absorb a significant growth in its assets under management – even more critical in the less liquid fixed income markets.

Of course, liquidity concerns are not the sole preserve of the provider and investors will look to the spread and depth of the order book on the secondary market before being comfortable that they are purchasing a truly liquid instrument.

There are some solutions that could be implemented now to help improve the limited transparency and consistency in ETF trading information in Europe. Investors can and should ask their brokers to report all ETF trades at the time of the trade.

ETF providers should amend their agreements with their market makers and authorised participants to require them to report all trades at the time of the trade.

A set of guidelines should be adopted by the ETF industry in which trades should be reported at the time of the trade, especially when creations and redemption are being done to facilitate a client/secondary market trade to eliminate the potential for double counting of some trades.

Regulators could provide guidance to support these changes being made now rather than waiting for MiFID II to be implemented.

Liquidity, over the course of the day, is typically higher and more focused when the underlying markets are open. So for an ETF tracking the US, liquidity will tend to be higher in the afternoon when the US markets are open. This means the spreads will be tighter, so it’s easier for brokers to trade.

In terms of the threshold for primary versus secondary trading in the ETF, when a large order is placed that is more than 20% of what the ETF normally trades in a day, this would likely have market impact if done on a secondary a basis – which is why the primary creation mechanism is used.

In a creation, an authorised broker can trade the underlying portfolio and send the securities to the custodian, creating new units of the ETF in the primary market rather than trading existing units on the secondary market, so the ETF gets bigger.

In the month of October 2012, two hundred and six brokers (globally) reported 752,974 trades totalling US$763 billion in volume in US and European listed ETFs and ETPs. Merrill Lynch reported the largest volumes with US$124 billion in trades, followed by Knight Securities with US$95 billion (see exhibit 4).

Exhibit 4: Top 20 Broker/Dealers trading US and/or European Listed ETFs/ETPs, October 2012

Note Broker data captured from Bloomberg based on “advertised” secondary market trades voluntarily reported by brokers/dealers. As some brokers/dealers do not advertise their trades, the above may not represent a complete picture of all activity. Approximately 50% of trades in US listings are reported to Bloomberg by brokers/dealers.

Source: ETFGI, Bloomberg, ETF/ETP providers

Note: Exchange Traded Products (ETPs) are products that have similarities to ETFs in the way they trade and settle but they do not use an open-end fund structure. The use of other structures including unsecured debt, grantor trusts, partnerships, and commodity pools by ETPs can, in addition to a significantly different risk profile, create different tax and regulatory implications for investors when compared to ETFs which are funds.