ETF Definition The Newer and Improved Evolution of the Mutual Fund

Post on: 24 Июль, 2015 No Comment

An exchange-traded fund or ETF definition can be boring and dry. They might as well define eyes glaze over. However, understanding the history of the investment evolution from the individual stock, to the mutual fund, to the index fund, to the ETF is much more interesting. Once you understand the evolution, you will be able to understand the ETF definition.

All products evolve. The candle evolved into the modern florescent light bulb. There are still times when the older products work better, such as when the power goes out, but the evolution generally creates a superior product. Investment evolution is no different, and that goes for the ETF definition.

The ETF definition begins with mutual funds. Mutual funds came into prominence during the incredibly volatile times of the early 1900s, when investors realized that diversification and professional management were a viable option to selecting individual stocks on their own. With one transaction, mutual fund investors received exposure to many stocks chosen by a professional investment manager.

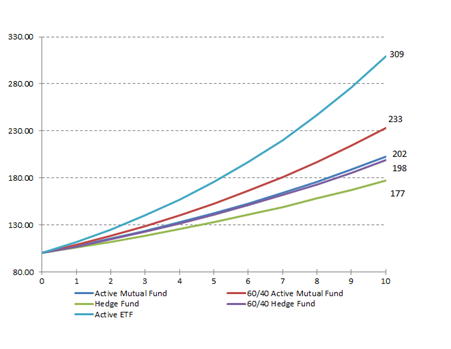

By the mid 1970s, studies revealed that a vast majority of mutual fund managers were not beating the comparable index assigned to their fund. These indexes were passive baskets of stocks with no manager picking and choosing which stocks to buy and sell. John Bogle at Vanguard Funds had the brilliant idea of making a mutual fund with no manager, which they called the index fund. The index fund simply bought these index stocks. Since no fund manager had to be paid, this created an investment with much lower internal fees and trading costs.

In the early 1990s, State Street created the first ETF the SPDR S&P 500 ETF (SPY). This resulted in the ultimate investment for our modern times. If you combined the traits of an index fund with an individual stock, you would basically have an ETF. Imagine being able to combine a candle with a fluorescent light bulb. You would have a light that gave off a soft romantic glow, that lasted for six years with no need for electricity. ETFs are not quite that good but look close and you can see why the assets have tripled in the last five years to 1.5 trillion (thats trillion with a t) and are projected to triple again in the next five years.

Now for the boring part of the ETF definition.

An ETF is diversified like a mutual fund or an index fund, but trades like a stock. ETFs copy as closely as possible an index of investments – typically an entire category of stocks, fixed income, or commodities. ETFs trade on stock exchanges for commissions (although some brokerages are waiving commissions), and investors typically buy ETFs from retail brokerages, or the fund families themselves. ETFs enjoy the same trading status as individual stocks allowing for trades during the day, instead of once per day like mutual funds or index funds. Unlike mutual funds to index funds, ETFs also allow for market orders, limit orders, stop orders, and short selling. Lastly, the tax-efficient structure of ETFs allows them to generally pass along less taxable income than similar mutual funds or index funds.

Did you like our ETF definition? Please share your thoughts in the comment section. If you would like to learn more about ETFs, and go beyond the ETF definition and history, download our free report:

Learn the 5 simple (and proven) principles for life-long investing success Download your FREE copy of Strategies for Better Investing: The Remonsy 5 Factor Investing Philosophy for Retirement Success and receive Remonsy ETF Monitor email newsletter—absolutely FREE.

Remonsy ETF Network exists to enhance your life-long investing success by providing independent and authoritative investment advice you can trust. Landmark academic financial studies, proprietary in-depth research and over a quarter century of real world financial advisory experience during good times and bad provide the foundation for our time-tested, proven investing guidance. And most important, we work only for you: We dont hold or manage your money. We dont earn trading commissions. And we dont take money from investment companies.