Endowments 2010 Risk Management Liquidity Stewardship

Post on: 6 Апрель, 2015 No Comment

Search form

Year-end statements for pensions, 403(b) accounts, and mutual funds aren’t as frightening to open as they were this time last year. University endowment managers usually wait until their fiscal year ends in June before they really look at their statements, but interim surveys indicate that performance has improved.

The Wilshire Trust Universe Comparison Service, which collects data from custodial organizations to report on the performance and asset allocation of major institutional investors, found that, for the third quarter ended September 30, 2009, the average foundation and endowment fund was up 10.31 percent. This represents the first quarter for most college and university portfolios. It was certainly an improvement over the third quarter of 2008, when the average foundation and endowment fund lost 9.37 percent. That 2008 quarter included the September 2008 market crash, although many of the problems in the market materialized long before that.

For the 12-month period ending September 30, 2009, the average endowment was up 1.27 percent. Foundations and endowments with more than $1 billion in assets had similar performance to the broader group, up 10.09 percent for the quarter and 12.82 percent for the 12-month period.

Diversification is not a bad strategy, but it does not prevent all problems.

Commonfund and NACUBO are now also tracking endowment performance. Preliminary data for the fiscal year ending June 2009, with 504 institutions out of a base of 800 having responded to a survey, shows that the results in aggregate are not as dire as they were for some marquee institutions. The average endowment was down 19 percent for the year ending in June; Harvard reported losses of 27.3 percent that year, while Yale lost 24.6 percent. Most institutions surveyed lost 22.5 percent from July 1, 2008 to November 30, 2008, which means that most participated in the market’s nascent recovery. Spending rates remained constant at an average of 4.3 percent of assets. The full study will be released on January 27.

Other studies show similar findings. Spectrem Group, an investment consulting firm, reported that all foundations and endowments lost 28 percent of assets in 2008 and that, no surprise, endowment managers viewed 2009 as a rebuilding year.

Campuses aren’t talking much, because the issue is so weighty. Columbia University is the only institution contacted for this story that responded, and the comments were conservative. Robert Hornsby, director of media relations, says, During a challenging economic period, we have been able to protect the endowment from the sharpest market losses suffered by many peers while prudently managing our resources to maintain our momentum in both academic excellence and long-term campus development.

The stock market is up, which gives everyone a little room to breathe. But 2010 is not a return to normal, however defined; the future for endowments includes changes in risk management, a new emphasis on liquidity, and improvements in stewardship. People are still feeling uncertain, says John Griswold, executive director of the Commonfund Institute.

The New View of Risk

The traditional approach to investment risk management is asset allocation across a diverse range of markets. The Wilshire survey found that the universe of all foundations and accounts showed a median commitment of 54.56 percent to equities, 22.82 percent to bonds, and 2.47 percent to cash. Accounts over $1 billion had a 53 percent median position in equities, with 21.05 percent in bonds and 3.32 percent in equities. These larger endowments had measurable commitments to other assets, unlike the wide universe: 0.74 percent to real estate and 10.01 percent to alternatives.

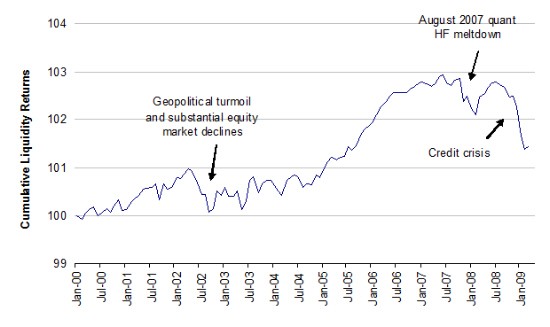

The key asset allocation question in the current market is how much of the endowment should be committed to liquid assets.

And yet, very few champions of diversification anticipated a situation where the stock market would be down, the real estate market would be down, and bond yields would fall to near zero. That’s what happened in 2008, and no one has ignored it. Most universities, through their investment committees, have had many conversations about rethinking their asset allocation, says John Curry, managing director at the Huron Consulting Group in Chicago. That doesn’t mean diversification is a bad strategy, but rather that it does not prevent all problems.

Risk assessment has moved out into the tails, as the statisticians like to say. Instead of making decisions on the most likely outcome, portfolio managers are looking at worst-case scenarios. After all, that’s what they experienced in 2008. Does a market collapse like that happen once every 80 years, or is it more common?

Many higher ed institutions financed new initiatives with debt, which seemed like a good idea when credit markets were robust and interest rates were low. They have been able to borrow with little fuss because their endowments could be used as collateral. The problem, Curry says, is that the endowments are now worth less, which may make some institutions in violation of their bond covenants and cause lenders to demand higher interest rates.

One way to reduce risk is better matching of assets and liabilities, Curry says. Short-term needs should be matched with short-term investments and long-term needs should be matched with long-term investments.

Another risk-management tactic is to use options and derivatives contracts as insurance, says Ronald M. Egalka, president and CEO of Rampart Investment Management in Boston. For example, an endowment can keep its existing equity commitment and equity manager, but obtain put options or sell futures on the market index that will pay off if the market falls. I think that’s a very powerful way of approaching it, he says.

Poor investment performance is not evidence of irresponsible behavior, but it may inspire a new line of tough questions.

The key to performance is the asset allocation strategy, not the managers hired to handle each piece of it. A June 2009 survey by Greenwich Associates, a Stamford, Conn.-based investment consulting firm, found that two-thirds of pensions, foundations, and endowments are planning to hire new outside managers and 46 percent plan to fire some existing investment advisors. Close to half of the endowments and foundations surveyed reported having already terminated some external managers. Changing the manager isn’t going to fix [performance], says William M. Courson, president of Columbus, Ohio-based Lancaster Pollard Investment Advisory Group. Instead, leaders need to understand how their investments are related and how much cash to keep on hand.

Egalka believes in risk management, because his firm specializes in strategies to do just that. But, he cautions, the danger is working so hard to reduce risk that institutions give up all upside potential when the markets recover. There is no such thing as a risk-free approach, and no such thing as a free lunch, he says. No one knows exactly when the market will rise or fall, so risk management has to be ongoing.

Learning to Love Liquidity

In their quest to diversify as much as possible with alternative assets, many endowment managers may have underestimated their need for liquidity, says Courson, whose firm advises foundations and endowments on investment strategy. He points out that such illiquid assets as venture capital, private equity, and real estate are interesting because they have a higher expected rate of return relative to their risk. In ordinary times, they are an excellent way to increase return. In tough times, though, illiquid assets put asset managers in a bind, because they cannot easily sell those investments to raise cash. The New York Stock Exchange was open every day when the market was falling, so endowments could sell their stock if they had to. With venture capital funds and other private partnerships, selling may not be allowed at all, even if a buyer could be found.

The expected rate of return on cash and equivalents is always lower than the expected return on other assets. Checking accounts pay little or no interest because the money in them is safe and accessible at any time, anywhere in the world where there is a cash station.

Endowment managers and others investing for the long term normally avoid cash in favor of riskier assets that pay a higher return. They are rethinking that position. Greenwich Associates found that endowments and foundations are increasing their commitments to cash even while they maintain a commitment to diversification. They did this by reducing their commitment to the stock market; 70 percent of the institutions in the Greenwich survey reduced their allocation to U.S. equities between 2008 and 2009. Furthermore, 65 percent of the endowments in their survey reported increasing their liquidity requirements, with 5 percent stating that they had increased their liquidity significantly.

Curry says that the key asset allocation question in the current market is how much of the endowment should be committed to illiquid assets. Endowments should invest in these assets, but maybe not to the extent that they have, he notes. Some endowments discovered that they were more illiquid than they ever thought.

If endowment managers need to commit a larger portion of their funds to cash, then returns will go down. Obviously, there is a liquidity premium, Courson says. There’s always a liquidity premium.

Curry explains that cash investments have to reflect cash needs. Many institutions had part of their cash allocation invested in auction-rate notes, which were bonds with rates that were reset monthly. These seemed to be as good as cash, but they were not. Problems in the credit market made it impossible to sell or value these securities. I don’t think anyone ever imagined a total freeze in the auction-rate market, he says. But it happened, and it hurt both short-term investors as well as short-term borrowers.

Endowment managers have often relied on cash flow from new donations to meet part of their liquidity targets. Rather than deposit the incoming cash in investment accounts, the money was kept as cash and distributed to various departments as needed under the campus budget. This allowed the endowment managers to keep the other funds in very long-term investments. But when the economy tanked, donations dried up, and that hurt the anticipated cash flow of the endowment itself and the cash flow needed for campus operations.

Campus leaders expect endowment income to supplement revenue from other sources—especially tuition. This meltdown was accompanied by a deep recession, and many small colleges depend on tuition revenues, Curry says. They may experience lower enrollments as fewer families can pay their tuition bills.

Griswold points out, however, that demand for higher education is increasing as well. If anything, a recession highlights the importance of education. Many nontraditional students find that unemployment gives them the time to return to school to complete their bachelor’s degree or pursue graduate work.

Endowment Management and Stewardship

Donors have less money now. No matter how loyal an alumna, a gift to her alma mater will be low on the list if she’s out of work. Some donors prefer to give appreciated assets, but little appreciates when the entire market is down. A handful of institutions have seen donors lose everything to con artists—in particular, Brandeis (Mass.) and Yeshiva (N.Y.) universities, which both had major donors who had invested with Bernard Madoff.

Greenwich Associates, www.greenwich.com

Lancaster Pollard Investment Advisory Group, www.chiefinvestmentofficer.com

Rampart Investment Management, www.rimco.com

For charities, this is still a very tough time, Griswold says, with foundations, donors, and some government funders all cutting back. Advancement officers and other campus leaders have to prove their cases now, as not only do donors have fewer resources to share, but they are also starting to ask tough questions about institutional responsibility. Poor investment performance is not evidence of irresponsible behavior, but it may inspire a new line of tough questions. Having to answer to the constituency now is more difficult, Courson says.

The Greenwich Associates survey found that 60 percent of institutions are responding to the need for greater stewardship by demanding more transparency from their investment managers, especially in the form of more frequent information on valuation, positions, leverage, and liquidity. This is new, as many hedge funds and private partnerships have emphasized their need to keep strategies secret.

The stewardship discussion may involve more conversations with campus stakeholders about the situation and educating them about what investment managers can and cannot do.

At Columbia, the president has communicated through whole-campus e-mails and letters posted to the university website. While the university has not been as negatively affected as many of our peers, it is never an easy matter to address a world that has taken a sharp turn for the worse for a great many people, wrote President Lee Bollinger in a letter addressing the campus in May. He and other university officials have been willing to talk about its finances to reporters at the student newspaper, if not to outside media.

External money managers and consultants can help in dealing with trustees or significant donors, reminds Egalka. We feel that that’s our most important job.

The long-term challenge is to codify the endowment’s place on campus. Is it to support current spending, sustain long-term growth, or provide institutional collateral? The answer will be different at each institution, but it has to be addressed for the endowment to be managed well.

Ann C. Logue is a Chicago-based freelance writer who specializes in covering finance.