DollarCost Averaging vBased Budgeting Evolving Personal Finance

Post on: 16 Март, 2015 No Comment

August 11th, 2014 | 26 Comments

Kyle and I had the most ridiculous fight about our budget two weeks ago. Our positions were only slightly different, yet we were so entrenched we couldn’t come to a resolution and had to drop the argument for the night! Both of us are very opinionated and stubborn and I am definitely not the only PF nerd in the family.

I’ve been preaching percentage-based budgeting on EPF basically since the start of the blog. What I mean by that is that our spending and saving should be in balance based on percentages that we set out in advance. Sticking to these principles keep us honest both in transitions and when our expenses are stable. For example, our overall saving and spending is fairly well aligned with the balanced money formula. with a few adjustments.

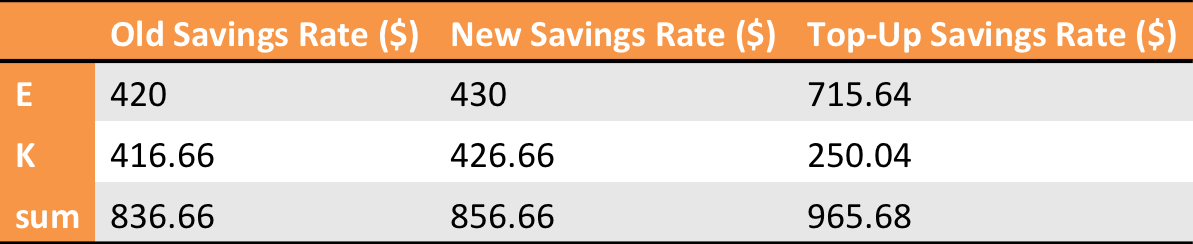

Right now the important percentage-based components of our budget are our giving and retirement saving rates. Each month, we transfer 10% of our gross income from the previous month to our church (plus some additional amounts to other recipients) and 18% to our Roth IRAs . The minimum we want to save each month into our Roth IRAs is 15%. though we’ve edged the percentage up a bit over the last few years, basically by rounding up each time we make an adjustment.

Kyle got a raise last month when he transitioned from being a grad student to a postdoc, meaning that we need to bump up our retirement contributions. However, I’ll be unemployed after August. so we’ll have to reduce our retirement contributions. How exactly to adjust our retirement savings as we go through these transitions was the subject of our very silly fight.

Emily’s position: We should follow our percentage-based budget exactly by contributing 15% of the previous month’s income to our Roth IRAs.

Kyle’s position: We should contribute 15% of our income but spread it out over several months to dollar-cost average (DCA) into the market.

Basically, I want Kyle to set up a recurring transfer to his Roth for 15% of his new gross income. I’ll keep my contribution the same as it has been through September (for August’s income, my last paycheck) and then cancel the recurring payment. I’ll set up manual transfers for whatever irregular income I have in the fall month-by-month. (We do manual transfers for all of Kyle’s income from our church since it is irregular, so we know it’s pretty easy.)

Kyle objects to my plan because to him it feels like lump sum investing or market timing. He is super into DCA and wants contribute the same amount of money each month from August through the end of the year. plus investing 15% of whatever I earn irregularly.

I am also into DCA from regular paychecks, but I know that when you have a bolus of money to invest, lump sum investing is likely to be the better strategy over dollar-cost averaging. That’s not about market timing, just that the general long-term trend is for stock values to increase . Plus, the changes in our employment status are unconnected with the market. But Kyle is really uncomfortable with the idea of saving a lot for two months and then not as much for several and wants to defer some of the savings from our higher-income months to lower-income ones.

I object to Kyle’s plan because I think it’s arbitrary. We should make our savings decisions based on the past, not speculations about the future. We don’t even know for how many months Kyle will be in his current postdoc or what my income might be in the fall. Kyle said that he would be fine accounting for some of my irregular income in the fall – basically doing a combo of lump sum and DCA for the Roth contributions from my remaining two paychecks – but I really am not confident yet that I’ll earn anything!

Aaaaanyway, that was what we argued over. We agree 98% what we should do with our money, yet still fight over the remaining 2% ! That’s just my personality.

A few days after our fight I volunteered to yield to Kyle’s wishes, even though I still disagree with him about prioritizing DCA over everything else. The compromise that I got was that Kyle would set up a recurring contribution of 15% of his gross pay from this month forward. I will set up a recurring payment to my Roth of my two months of contributions smoothed over five, plus do the manual contributions for our additional irregular income. At least that way, we won’t have to alter Kyle’s recurring contribution after this smoothing period ends until he changes jobs. Kyle’s happy and I don’t mind this solution too much because I do like DCA. I’ll just have to mess up his plan by earning a bunch of money in the fall.

What are your opinions on dollar-cost averaging and lump sum investing? How quickly do you update your recurring transactions after an income change?