Do Mutual Funds that Treat Shareholders Fairly Deliver Better ReturnsKiplinger

Post on: 17 Июнь, 2015 No Comment

A new Morningstar study suggests that funds with high stewardship grades tend to perform better than those with low grades.

Does your mutual fund play fair, giving the same rights to the little guys that it gives to big institutional investors? Does it have systems in place to ensure that fund officials don’t violate securities rules and are paid based on performance? In other words, is your fund as careful with your cash as you are?

A new study suggests that paying attention to issues such as these is more than an academic exercise. Fund researcher Morningstar says its data confirm a link between how mutual funds treat clients and how well the funds perform. Morningstar has been calculating stewardship grades for funds since 2004, right after the industry was rocked by revelations that some funds had allowed big customers to break the funds’ rules at the expense of smaller clients.

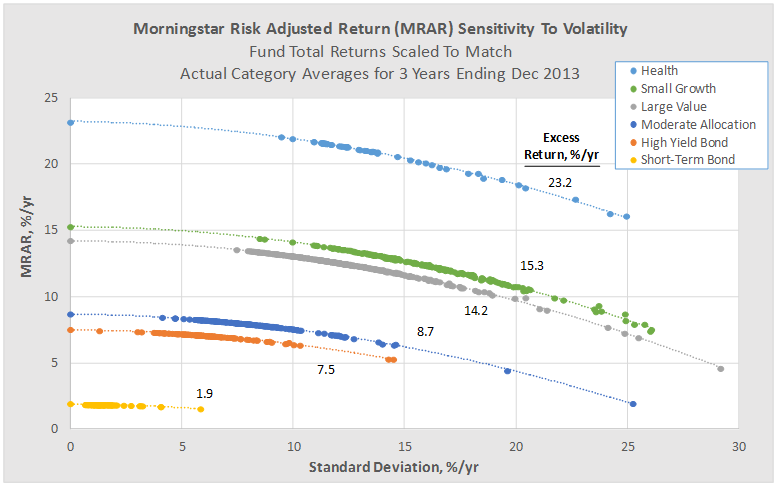

Laura Lutton, Morningstar’s editorial director, says that more than 25% of the funds that received Ds and Fs in the initial set of ratings have since closed or merged — both signs of failure. More than 80% of the funds that got grades of A and B in 2004 subsequently delivered above-average risk-adjusted returns. (Risk-adjusted performance typically compares a fund’s returns with its volatility. A fund with, say, good returns and low volatility may have better risk-adjusted results than one with great returns and high volatility.)

Funds with above-average risk-adjusted performance may not be the hot funds of the hour. But they’re the kind of funds you can own for decades without regrets, says Lutton. Yet even she wouldn’t pick a fund based on its stewardship grade alone. She considers the grade more of a tie-breaker.

Advertisement

The stewardship grade takes into account five factors:

1. Regulatory history (funds that break the rules get bad grades).

2. Fees (the lower the better).

3. Manager compensation based on performance.

4. The strength and independence of a fund’s board of directors (and thus the value of the oversight it provides).

5. Investor-friendly rules and policies — for example, whether the fund is willing to close to new investors before it gets too big.

How do the funds in the Kiplinger 25 rate on stewardship? Quite well, overall. Of the 17 funds with grades, eight received an A; none got a D or an F. (For comparison, just 9% of ranked funds overall received an A.) Below are more details on these scores.