Do Mutual Fund Fees Really Matter to 401k Investors and Fiduciaries

Post on: 22 Июнь, 2015 No Comment

T he Department of Labor (DOL) has been on a foolish crusade for some time now. Under the banner of “protecting 401k investors,” the DOL appears more likely to merely – and arbitrarily – increase fiduciary liability. If a plan sponsor, trustee and any other ERISA fiduciary can’t see how this campaign will increase their liability, then how can they take the proper actions to reduce their fiduciary liability?

A mutual fund’s expense ratio represents only one factor in analyzing the appropriateness of a mutual fund as an investment.

Unfortunately for us fiduciaries, Washington constantly falls victim to the behavioral fallacy known as “recency.” For those not familiar with this academic realm, recency means overweighting the most recent event you’ve witnessed. It’s why current players tend to overpopulate “greatest team” lists. It’s also why sports Halls of Fame insist on waiting five years after retirement before a player becomes eligible for consideration. Worse, when applied to government, lies the awful corollary of recency: the knee-jerk reaction.

When markets fall (as they do periodically), hundreds of thousands of investors (read “voters) lose money. Rather than allowing time heal this wound, our friends in the Capitol tend to prefer to act. Here’s the problem: investment advice, like witchcraft, tends to be a little hard to pin down. So the bean-counters in the various constitutional branches focus on the most measurable factors.

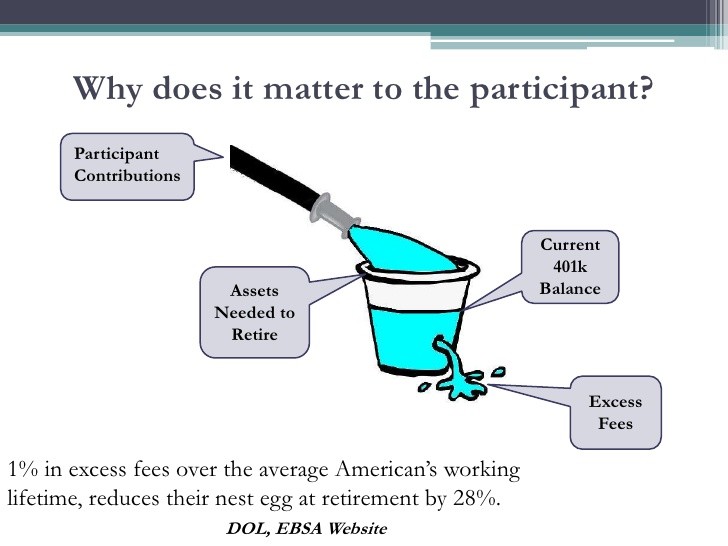

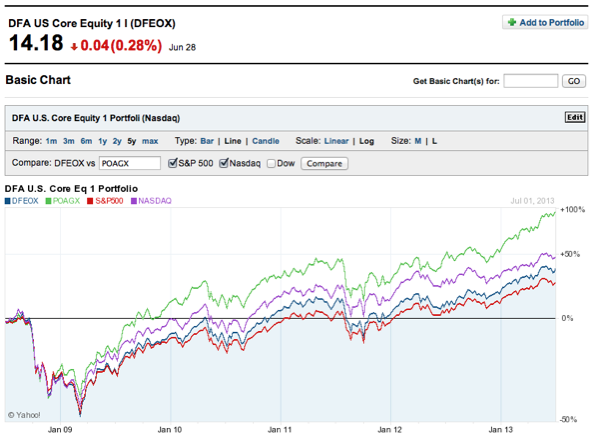

Only two measurable factors exist in the world of investments: performance and price. Of course, we’re all taught “past performance cannot guarantee future results.” No administrator will want to risk losing the boss’s reelection chances by using something not guaranteed. That leaves price, or, in the case of mutual funds, an extremely easily measurable expense ratio. A mutual fund expense ratio includes everything from the investment adviser fee, to the independent auditor fee, to all regulatory fees (just to name a few). Some advisers use the expense ratio as an exclusive criterion when assessing the appropriateness of recommending a particular mutual fund.

This is wrong. Even if the DOL demands it, focusing too much on a mutual fund’s expense may actually increase fiduciary liability and hurt 401k investors.

Why? Because a mutual fund’s expense ratio represents only one factor in analyzing the appropriateness of a mutual fund as an investment. Other factors may in fact be more important (including, among other things, portfolio manager tenure, number of holdings, total net assets, investment objective and consistency of returns). As a fiduciary, a fund’s expense ratio can become less relevant should the fund exhibit reliable high performance. Fund expenses, then, only rise to pertinence when all other factors are equal. Any fiduciary consultant can easily demonstrate this.

This explanation has the merit of being easy to understand as well as making prefect common sense. Why, then, do reporters, regulators and even some members of the financial industry chase the red herring of mutual fund expenses? It’s simple. Of all the possible fees underlying 401k plans, mutual fund expenses are the easiest to measure with reliability. Unlike all other 401k plan service providers, mutual funds are required to disclose their financials – which include fee information – twice a year. Some vendors don’t even need to disclose their fees! (Although Congress is talking about changing that.)

The mutual fund expense issue is perhaps one of the lower priorities when it comes to reducing 401k fiduciary liability. Indeed, the ICI report shows the average total expense ratio incurred by 401k investors in stock funds was 0.72%, exactly half of the average of all stock funds. The same is true for bond funds (0.52% versus the average 1.06%).

So, what should the 401k fiduciary focus on? That’ll have to wait for another column. In the meantime, I’ll leave you with this:

It’s not what you pay a man, but what he costs you that counts.