Dividend Funds That Don t Pay Dividends

Post on: 9 Апрель, 2015 No Comment

One of the great ways to boost your investment portfolio is to add dividends. Dividend paying investments provide you with additional income from your investments, since they are payouts on top of capital appreciation. You can use the dividends as income, or you can even reinvest them to help you grow your portfolio at a faster rate. Since dividend payouts are based on the number of shares you own, using your dividends to buy more shares can increase your payouts in the future. Its a beneficial cycle that can boost the rate at which you grow your wealth.

Its even relatively easy to start investing in dividends. There are many great dividend stocks in Canada. I personally have about 30 that I watch for adding to my Smith Manoeuvre. You can also invest in dividend paying funds to help your strategy. Unfortunately, if you’re looking to mutual funds to fill the Canadian dividend portion of your portfolio, you may not be getting what you pay for.

Mutual Funds and Dividend Payouts

One of the nice things about mutual funds is that you have the chance to spread the risk around. You get instant diversity, and a better bang for your buck if you dont have a lot of capital to start with. There are dividend funds in Canada, but you have to be careful.

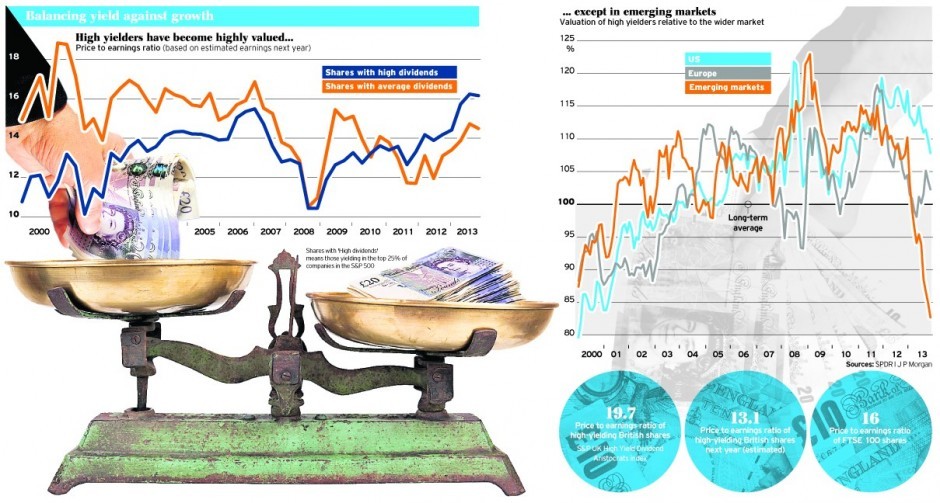

First off, since these dividend funds have Management Expense Ratios (MERs) in the 1.6-1.7% range, this creates quite a drag on the dividend income you can expect from this type of fund. If the dividends are low, the cost of the fund can completely negate the payout. To compensate for this, fund managers have to look elsewhere to bring the payout back up in real terms. This can mean looking for better performing funds with higher expense ratios. It becomes a frustrating and counter-productive exercise if you arent careful.

Four of the five major Canadian Banks have Canadian Dividend funds that are made up of only about 85% Canadian equities. TD bank was the only exception, being in the 95% range. The rest of these funds include T-bills, as well as US and international equities. Even within the Canadian equities portion, not all stocks are dividend paying equities and other stocks have low or unstable dividend payments.

The reality of fund composition creates a few issues. You are not getting only the dividend paying equities that you were looking to add to your portfolio; you are likely just adding another high-MER equity fund with a different name. This fund will also not provide the tax efficiency of a true dividend only fund, since the payouts include capital gains and return of capital (ROC). You need to dig down into the realities of the funds makeup in order to determine whether or not you are truly getting what you think you are.

Choose Better Funds for Your Dividend Portfolio

So what are your options for adding dividend paying companies to your portfolio? With mutual funds, not much, though the TD Dividend Growth funds may be closer to the real thing. The truth is that there just isnt much to choose from when it comes to true dividend paying mutual funds in Canada. You dont want to pay high expenses; you want to get a low-cost fund with the true tax benefits of investing in Canada dividend assets.

Your best option might be Exchange Traded Funds (ETFs). ETFs are similar to mutual funds, but they often come with much lower costs, and they are traded like stocks on the exchanges. You can get the benefits of mutual funds, but without some of the costs. Plus, many dividend ETFs dont include all those other income investments that can dilute your dividend payments.

If youre looking for a dividend ETF, the iShares CDN Dividend Index Fund (XDV) is a solid choice. While you may have to pay commissions to buy these ETFs, the 0.5-0.6% MER and the fact that you get the dividend paying stocks that you’re looking for will make it worthwhile.

Sign up today to be the first to know about all the latest topics on one of the top personal finance blogs in Canada.