Diversification Will Provide Low

Post on: 28 Апрель, 2015 No Comment

1. International diversification will provide low risk when the investor finds international securities having a compound rate of return equal to that of the United States and a correlation coefficient close to that of the United States portfolio. (Points. 1)

True

False

2. By combining foreign securities with domestic securities, investors increase their portfolio risk because foreign securities are more volatile than United States securities. (Points. 1)

True

3. ADRs (American Depository Receipts) represent an ownership interest in a foreign company’s common stock. (Points. 1)

True

4. Currency fluctuations and rates of return are the only really important things to consider when investing internationally. (Points. 1)

True

5. One possible way of achieving international diversification in a portfolio is to invest in foreign firms which trade on United States markets or through ADRs. (Points. 1)

True

6. Foreign exchange risk is not a major concern to international investors, because there have been fewer wide swings in currency values in recent years. (Points. 1)

True

7. One of the biggest risks when investing in a foreign security market, is the risk of currency exchange fluctuations. (Points. 1)

True

8. Less developed countries may provide even greater risk reduction in a portfolio than developed countries. (Points. 1)

True

9. Countries are divided into developed and emerging markets based on the market capitalization of their stock market. (Points. 1)

True

False

10. The best possible way of achieving international diversification is to invest in United States companies having a large share of their business coming from foreign investment. (Points. 1)

True

False

11. The benefits of American Depository Receipts (ADRs) are many. Which of the following is not a benefit? (Points. 1)

ADRs allow foreign stocks to be traded very similarly to United States stocks

Commission rates on ADRs are generally lower because the actual stock certificate is held by a bank

Dividends are paid in United States dollars

The annual report you receive will be in English

12. An investor can earn a higher return in foreign markets than in the U.S. because (Points. 1)

A number of countries have superior real GDP growth rates compared to the U.S.

Of foreign competitiveness in traditional U.S. products such as automobiles and steel

Of the fact that many nations enjoy a higher savings rate than the United States, which leads to capital formation and potential investment opportunity

13. Multinational corporations are firms that (Points. 1)

Operate in several countries

Have clients in several countries

14. Indirect international investment effectively eliminates problems with (Points. 1)

Taxation by foreign governments

Administration of foreign securities problems

Different cultures and reporting standards

15. An investor who wishes to achieve high returns and low risk exposure through international diversification would probably look for (Points. 1)

Compound rate of return higher than that in the United States and a negative or low positive correlation of returns with the United States market

Stable currencies relative to the dollar, total market value potential higher than the United States and high correlation of returns

Compound rate of return equal to that of the United States and a correlation coefficient close to that of the United States

None of the above

16. Which of the following is NOT a valid reason for discounting the importance of stable foreign currency in evaluation international investment alternatives? (Points. 1)

A devaluation in one country is usually offset by an increase in value in another

The overall effect of a devaluation in the economy of the country is insignificant

Risk exposure can be hedged through foreign exchange contracts or foreign currency options

All of the above are valid reasons

17. Indirect means of participating in foreign investments include purchasing (Points. 1)

Exchange traded funds

Open-end mutual funds specializing in foreign securities

Closed-end mutual funds

A and C

18. Direct international investment without the numerous associated administrative problems can be achieved by purchasing shares (Points. 1)

Of foreign firms which trade on the New York Stock Exchange or NASDAQ

In a mutual fund

In an exchange-traded fund

Of multinational corporations

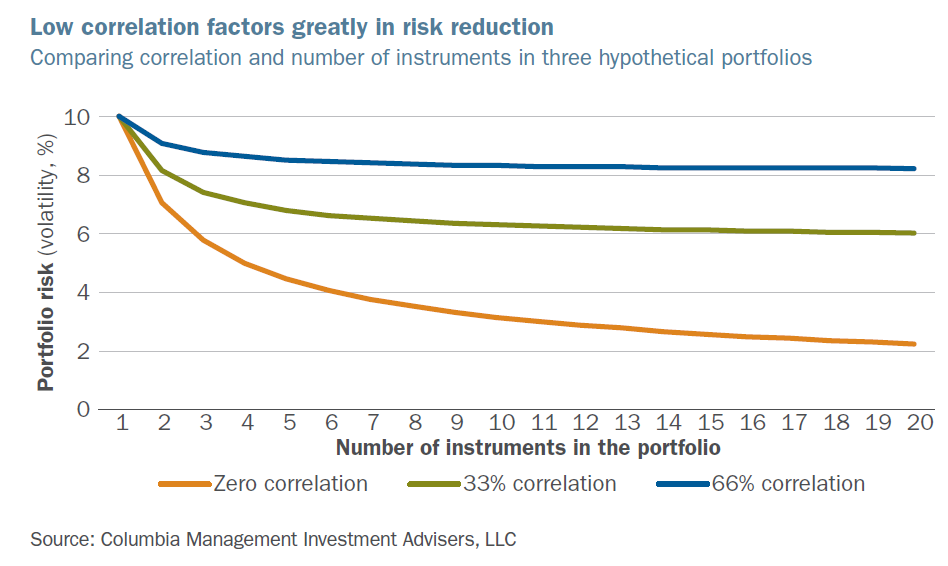

19. The investor can maximize risk reduction benefits by combining United States securities with those of countries which are _________. (Points. 1)

Oil exporting nations

Negatively or least positively correlated with the United States

Correlated with the United States

None of the above

20. There are several reasons why some analysts think that financial market have become more highly correlated in recent years. Which one does not belong? (Points. 1)

The development of a global economy has made companies and those economies more connected and less diverse

The new European Central Bank has coordinated economic policy across the European Union making that region more coordinated

U.S. companies operating abroad like Coca-Cola, McDonalds, and ExxonMobil are highly correlated with U.S. markets

Every time we have a world event such as September 11, 2001, a currency crisis, or a market collapse somewhere, the international stock markets seem to fall together making them look like they are highly correlated

21. Specialists in international securities associated with financial management firms provide their expertise primarily to (Points. 1)

Wealthy investors

Institutional investors

Managers of mutual funds

More than one of the above

22. An advantage to investing in foreign markets is (Points. 1)

Diversification

That it is easy to profit from foreign currency exchange

That there is more potential to profit from foreign markets than domestic markets

There is less risk involved in investing in foreign markets

23. Which of the following reasons might explain why international investing might offer diversification benefits? (Points. 1)

Companies operating in different countries will be affected differently by international events such as crop failures, energy prices, wars, tariffs, etc

Since the introduction of the euro, European and U.S. markets have a tendency to move in the same direction on an annual basis

World markets are highly correlated to the U.S. market since the U.S. is the engine of economic growth around the world

U.S. companies operating in foreign countries automatically provide the investor with diversification against foreign currency fluctuations

24. Which of the following statements about mutual funds and closed-end investment companies investing in foreign companies is true? (Points. 1)

The fund managers are specialists at handling various foreign investment problems

It is difficult for track the stock prices of foreign equity investments

Professional management provides an opportunity for superior returns compared to the foreign market

All of the above are *a. true

25. Administrative problems such as different settlement procedures for various markets can best be avoided by (Points. 1)

Becoming thoroughly comfortable with each country’s procedures

Using a local broker

Investing in a mutual fund

None of the above

26. Political risk can best be effectively reduced or eliminated (Points. 1)

Of internationally invested mutual funds

More than one of the above

28. Methods of indirect international investment include all of the following except (Points. 1)

Buying shares of a multinational corporations

Investing in mutual or closed-end worldwide investment funds

Hiring a specialist in foreign investments

All of the above are methods

29. Which of the following might be a reason for higher return potential in certain foreign stock markets than in U.S. markets? (Points. 1)

Some small economies have more growth potential because they are starting from a smaller base of GDP

GDP is growing at a faster rate in some countries than in the United States

Many of these foreign economies have older populations that spend a higher percentage of their income than the U.S. population

A and B are valid reasons

30. Which of the following are benefits of diversification into foreign securities? (Points. 1)

Diversification offers opportunities for higher returns than a single country portfolio

Diversification reduces portfolio volatility

Returns between countries are not highly correlated