Diversification The Importance of Diversification in Investing

Post on: 4 Август, 2015 No Comment

Investing involves risk. When you invest your money, most of these investments have no guarantee that you will earn a profit with the exception of few investment vehicles like time deposit.

I know many people are keeping themselves away from investing because of their lack of knowledge and understanding how a particular investment works. It is the reason why it is very important to learn and understand first before you put your money on what you consider as an investment .

Perhaps, you have already heard or read the phrase Dont put all your eggs in one basket. It is also true when it comes to investing your money specially if you are a newbie in investing.

When I started to invest some of my money, I tried to study and learn which investments could be better choices. Maybe you know there are several investments available for individuals such as time deposit, mutual funds, bonds, stocks, UITF and a lot more.

Each of these investments has its unique features and characteristics as well as the risk involves. My suggestion for you before you place your money in these investment is that you should understand and study first how it works and how yu could earn money from it.

So the question is how to reduce the risk when investing. The risk involves losing of the principal money you have put into the specific investment. Here are some of the things I think why diversifying your investments is very important to protect yourself from the risk.

1. Diversification will protect you from losing all your money

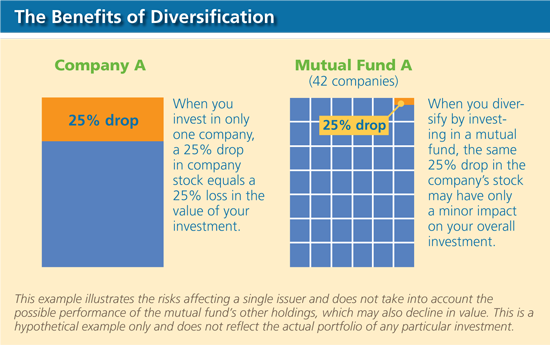

It is not wise to invest all of your money in just one investment, for instance, in the stock market. Maybe you know some people who loss considerable amount of money because of the 2008 global economic crisis.

Many people loss their investments due to collapse of stock market of most countries including the USA, Canada and European countries. Stock market is one of the riskiest investments out there so do not put all your hard-earned money into this kind of investment. Just a warning but do start investing.

I would suggest you can breakdown your investments in percentages. Allocate certain amount or percentage in the stock market, some in time deposit, others in mutual funds and so on. Make sure that you know the investments you are starting to prior putting your money into it.

2. Diversification offers new opportunities to make a profit

Im not a professional financial planner or adviser but in my own experience, I could say that if you have several investments, not just one, it will give you more chance to make more profit. However, before you diversify to other investments, it will be better to ensure that you have enough knowledge and understanding how this particular investment could make money for you.

I will give you an example. When I started investing in stock market in 2010, I have a great hope that I could earn money even if it is small. But when I realized that stock posses high risk, I started to look for other investments that has lower risk than stock investing.

I read blogs about investing during that time and many blogger are suggesting to invest in mutual funds. One of blogs I follow regularly suggest its readers to invest in ETF. However, in the Philippines, ETF is not yet available, but you could invest in other ways like UITF and mutual funds.

3. Diversification will increase your financial knowledge

As you keep on diversifying your investments, your financial intelligence and experience will also increase. You will know many terms and strategies on how to effectively place your money to these investments.

I will give you an example. During my early days of investing in the stock, I dont know many things and terms about the stock market. I have learned it along the way and then I started to study mutual funds.

Both of these investments have almost the same structure. Actually, some type of mutual funds are invested in the stock market so they are closely related to each other.

If you have your own business, I assumed you have learned many things about tax, assets, liabilities, cash flow and so on. By diversifying your investments, you will not only make profits but you will also increase your financial IQ.

If you diversify your investments, you are not only concentrated to one particular vehicle. If you are an entrepreneur, it will be better to put some of your earnings in other vehicles, not solely in your own business. Those investments with lower risk like mutual funds and time deposit.

Final Note

Diversification is very important for new and old-time investors. Putting all your money in one investment will increase the chance of losing your principal. Make sure to learn the several types of investment before you put all your money into that kind of investments, then diversify!

Grab My FREE Newsletter!

If you haven’t subscribe yet to my blog and you want to learn more about how to make money online, stocks, mutual funds, choosing the right investment, increasing your income and a lot more under the sun.

Just subscribe to our newsletter by entering your email below. Don’t worry your email is secure and you will not receive spams. Thanks!