Difference between Index funds and Index ETFs

Post on: 30 Июль, 2015 No Comment

Beating the market consistently is difficult even for fund managers. In a bid to time the market, they may take a wrong call, resulting in losses for investors. In such cases, it may not be easy to justify the extra fee paid in the form of fund management charges. A better option could be the passive funds, which cut these costs and deliver returns in tandem with the market indices as they have securities in the same proportion as in the underlying index.

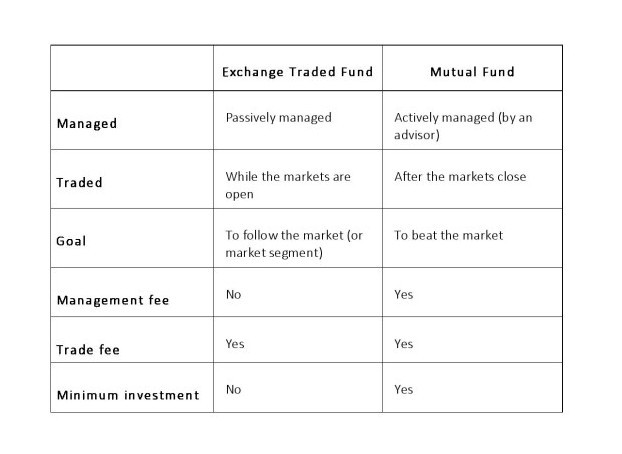

There are two types of passive funds-index funds and index exchange traded funds (ETFs). Though both mirror their benchmark indices, they are traded differently. Index ETFs are more like stocks as they have a fixed amount of units and can be sold in the secondary market. In the past few years, ETFs have branched out to gold and sector-specific ETFs.

Tracking error

Tracking error is the difference between the returns delivered by the fund and that of the benchmark index.

On an average, it is higher in the case of index funds than for index ETFs. For instance, the tracking error for Magnum Index is 0.88, while it is 0.06 for UTI Sunder (see table). One reason for this is that an index fund deploys money from the investor the next day while allotting units on the same day, whereas an ETF deploys the money immediately on a real-time basis.

The following are factors which will help investor to decide either Index fund or Index ETF

Cost Factor

The first and most important factor is the cost of the fund.

Index ETFs are more cost-effective as there is no distribution commission involved. It also saves on operative expenses, such as custody cost and account statement fee, which are present in the case of an index fund. This is why the expense ratio of index funds is usually higher than that of index ETFs.

For instance, Birla Sun Life Index fund has an expense ratio of 1.5%, while Motilal Oswal MOSt Shares M50 ETF, an index ETF, has an expense ratio of 1%.

This small difference in the cost creates a significant variation in the returns generated by these funds over a long period of time. Therefore, index ETFs usually deliver higher returns than index funds. When we consider the three-year returns of both categories, index ETFs have delivered returns that range from 19-24%, while index funds have delivered returns of 17-20%.

Higher returns are obviously attracting more investors.

Another reason is that index funds are required to keep some cash in order to meet redemption demands, which is not the case for ETFs, where new units are created by the exchange at the fund level. So, in the case of gold ETF, if an investor (usually authorised participants) wants to create new units, he will have to give physical gold.

For example, a fund may specify that for creating 1,000 units, the fund will require 1 kg of gold. Similarly, when an investor wants to redeem the units, the fund will return the underlying asset in a defined proportion. This creation or redemption with the fund house is done by authorised participants. In the case of retail investors, they can buy or sell the units in the secondary market, a mechanism that ensures the secondary market prices are very close to the NAV of the fund, says Rajan Mehta, former executive director, Benchmark AMC.

There is no difference in the tax treatment for both types of funds, which follow the same rules as that for equity mutual funds.

Which is a better option?

Like an index fund, an index ETF too invests in the stocks of an index in a similar proportion. However, it is traded on a stock exchange as one unit. So, you can take advantage of intra-day volatility and buy and sell it on the basis of its real-time NAV, unlike in an index fund, which is sold and bought like any other actively managed mutual fund buy only mutual fund entities.

Though fund houses do not offer systematic investment plans (SIPs) in ETFs, you can instruct your broker to invest a fixed amount monthly. One drawback is that you need to hold a demat account to access an index ETF. The process may be a little cumbersome for those who do not conduct online transactions.

Index ETFs certainly seem to score over the index funds as they deliver better returns and match their benchmark indices more closely.