Definition of Mutual Fund Expense Ratio

Post on: 25 Июнь, 2015 No Comment

The Facts

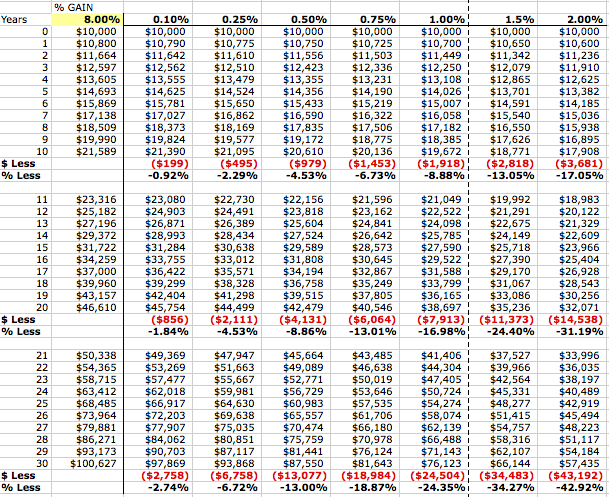

Expense ratio refers to the cost of running the mutual fund. It is calculated by dividing the fund’s operating expenses by the average value of all of the fund’s assets. These fees are charged regardless of any gains or losses of the fund, and are paid before any money is returned to the investors. Expense ratios vary greatly between funds, so you should pay attention to the fees charged by different funds, as this will directly affect your returns.

Features

While expenses are necessary and unavoidable, mutual funds are able to control the amount of the expense ratio by how well they control operating costs. More actively managed funds will naturally have a much higher manager’s fee. If a fund charges a 12b-1 fee, one that advertises heavily on television and radio will naturally have a much higher expense ratio than one that markets through direct mail. The location of a fund’s offices and the size of its staff also have an effect on its costs.

Considerations

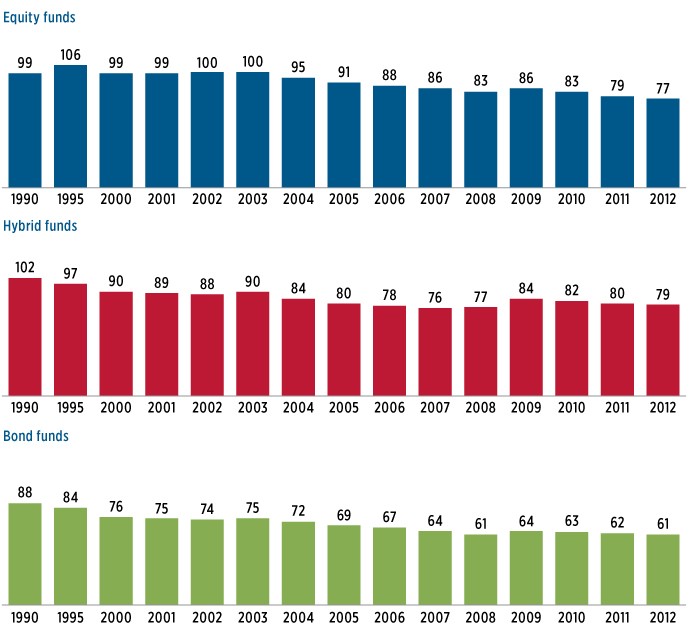

Pay attention to expense ratios when comparing mutual funds. Some funds, especially smaller funds or those in more specialized sectors, can have expense ratios of 2 percent or more. Index funds, which are not actively managed, typically have much lower fees, with expense ratios as low as 0.2 percent. Look carefully at this number when comparing different mutual funds. The expense ratio also does not take into account any sales charges (called loads) or redemption fees. These fees, if applicable, are paid directly to the fund by investors, not taken out of assets.

Warning

Resources

More Like This

What Is the Difference Between a Weighted Average Expense Ratio & a Net Expense Ratio?

You May Also Like

Mutual fund expense ratios are simply a percentage that indicates how much a mutual fund charges its investors for its service on.

Expense ratio is the overall expenses of a company relative to its overall income coming in and dividing the two financial components.

In investing, an expense ratio measures how much it costs a company to operate a particular mutual fund — how much money.

An expense ratio is a company's expense to income ratio and is used to for research when investors are looking for healthy.

Before you decide to keep a mutual fund investment or invest in a new fund, question its expense ratio. The mutual fund's.

The expenses of a mutual fund are provided by the mutual fund company in the fund's prospectus. Investors researching mutual funds should.

What Are Average Mutual Fund Expense Ratios. Mutual funds have annual expense ratios that cover the managing and running of a mutual.