Define Class K Mutual Fund

Post on: 19 Июль, 2015 No Comment

Other People Are Reading

Mutual Fund Expenses

After evaluating the kinds of securities in the fund, fund management objectives, and historical performance, determine investment costs. This cost, or expense ratio, presents as a percentage of fund total net assets. Added to securities acquisition or disposition costs, commissions, loads or 12b-1 charges, yearly distribution or marketing fees included in total operating expenses, the expense ratio defines how much total fund capital services the fund. Even no-load funds bear operating expenses.

Professional investors evaluate all aspects of an investment. Costs to manage capital impact total performance.

Class K Funds

Class K funds employ the identical fund managers as retail mutual funds with lower expense ratios.

Many investors choose mutual fund families for flexibility and fund exchange privileges.

For example, an investor chooses a fund whose objectives match her own at age 25. Stock and bond market trends appear positive: she chooses a balanced fund with good performance.

Later on, recession changes market trends. The investor moves her funds to a conservative income fund. Because she invested in a fund family, the funds move within the family of funds.

Now the investor hears about Class K mutual funds. The university she works for explains the advantage of lower expense ratios for her 403(b) investment. A 403(b) plan is available to many employees of non-profit organizations. Similar to a 401(k) plan, her funds grow tax-deferred.

The investor selects a fund in sync with her investment objectives, market outlook and time to retirement in the same way she always has. She factors in expense ratio differences to make a Class K fund choice.

Expenses and Total Return

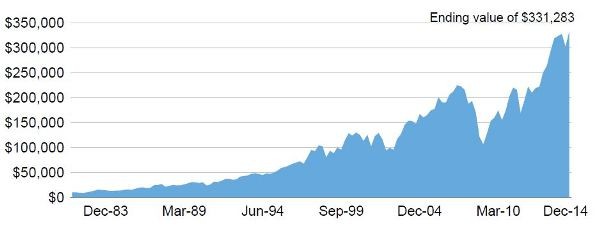

Using a $100,000 example, the investor above identifies a mutual fund meeting her investment criteria. The Class K fund quotes a 0.2 percent annual expense ratio, or a $200 yearly expense to manage and maintain her investment. The non-Class K fund, managed by the same portfolio managers as the retail mutual fund of the same name, shows an expense ratio of 1.5 percent, or $1,500 per year.

Fund Families

Your employer selects funds and families of funds for their administered plans. Evaluate funds most closely matching your investment objectives and outlook. Compare expense ratios between the retail investment and institutional investment equivalent. The K fund most likely provides a lower expense ratio.

Mutual Fund Families with Class K Funds

Always request a prospectus before making investment in any security. This article is not an offer to buy or sell securities.