Debate RESOLVED The United States should abandon the current tax system and adopt a flat tax rate

Post on: 16 Март, 2015 No Comment

Pro

A flat tax rate simply means making the same percentage of taxation upon every income level as the United State currently raises it depending on income

I propose we look to the value of Justice for the round, or fair due. I will not offer a criterion as those are overly limiting and there is no reason we cannot weigh each impact on it’s own.

I affirm for 3 main reasons.

Firstly, A simple rule such as this which overrules all other tax law’s will make things much more simpler so that it is easier for people to understand and less mistakes occur. Many people can attest to the complexity of taxes, the loopholes, the benefits, the extra taxes, the dreaded audit. Every year 1 million five hundred and fifty tax forms are audited according to the IRS’s website, and it is even said that a large majority of people make mistakes on their tax forms but the IRS does not have the man power to go after all of them. Reducing it all to just 13 percent reduces complexity on a massive scale meaning that it is vastly more fair to the American people.

Secondly, Low taxes encourage the richer classes to not use evasions like swiss bank accounts and such to avoid taxes, thus actually increasing the amount of money brought in. Daniel J. Mitchell wrote in an article for the heritage society on august third 2003 that during the Reagan tax cuts, the kennedy tax cuts, and the tax cuts of the 20’s tax revenue increased by over 70% each time, and all of those cuts were massive in size. He further says that this is due to the fact that with higher taxes people always find ways around paying taxes, like the classic example of the swiss bank account. This resolution will for the most part lower taxes dramatically as currently percentages are much higher.This will mean more revenue since people are all willing to pay and less likely to try and cheat the government. And so there is more money for the government to help its country, defend itself, and all that other cool stuff.

Finally, flat tax rates encourage economic growth and foreign and homegrown companies moving back in and providing jobs. This is proven by the example of Estonia, which since its breaking off from the soviet union has been using a flat tax system. Dan kenitz of yale university explained in his article in bi-polar nation on October 29th 2007, that estonia has a GDP growth of about 10% annually and after the Flat Tax was installed, huge corporations like Microsoft moved in and Foreign investment increased leaps and bounds. Since flat taxes are a system which does not punish companies for being successful, and in general lower taxes attract business, flat tax does attract many new companies. These new companies bring jobs and money with which we can revitalize America and get ourselves back on track.

I leave definitions and such for the most part up to the con but if there is serious abuse in them I reserve the right contest them with counter-definitions.

A quick search on google of flat tax rate v. current system or such will probably yeild you more than enough information to have a fun debate, and if you are already informed then even better!

I await a negation.

Con

A flat rate of 10% would cause the United States to go bankrupt within a year.

If you’re going to go with simple rules why not get rid of them all. The US would still go bankrupt and no taxes for anybody! Yippee! I don’t know if you’ve ever filed your taxes but it’s pretty straight forward. You enter the numbers in the computer and it spits out what you owe or are due.

The rich aren’t concerned with such things. They want more money and getting a little dodgy with their taxes gets them more money. Swiss bank accounts and hidden funds will still save you thousands of dollars. And it’s probably a good investment to store money in other places because, as I’ve mentioned before, the US is going belly up. Further, as all the government employees can’t get paid and unemployment skyrockets the economy is going to grind to a halt. I’m not sure what kind of bizarre logic leads one to such conclusions, if you give somebody a million dollars they are going to stop wanting more money.

Further, I’m quite annoyed by the constant claims by flat tax proponents that lowering the tax rate increases revenues when the only thing that increased the revenues in was the economic booms that were unrelated. For example, Clinton raised taxes on the rich, and the following economic boom raised revenues dramatically. It was the only time in the last 30 years or so that the federal budget was in surplus.

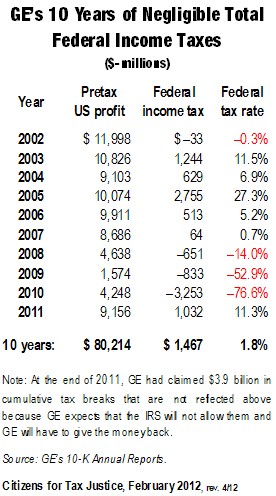

Lastly, as is many companies don’t pay taxes. They play loose with the accounting and avoid paying any taxes. Now, you want it both ways though. You want to say that Estonia has attracted businesses by attracting shell companies of US businesses, and that the US will do the same by lower taxes. No the US already has the businesses and we just need to actually tax them properly and fix the loopholes and such.

Finally I think it’s most important to note the problem I alluded to earlier. the US would go bankrupt. A 10% tax rate is so low that it would cause the government to seize, we’d have to close all the schools, fire all the teachers, close down a lot of the police stations, give up on all the wars and stop all the projects (this would happen automatically with the complete lack of money) and the sudden surge in unemployment due to the largest US employer going under would cause the rest of the economy to seize back up.

Many corporations at present are funneling all their money around and avoiding paying any taxes, they are still going belly up. You can’t reduce a 0% tax rate for the cheats. And because their due isn’t the standard flat rate 35% they are going to suddenly pay the ten percent and do what, pay more taxes and still go bankrupt or keep cheating and still go bankrupt.

10% just isn’t enough to keep the US government alive, even if we cut all the vital services.