Cross your fingers Bot lets superstition guide stock trades

Post on: 16 Март, 2015 No Comment

digg

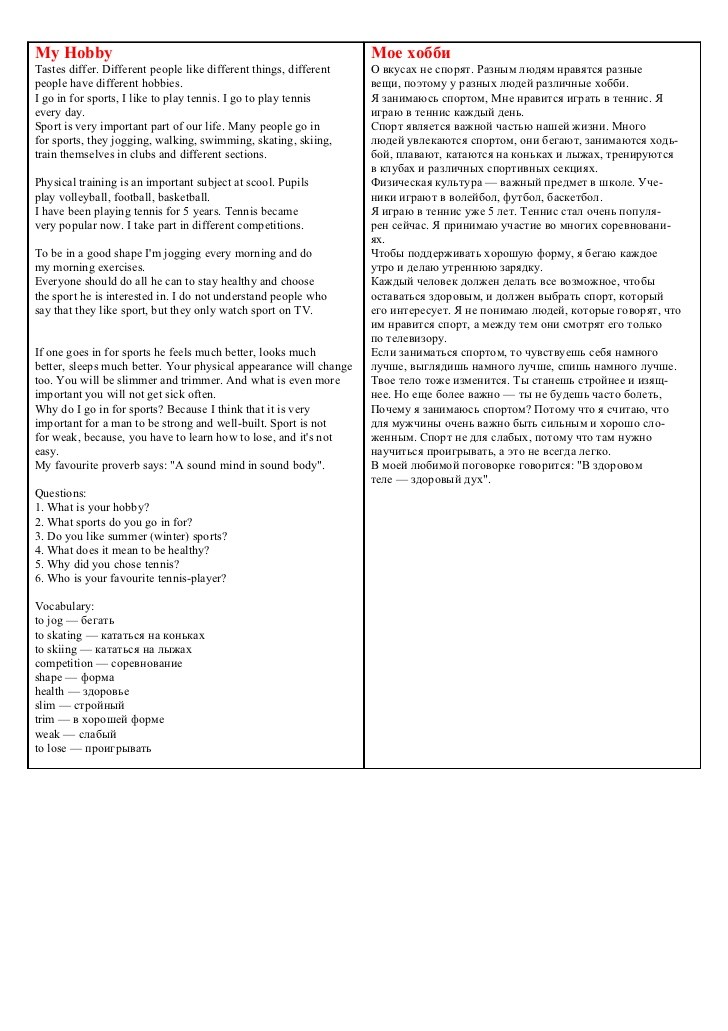

The Superstitious Fund stock market board uses Arduinos to collect and stream live fund data. Diego Trujillo

Would you invest in a fund that bases its trades on the patterns of the moon? In a move unlikely to be espoused in any Business 101 class, lots of people already have.

They’re sinking their dollars into the Superstitious Fund. a one-year experiment that invites the public to invest in the stock market via an uncanny trading algorithm. The automated bot trades live against the FTSE 100 index on the London Stock Exchange predicated purely on numerology and astrology.

So far, 144 investors from more than 35 cities worldwide have invested almost $5,500 in the Superstitious Fund, according to Shing Tat Chung. a recent Design Interactions graduate from London’s Royal College of Art who conceived of the project as an exploration of superstition’s role in society today. Logic doesn’t always equal financial success, he notes in an interview with CNBC. and superstition that permeates consciousness on a broad scale (think Friday the 13th) can and does have real-world financial repercussions.

But what if computers operated on the same sorts of superstitions as humans? Chung wanted to examine the intersection of superstition and technology, a topic that’s apparently of interest beyond art schools as Microsoft Research and GDP Capital are among the project’s sponsors.

Chung’s autonomous algorithm — developed with help from an unlikely coalition of finance professionals, fortune tellers, programmers, and lawyers — buys or sells when a superstitious indicator, such as the number 13 or a full moon, appears. It won’t trade on certain dates or at certain times. The Fund reserves the right to refine and edit its trading strategies. After all, you never know when Chung will step on a crack in the sidewalk.

Related stories

The Superstitious Fund began trading last month, and at the end of the one-year experiment, the value will be distributed to the investors at a profit or loss. (Call me a skeptic, but I’m prone to bank on the latter.) Investors can contribute as little as $3 but cannot withdraw their funds until the fixed-investment period is complete. The experiment is speculative and extremely risky, the fund’s Web site warns, though it does promise that investors won’t lose more than they put in.

Recent Royal College of Art graduate Shing Tat Chung consults with a fortune teller as part of his Superstitious Fund project. Diego Trujillo