Counterparty Risk Management

Post on: 16 Март, 2015 No Comment

Counterparty Risk Management | Counter Party Risks

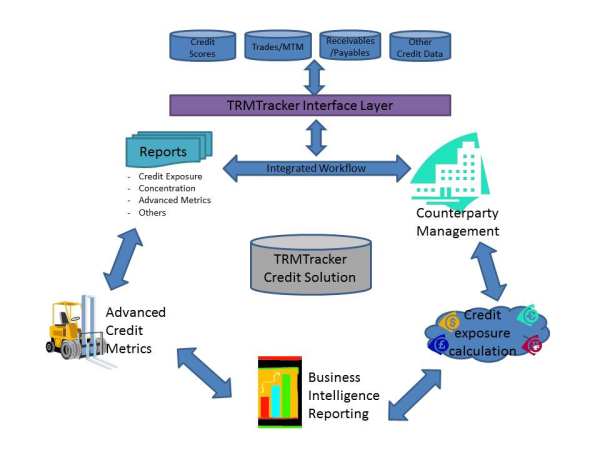

It goes without saying that counterparty risk management has become more important to look at for just about everyone in the industry. What needs more discussion is exactly how to conduct and assess counterparty risks. Here is an article on this topic:

___________________

Risk and Reward: Hedge Funds Changing Views on Counterparty Relationships, focuses on the heightened importance of effectively managing counterparty risk and the integral role it plays in partnering with a prime broker. It also highlights best practices that have been implemented by other hedge funds to help address and mitigate counterparty risk. Key findings from the study include:

Hedge Funds Increase Scrutiny On Managing Counterparty Risk — Counterparty risk monitoring has become a significant part of overall business operations. One of the major drivers for heightened attention to managing counterparty risk are hedge funds’ concerns about the negative impact it could ultimately have on their firms’ operations should one of their key counterparties default on their obligations. More than 50% of respondents reported monitoring counterparty risk on a daily basis and nearly 85% consider it an extremely important or very important business issue. An overwhelming 96% of respondents also cited managing counterparty risk as the number one factor in selecting their prime broker relationships. Concerns about managing counterparty risk two years ago were not a primary issue for most hedge funds, as 26% of the respondents considered counterparty risk important and 22% viewed it as moderately important;

Counterparty Risk Management Must be Tackled Directly and Systematically — Effectively monitoring counterparty risk will continue to be a critical component of a hedge fund’s business operations. The development of a standardized, well-documented approach to analyzing counterparty risk remains one of the top priorities for the hedge fund community. Best practices for proactively managing counterparty risk include:

* Leveraging innovative services from prime brokers, such as a tri-party account approach

* Conducting consistent internal portfolio and risk assessments

* Formalizing business processes by outsourcing and installing in-house technology solutions such as portfolio management systems

* Implementing third-party independent valuation technology solutions and service providers supplemented with in-house valuation tools; and

Adoption of Technology — There is no silver bullet for hedge funds when attempting to actively monitor the balance sheets of important counterparties despite the growing concerns over counterparty risk management. Read the full article