Count ETFs in 401(k)s

Post on: 3 Май, 2015 No Comment

As Congress frets about 401(k) fees, the low cost of exchange-traded funds (ETFs) is attracting the interest of 401(k) plan sponsors. But the differences between ETFs and mutual funds traditionally have made it hard for 401(k) plans to add ETFs to their line-up of mutual funds. Now iShares, the Barclays Global Investors unit that is the biggest provider of ETFs, has teamed up with financial technology vendor SunGard to make it easier for 401(k) plans to use ETFs.

The addition of SunGard makes any of the operational challenges a thing of the past, says Darek Wojnar, head of U.S. iShares product strategy and research.

ETFs have been problematic because they trade intraday, while mutual funds are priced just once a day. And since 401(k) participants make regular small investments, they can be hit hard by ETFs’ trading costs, like the commission charged on each purchase.

SunGard’s solution is available to the third-party administrators that use its Omni and Relius recordkeeping platforms, as well as those that connect to the SunGard Transaction Network (STN), says Mike Vogel, vice president for SunGard’s wealth management business. The solution makes ETFs look like no-load mutual funds, in part by pricing them once a day, Vogel says, so everybody who is investing in ETFs will get an end-of-day price. SunGard also rolls up all of the trades each day into a single transaction for each ETF, thus minimizing trading costs for participants.

Michael Calandra, a principal at New York-based CMC Interactive, which administers retirement plans, says that until now, he has been unable to provide ETFs to 401(k) sponsors. But SunGard has come up with a seamless solution, he says. The ETFs are traded like mutual funds, they settle like mutual funds, and the participant gets to see the exact number of shares he owns in his account.

Since SunGard only links to iShares, challenges remain for plan sponsors that want to offer other brands of ETFs. And the operational difficulties aren’t the only barrier to putting ETFs into 401(k)s. Some experts question whether ETFs really are cheaper than other investments once all the costs are taken into account.

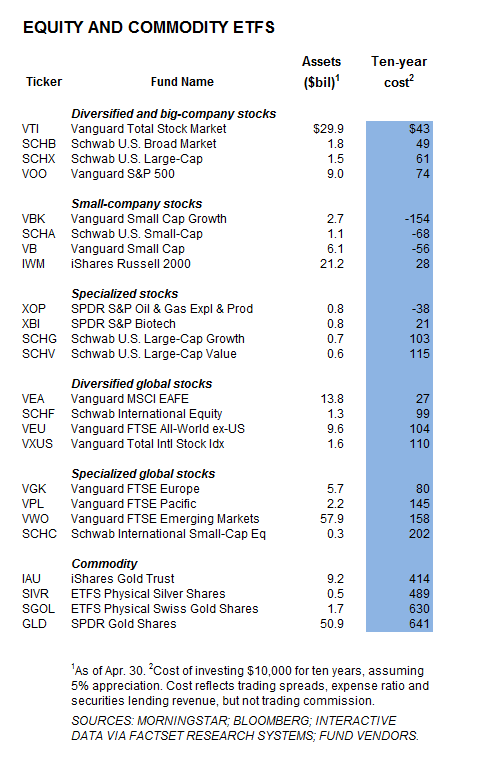

Pam Hess, director of retirement research at Hewitt Associates, says ETFs’ low fees are offset by their transaction costs and the additional expense of handling them. A lot of mid to large companies have access to very low-cost index funds already, with no transaction costs, Hess says, but adds that for smaller 401(k)s that might not have the same access to cheap mutual funds, ETFs could absolutely make sense.