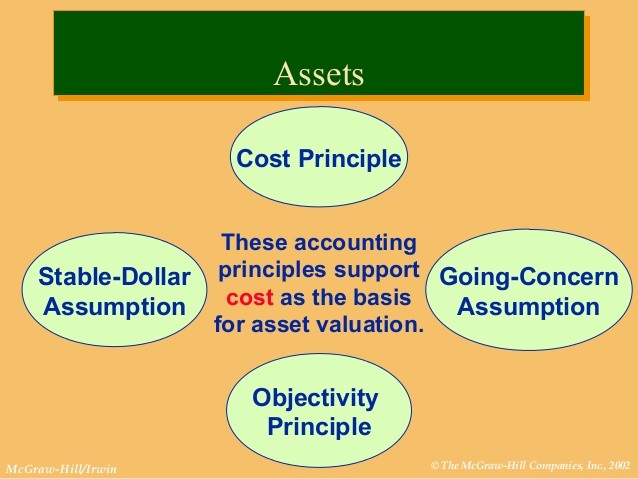

Cost Basis Support

Post on: 16 Март, 2015 No Comment

Very Important New Law for All Issuers, Transfer Agents, and Brokerage Firms Effective January 1, 2011

**********

As an Issuer, you are just as responsible for this information as we are. IRS could fine all entities who do not provide this information at $50.00 per missed statement, and 10% of the total cost basis amount for intentional disregard of the new law. This can, potentially, be in the millions of dollars. Call us if you have any questions!

**********

In October 2008, George W. Bush signed into law the Emergency Economic Stabilization Act. As part of that Act, the IRS included a proviso that all equity securities and units of investment trusts bought after January 1, 2011 will be required to maintain, pass-through and report all cost bases on all transactions. For years, the brokerage industry has maintained this information on a voluntary basis and the mutual fund industry has both maintained and, in the case of sales, reported this information on 1099B forms. It was up to the investor, however, to report the correct cost basis for individual sales of equity securities to Do you know how to allot cost basis on every transaction?

Now, the issuer (YOU!) and the transfer agent (US!) will be required to maintain all tax lot cost basis information for any transfers of shares that occur after January 1, 2011. The Depository Trust & Clearing Corporation is designing new software to accommodate all pass-through information through their CBRS program. This may or may not be a program in which issuers will be allowed access. As your transfer Our software has been updated and designed to handle the new law. We will require more information from you, however. For any new issuances completed after January 1st, we will require the following additional information: cost basis per lot, and the date the money changed hands or services were rendered. If the shares are for services rendered, you will have to place a value on those services at the point when the shares are issued. We will maintain this per lot cost basis in the shareholder’s account See new Transfer Request Form and (proposed) Issuance Resolution required for use on or after January 2011. When a transfer occurs, we must pass the information through to an applicable person, via a transfer statement. The transfer statement must be sent within 15 days. The recipient is not allowed to pay for this information unless they are also the presenter of the transfer request. In most instances it may be you, the issuer, who will be billed for the additional work that we are tasked with performing.

Statements are required to sent within 15 days and Issuers may have to pay for them. If we receive an applicable transfer request and the cost basis is not included, we are required to make one request for the information. If it still is not provided, we code the transaction as “uncovered”. The IRS will be tracking both covered and uncovered transactions. If the tax lot cost basis is incorrect we also must send a corrected statement within 15 days of the discovery of the error. The shareholder has the right to choose which tax lot’s cost basis to use, especially in the case of book entry shares, but if the holder does not specify, the FIFO (first in, first out) method will be used. If the shareholder opts to choose a different tax lot, we must be notified by settlement date – which, in the case of private transfers, is the date the transfer is made on the books of the issuer. If a certificate is presented, it, alone, is evidence of the correct tax lot to use for the report.

FIFO allocation will be used unless otherwise notified.

Two situations, in particular, bear additional attention: the gifting of shares and inheritance. If a tax lot is not specified and no cost basis is presented, we must assume that the shares are gifted. In a case such as this, the tax lot of the donor is used in combination with the fair market value on the day the shares are transferred. This, then, becomes the cost basis that we will maintain and pass-through to a recipient.

Gifting will require report of fair market value on day of gift and donor’s cost basis.

In the case of inheritance shares that are transferred, the estate representative must inform the agent of the cost basis, per lot, of presented shares. The representative must also notify the agent of the proportional share per recipient. If the proportional share per recipient and cost basis allocation is not provided, the agent will use the FIFO method and allocate an equal proportion per lot to each recipient. Remember, that the agent must send one request, first, if the information is not provided with the transfer request. If the information is not received within 15 days, the transaction will be coded as “uncovered”. However, 15 days is too late to wait and be provided the information before completing the transfer. Therefore, we will send the request, continue to perform the transfer as required, code it as uncovered, and then, later, correct the tax lot cost basis and send a corrected statement when the information is received.

One additional situation is the occurrence of a corporate action. Corporate actions require adjustments of the cost bases for each share of stock proportional to the split, distribution, etc. Starting in January of 2011, each Issuing Company will be required to produce an internally generated number applicable and unique to each corporate action that reflects either the adjustment per new share or the cost basis percentage of older shares, so that proportional adjustments, per that specific corporate action, can be performed on the shares presented for transfer. Failure to provide the unique Corporate Action Number will result in a rejection of the transfer request. The Corporate Action Number will be required by FINRA prior to approval of your corporate action request applications.