Core Satellite Investing

Post on: 6 Апрель, 2015 No Comment

Core Satellite Investing

2C225 /%

Portfolio management can be a daunting task for anyone, including professional investors. But just like with any other type of activity, the more knowledge you have and the better the tools you have access to, the easier it becomes.

Unfortunately, most investors don’t think about portfolio management. Instead, they focus on individual stock ideas and not unlike the gambler mentality, are looking for a big winner. I have had many conversations with clients that have wanted to buy individual stocks without thinking about the strategy of their investment decisions, and how those decisions affect their overall portfolio.

Core/Satellite investing serves as a guide or set of guidelines, which builds on asset allocation to give investors greater comfort in managing or participating in the decision making on their portfolio. Using a core/satellite approach can help an investor have better control of the portfolio, including the occasional idea they get from a “buddy”.

Understanding the core/satellite approach can also help investors have a better dialog with their financial advisor whether they prefer to allow their advisor to make decisions for them, or whether they would like to be involved in the investment decisions. For investors that like to be involved, the core/satellite approach offers a complement to a more traditional buy and hold strategy.

What is Core/Satellite Investing

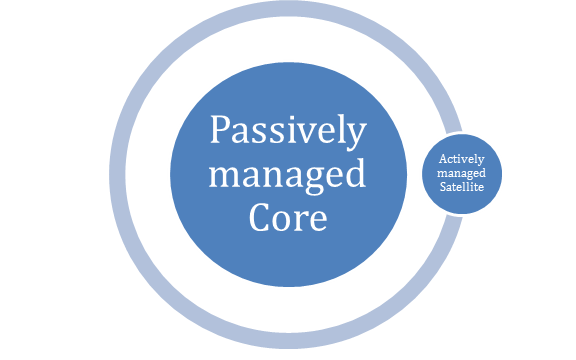

Contrary to what it sounds like, core/satellite investing has nothing to do with geology or astronomy and you don’t need to be a rocket scientist to understand it. As mentioned earlier, core/satellite investing builds on asset allocation for managing portfolios.

The core portion of the portfolio can be considered the long-term, buy and hold strategy that is made up of asset classes that are representative of the overall market. In other words, the core portfolio should contain an allocation to US equities, Non-US equities, (including emerging market equities), fixed income, and alternative investments such as real estate and natural resources, to name a few. The proportion invested in each will depend on your investment objectives and risk tolerance.

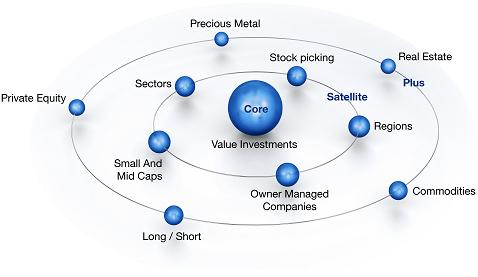

The satellite investments, on the other hand, consist of shorter-term, tactical ideas that may present themselves in certain market environments and/or regions or countries of the world. Satellite investments can be held for long-periods of time as well, but are usually differentiated by some unique characteristics or style of investing. Within a portfolio, there is no limit to the number of satellite investments you can have but they should generally be limited to a reasonable number that could be monitored on a regular basis.

Satellite investments can focus on certain themes, asset classes, regions, countries, strategies, etc. For example, a satellite

Core Satellite Investing Diagram

investment can be based on a positive outlook on Brazilian equities. Even though the core portfolio may have some exposure to Brazilian equities, a positive opinion may lead to added exposure to the country through a satellite investment without affecting the core portfolio. This type of investment can be made through an exchange traded fund (ETF) or mutual fund that focuses on Brazil or through a series of investments in individual stocks of companies domiciled in Brazil. The diagram below provides a good representation of a core/satellite investment approach.

The sizes of the core and satellite portions of a portfolio are based on each individual’s investment objectives, risk tolerance, and willingness to deviate from a broad representation of the overall market. It can be increased or decreased according to your preferences. In the diagram below, the blue arrows on the pie chart on the left highlights the flexibility of increasing or decreasing the core portion of the portfolio. The pie chart on the right takes the flexibility a step further and indicates that the core/satellite proportions can even be applied at the asset class level.

In the example below, cash, bonds, and property all have the same proportion of core/satellite, while UK equities and Global Equities have a smaller core and larger satellite allocation.

Source: Vanguard

Implementation of a Core/Satellite Portfolio

There are many articles written about the core/satellite approach and Vanguard is a big proponent of the process. For those of you not familiar with Vanguard, it is one of the largest, if not the largest provider of passive index funds in the world. Passive index funds are designed to replicate the returns of a specific index, such as the S&P 500, by holding the same stocks in the same proportions (Or some form of synthetic replication) of the index. A passive index ETF should mimic the index minus a minimal fee for the cost of providing the ETF.

The Vanguard approach to core/satellite investing is to use index ETF’s to construct the core of the portfolio and use a combination of active and passive investments to implement the satellite investments. Notice that in the chart below, only index funds are shown within the core portfolio.

Core Satellite using Index and Active Funds

Source: Vanguard

I disagree with this approach. I think that both passive and active management can be part of the core and that the portfolio will look more like the chart below.

Using both Active and Index funds within the Core Portfolio

Source: Vanguard

I agree, however, that the combination of core and satellite should result in an overall asset allocation that is consistent with an investor’s investment objectives.

Core vs. Satellite

There is no one answer to how big or small the core portfolio should be nor how much of a portfolio should be invested in actively managed mutual funds versus passive index funds.

An investor that is more involved in the management of his portfolio may consider a smaller proportion of his portfolio be invested in core strategies. While a less active investor may want a large core and just a little ‘play money’ to tactically invest in his favorite ideas or companies. Note that in neither of these cases, should the concept of asset allocation be ignored. Even if the core is but a small portion of the portfolio, there should be an overarching strategy that guides the percentage allocations to satellites, such that the overall portfolio is still invested in accordance with the proper investment objectives and risk tolerance.

The size of the core versus satellite as well as the active versus passive style should be dependent on the investor’s skill in choosing the right investments. In this case, I am referring to the ability to choose mutual fund managers that consistently outperform an index or benchmark. If an investor cannot consistently choose a manager that can outperform the index, then she is better off investing in an index fund. By the same token, if an investor’s satellite investments detract from the portfolio return more often than they add, then the satellite portion of the portfolio should be smaller than if the results were reversed.

Vanguard performed a study that analyzed the probability of success of investors to choose managers that consistently outperform their index. The study was broken down to understand the results obtained by different groups of investors, each with varying degrees of investment skills. The investors were grouped into three categories based on skills and were also compared to a simple random selection of managers. The study ran thousands of simulations then analyzed each investor’s ability to select combination of investments (both index and active managers) that would result in an optimal portfolio. (The optimal portfolio is a portfolio on the efficient frontier that provides the highest return for each unit of risk taken)

The skill levels were partial skill, perfect skill, and perfect but unlucky skill.

Source: Vanguard

The results indicate what I briefly mentioned earlier. Investors with more knowledge of investing can and should be more involved in the decision making of their portfolio and choose a higher percentage of active funds than those investor with less knowledge of investing.

For investors randomly choosing actively managed funds, the optimal portfolio will consist of 100% index funds 64% of the time; index and active funds 30% of the time; and only 6% of the time will the optimal portfolio be 100% active funds.

Interestingly, for the investors with partial skill, 54% of the optimal portfolios would have been 100% index funds, with 38% being both active and index funds. The median portfolio index exposure for both neutral and partial skill investors was 100%, indicating that investors with little investing skills should remain invested solely in index funds.

On the other hand, for investors with perfect skill, the percentage of optimal portfolios with 100% index funds was only 19%, with 69% falling into the index and active category. This skillset also had the highest number of portfolios that were 100% active, with 22% of the simulations. So investors with very good skills of picking managers that will outperform benchmarks should certainly choose more actively managed funds than investors with less skill.

Changes to Core/Satellite Proportion

Deciding on a core/satellite approach, or a specific asset allocation strategy does not mean it is set in stone. Investment objectives and risk tolerances change, and when they do, your asset allocation, including the core/satellite plan may need to be adjusted. For example, you may find yourself with less time available to monitor your investments and decide to increase the core portion of your portfolio so you can monitor fewer satellite investments. You may also lack Source: Vanguard

compelling ideas to invest in with conviction and are better off in the diversified investments offered by your core holdings. In this case, you would also shift from satellite to core. The reverse can be true as well. Perhaps you have some expertise in a given market and want to invest some of your portfolio in that market. In this case, you would reduce your core and increase the satellite portion of your investments. Keep in mind, however, that the overall asset allocation should remain intact.

Core Satellite with Asset Allocation

Source: Vanguard

Using Discretionary Management

At this point I would like to point out the use of discretionary management. Discretionary management is when an investor hires a portfolio manager, advisor, consultant, etc. to manage her account in accordance with pre-defined rules and mandates (Documented through an Investment Policy Statement), in a discretionary manner. That means, the portfolio manager does not need to obtain permission from the client for the purchase or sale of individual investments in the portfolio so long as the portfolio is managed within the guidelines set forth in the Investment Policy Statement.

Discretionary management can be used to manage an investor’s core portfolio, satellite investments, or both. If the portfolio manager is managing the entire portfolio, it is within her discretion to create a combination of core and satellite investments that best meet the objectives of the investor. As an investor, you need only worry about the bottom line results.

On the other hand, an investor may want to invest in a series of mutual funds and index funds to construct the core portfolio, and hand over the satellite portion of the portfolio to a portfolio manager. However, I believe this is probably the least popular use of discretionary management.

Lastly, an investor can have a portfolio manager actively manage the core portfolio while the investor chooses individual ideas to invest as satellites. In this way, the core is being managed by a professional, while the ‘play money’ keeps the investor involved in the process through tactical allocations.

Conclusion

There are a number of different combinations you can apply to your portfolio allocation and the percentages you assign to each are limitless. My advice is to develop a plan and modify it as needed. Eventually, you will find the right mix. It’s almost like cooking a dish and having the list of ingredients but not the specific combination of ingredients to satisfy your taste. It may take several iterations before you finally find the right one, and even then, over time, you may tire of that combination and decide to ‘spice it up’ some more. The combination of ingredients that satisfy your tastes will also differ from the combination of ingredients that satisfies someone else, even if you’re making the same dish. For this reason, I also caution against comparing notes with friends or family because their objectives, risk tolerances, investment knowledge, and portfolio amount, may be quite different from yours.

Use the guidelines shared in this article and throughout the site to help you in your portfolio management endeavors, and as always, if you have additional questions, please do not hesitate to contact us.

Feature image source: myinvestingnotes.BlogSpot.com

For more information on Core/Satellite Investing, you may want to refer to the following books: