Convertible Bonds

Post on: 25 Август, 2015 No Comment

by Cara Scatizzi

Investors typically classify investments into either the fixed income or equity category. But not all securities fit into only one niche.

Convertible bonds have both bond-like and stock-like features.

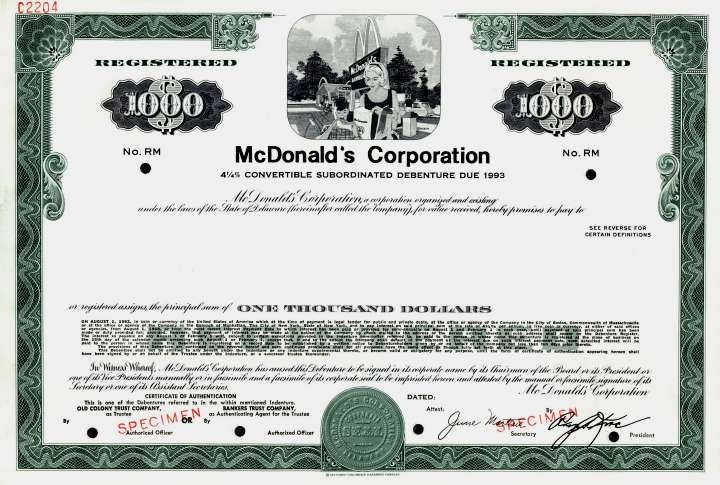

A convertible bond is a bond that provides a stated coupon, but that also gives the holder the right to convert the bond to a specified number of shares of the issuing companys common stock. Depending on market conditions, an investors return may be more bond-like, based on the stated interest rate, or it may be more equity-like, due to its conversion features.

These hybrids have three basic attributes:

- An upside potential that normally is less than that of the underlying common stock because convertible buyers pay a premium for the conversion privilege.

- Less downside risk than the stock due to built-in price supports.

- A yield that normally is higher than that of the associated stock.

How It Works

A company issues bonds when it needs to raise capital.

Issuing convertible bonds is a way to offer a low coupon yield, but entice investors with a value-added component. Most convertible bonds have intermediate-term maturities.

Each security has a conversion ratio that denotes the number of shares of common stock the bond holder can receive upon conversion. The ratio may be stable or it might change over the bonds life, but it is always adjusted for stock splits and dividends of stock. A conversion ratio of 45.5 means that for every $1,000 of par value the bond holder converts, he will get 45.5 shares of common stock.

A price at which it becomes profitable to convert the bond into shares can be determined based on the price paid for the bond per $1,000 of par value and the conversion ratio. For example, a $1,000 par value bond with a conversion ratio of 25 is sold for $900. The share price at which it would become profitable to convert the shares is $900 25 shares, or $36.

An investor might decide to convert the bond into shares of common stock if the share price rises to a desirable level. If the share price never reaches a profitable level, the bondholder will not convert the shares, but instead will receive a return based on the bonds stated interest rate.

To see how this might work, you must look at the conversion value relative to the initial investment value. Lets look at the above example and add the investment value component. Company As 5% convertible bond, with a five-year maturity, is selling for $900. If Company As stock price is $20, and the conversion ratio is 25, then the current conversion value is $500 ($20 25) and it is not profitable to convert the shares at this price. If the price rises to $45, then the conversion value is $1,125 ($45 25).

Convertible bonds offer downside protection, but less appreciation than owning the actual stock. In the above example, the share price went from $20 to $45. An investor who owns actual stock would see his investment gain 125%, while the owner of the convertible security would see an increase in value of only 25% (the change from $900 to $1,125). The difference is mainly due to the premium paid for the ability to convert the bond to stock.

Most convertible bonds have a call provision, meaning the company can force investors to convert the bond into common stock. This typically happens if the stock price goes to an undesirably high level. Investors who wish to convert will have to do so at that price, even if theyd prefer to wait for an even higher price. The upside is not unlimited.

On the other hand, the investor will always receive the par value of the bond at maturity, even if the share price falls dramatically. This allows for some downside protection.

Types

In addition to a traditional convertible bond, which allows investors to convert the security into shares of the issuing companys stock, there is an exchangeable bond that allows investors to exchange the bond for shares of stock in a company different from the issuing company.

While the plain-vanilla convertible bond is convertible into common stock, some are convertible into preferred stock. You can also purchase a zero-coupon convertible bond, which usually sells at a deep discount to face value. Zero-coupon convertibles tend to offer lower yields than regular zero-coupon bonds, but potential increases in stock price offer greater capital gains prospects.

As with any investment, conditions and rules can always be added, so be sure to fully understand all caveats of the security before investing.

How to Trade

Many brokers allow investors to trade various types of bonds. In addition to investing directly in the convertible securities, you can invest in mutual funds that hold these securities as well.

Investor Suitability

Tax Consequences

Taxes on convertible bonds can get tricky, so be sure to read the prospectus carefully and talk with a tax professional. In general, convertible bonds receive the same tax treatment as other conventional securities concerning interest payments, gains and losses. If a plain-vanilla convertible bond is converted to common stock, there is no recognized gain or loss, so no additional taxes are due at the time of conversion. If the bond is sold before conversion, any gain or loss on the sale is taxed. Any interest earned during the holding period is taxed as interest income.

The Pros

Limited Downside Risk

Unlike owning a companys stock whose price could fall to $0, holders of convertible bonds are promised the par value of the bond at maturity regardless of the stock price.

Potential for Higher Gains

Compared to a traditional bond, convertible bond holders can benefit from a rising stock price by converting the bond into shares of common stock when the actual price is higher than the conversion price.

The Cons

Call Feature Caps Gains

The call feature allows companies to limit the upside gain for investors. If the stock price rises, a company may force conversion into stock.

Lower Yields Than Straight Bonds

Compared to a similar plain-vanilla corporate bond, the interest rate will be lower. This accounts for the added conversion feature. If the stock price never reaches a level desirable for conversions, the holder is stuck with a lower-yielding bond.