Computerized Investing

Post on: 14 Апрель, 2015 No Comment

by Joe Lan, CFA

Mutual funds have been used by investors for a number of years. By definition, mutual funds are simply an investment vehicle that pools together investors money and buys securities. These types of investment vehicles are used in a variety of ways by investors, with some using only mutual funds in their entire investment portfolio and others tapping funds to simply add some diversification to certain sectors of their portfolio. No matter how you want to use mutual funds, it is important, as with all securities, to have a plan for choosing between funds.

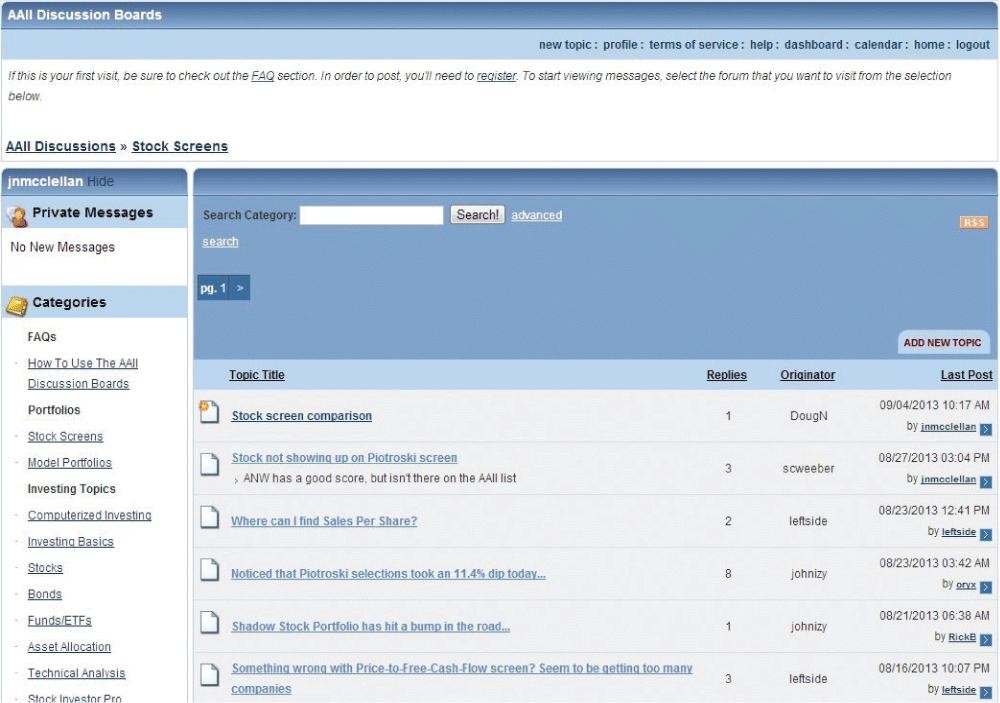

With over 26,000 mutual funds at your disposal, the number of fund options now far outweighs the number of stocks for most investors. Here at AAII, we often use screening as our first step when researching stocks. Screening is one of the quickest ways to winnow down a large number of investment options to a more manageable number. Just as with stock screening, mutual fund screening enables investors to target mutual funds that exhibit strong characteristics, allowing you to focus on those mutual funds worth a second look.

The Comparison article in this issue discusses in detail several mutual fund screening options and presents the differences in each. Though most mutual funds screeners are similar, there are still little nuances that make each one unique. This Feature article is the first in a series for the individual investor who is analyzing mutual funds. In this first article, I use Morningstar.coms Premium Fund Screener, a CI Editors Choice, to create screens that target mutual funds with certain characteristics. The Morningstar.com Premium Fund Screener is one of the best available to individual investors. Additionally, Morningstar.com is known for its exhaustive mutual fund data, so after the funds have been identified during the screening process, performing further research is quick and easy.

What to Look For

Naturally, the first step in mutual fund screening is to set up a screen. Before doing this, be sure you have an idea of the characteristics you are looking for in a mutual fund. Oftentimes, mutual funds focus specifically on certain types of offerings. The most popular mutual funds focus on certain market sectors, styles, geographical areas or a combination of the three. For example, a large-cap value mutual fund typically invests in equity stocks that have large market capitalizations and are value-oriented. Alternatively, mutual funds can only invest in bonds or dividend-paying stocks. The possibilities are endless.

When creating a mutual fund screen, I suggest deciding on the type of mutual fund you are targeting and then building a screen to identify these types of mutual funds. Mutual funds focusing on different types of stocks will have different characteristics. For example, small-cap growth funds may have higher returns, higher fees and higher median price-earnings ratios than large-cap value funds. It is important to take these differences into consideration. If you build a generic screen that is applied to the entire universe of mutual funds, you may find that the vast majority of funds passing your screen are of a certain sector or style.

Another area that investors should pay close attention to is fees. A mutual fund may have several different types of fees, including sales fees (or loads), management fees, administrative fees and marketing fees. There are two different types of loads: front-end loads and back-end loads. A front-end load is a sales fee that is deducted when the mutual fund shares are bought, whereas a back-end load takes a fee when the mutual fund shares are sold. Generally, the other fees mentioned represent the expense ratio. Make sure the fees paid on any mutual fund are reasonable. I would suggest staying away from mutual funds charging any sort of load, as these loads are very hard for mutual funds to make up in performance. In addition, redemption fees (back-end loads) can be especially penalizing if you only hold a mutual fund for a short time.

Here, I illustrate how to create two fund screensa large-cap screen and a small-cap screen. Be sure to have an understanding of what you want to look for before creating a screen.

Screening for Large-Cap Value

Using Morningstar.coms Premium Fund Screener, the first step is to specify the type of mutual fund you want to target. In this case, the first criterion line is:

Fund Category = Large Value

Source: Morningstar.com Premium Fund Screener.

To choose this criterion, select fund category from the pull-down menu. A window pops up (this same window pops up after you select any data point going forward) allowing you to enter a desired relationship to other criteria (and/or), data, condition (equals, not equal to, greater than, less than, etc.) or value. Simply selecting this one criterion has narrowed the number of options down significantly. Instead of 26,500 or so mutual funds, there are only 1,273 mutual funds that qualify as a large-cap value fund (Figure 1 ).