Complete Guide To Investment Companies Funds And Reits 2015

Post on: 4 Август, 2015 No Comment

Complete Guide To Investment Companies, Funds And REITs

3A%2F%2Fwww.investopedia.com%2F?w=250 /% Taxes To qualify as a REIT with the IRS, a real estate company must agree to pay out at least 90% of its taxable profit in dividends (and fulfill additional but less

A Guide To Investing In Real Estate Investment Trusts

3A%2F%2Fwww.investingthesis.com%2F?w=250 /% A Guide To Investing In Real Estate Investment Trusts (REITs) With Dennis Mitchell, CFA Of The Sentry REIT Fund

SEC.gov | Real Estate Investment Trusts (REITS)

3A%2F%2Fwww.sec.gov%2F?w=250 /% Real Estate Investment Trusts (REITs) A real estate investment trust (“REIT”), generally, is a company that owns – and typically operates – income-producing

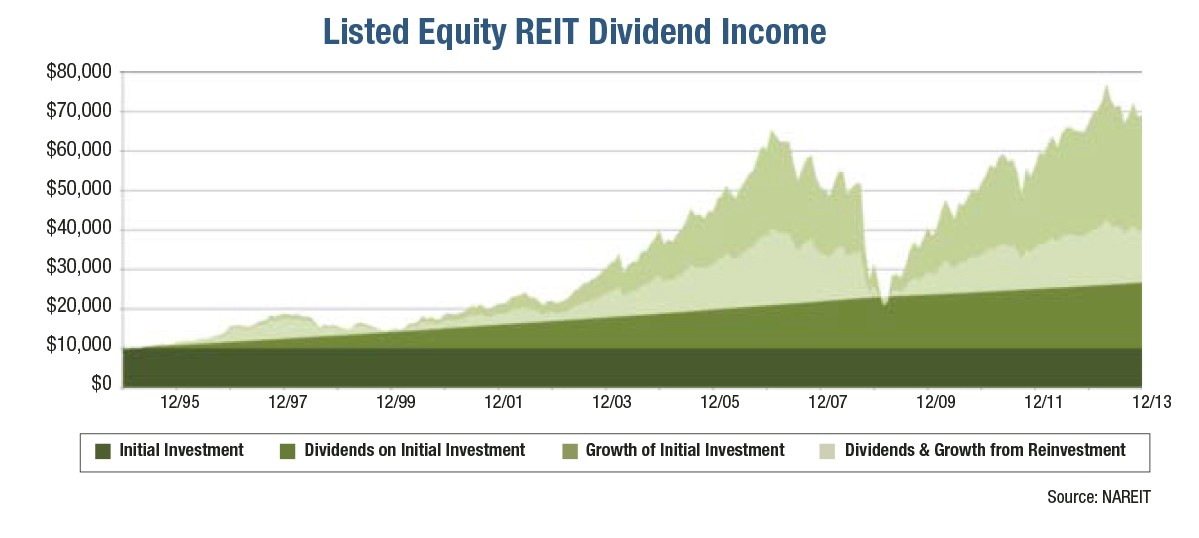

Welcome to REIT.com | REIT.com

3A%2F%2Fwww.reit.com%2F?w=250 /% NAREIT ®, the National Association of Real Estate Investment Trusts®, is the worldwide representative voice for REITs and publicly traded real estate companies with

Complete Easy to Understand Guide to Basic Investing and

3A%2F%2Fwww.atozinvestments.com%2F?w=250 /% Visit A to Z Investments to read and find resources on many hot investment topics. Get your questions about investing basics answered the right way.

Guide to REIT Dividends (Real Estate Investment Trusts

3A%2F%2Fwww.dividend.com%2F?w=250 /% Real estate investment trusts, or REITs, are companies that focus the majority of operations in real estate. These companies are usually in the business of owning and

Real Estate Investment Trusts (REITs) | Investor.gov

3A%2F%2Finvestor.gov%2F?w=250 /% What are REITs? Real estate investment trusts (“REITs”) allow individuals to invest in large-scale, income-producing real estate. A REIT is a company that owns

3A%2F%2Fwww.forbes.com%2F?w=250 /% The smart money is betting that student debt is not only a Millennial burden but also a new asset class.

3A%2F%2Fwww.sec.gov%2F?w=250 /% Investor Bulletin: Real Estate Investment Trusts (REITs) Real estate investment trusts (“REITs”) have been around for more than fifty years.

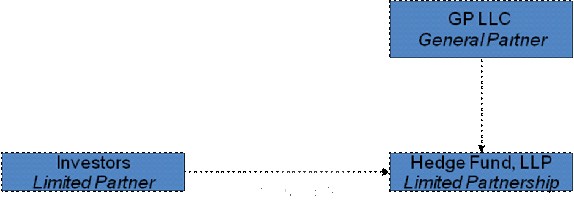

Indian budget ushers in tax relief for Reits but sector still on shaky ground

3A%2F%2Fwww.globalcapital.com%2F?w=250 /% They had to structure their Reits in a more complicated because historically many companies have tried to tap business trust markets of Singapore and Hong Kong because India had a lack of avenues to raise funds from,” said Luthra & Luthra’s Yaduvanshi.

INVESTMENT: Are taxpayers missing the boat?

3A%2F%2Ffinweek.com%2F?w=250 /% complete due diligence, and report accurately on the performance of the investment, investors have ease of mind knowing that the CA has board representation, and acts as the guide to the owners, opening the door to equity and managing the process.”

DR 163: The David Swensen Unconventional Success Portfolio

3A%2F%2Fwww.doughroller.net%2F?w=250 /% Several years ago he distilled his investment REITs (10%), more in emerging markets (10%), and less in bonds (25%). Using Swensen’s framework, however, I put together a portfolio with specific mutual funds and ETFs from a variety of mutual fund

DoubleLine Income Solutions Fund Declares March 2015 Monthly Distribution

3A%2F%2Fmarkets.financialcontent.com%2F?w=250 /% Investing in the Fund involves the risk of principal loss. As the Fund is newly organized, its shares have a limited history of operations and public trading. Shares of closed-end investment companies not constitute a complete investment program.

Tritax Big Box REIT: Proposed Issue of Equity

3A%2F%2Fwww.trustnet.com%2F?w=250 /% As a result, the Company has invested or committed substantially all of the net investable funds available upon as a guide to, the future performance of the Company or the Manager. Prospective investors should be aware that any investment in the

Which Investments Could Benefit From Rising Interest Rates?

3A%2F%2Fwww.msn.com%2F?w=250 /% That’s a good illustration of how maintaining a diversified portfolio and basing your investment companies borrowing via the bank-loan market will have trouble meeting their obligations. Finally, investors have been pulling assets from bank-loan funds

3A%2F%2Fwww.livemint.com%2F?w=250 /% He also proposed to increase customs duty on imported or complete Investment and Infrastructure Fund (NIIF). NIIF, which will initially be funded by the government, will raise debt in future that can be invested in infrastructure finance companies

3A%2F%2Fmarkets.financialcontent.com%2F?w=250 /% CINCINNATI, March 9, 2015 /PRNewswire/ — Phillips Edison Grocery Center REIT I, Inc. (the Company to acquire the investment from the operations derived from the investment. We have funded, and intend to continue to fund, both of these acquisition