Comparison Mutual Fund Screening & Analysis Services

Post on: 14 Апрель, 2015 No Comment

by Cara Scatizzi

I nvesting in mutual funds can be a cost-effective way to own a diversified portfolio. Selecting and managing a portfolio of individual stocks and bonds can be very time consuming, making mutual fund investing more attractive.

However, it’s easy to feel overwhelmed when looking for mutual funds because there are currently over 18,000 different funds in existence. It can be difficult for investors to choose a fund that fits their investing goals, needs and expectations. For those who prefer to make these decisions without the help of an adviser, mutual fund screening software and Web sites provide the necessary tools.

Mutual Fund Screening

Taking the time to find a fund that suits your needs can be beneficial in the long run. This is where mutual fund screening comes in. Our comparison looks at six disk-based software programs and 11 Web sites that offer mutual fund screening services. These services can ease the burden of finding the right fund to invest in.

Screening involves choosing a set of criteria to find a group of funds with similar characteristics. While a basic screening process can be performed using a financial newspaper, magazine or book, the screening process is most easily and thoroughly accomplished using a computer.

Software programs often have high-powered and highly flexible screening capabilities. Subscribers receive periodic data updates, usually monthly or quarterly, without which a software program is of no value. Software programs can be costly, but for investors desiring more statistics, data and control to create unique and in-depth screens, it may well be worth the extra money.

Web-based screening tools have made mutual fund screening more accessible and effortless. The software is either downloaded to your computer or the screening criteria are established through forms on your Web browser. Also many of the Web-based services are free.

With a mutual fund screening system, investors can find multiple funds that meet personal risk, return and management style requirements quickly and easily. For example, if you determine that your portfolio is lacking international equity diversification, a screening service can provide you with a list of no-load, internationally oriented mutual funds with consistent performance above the average for international equity funds, acceptable risk and below-average expenses.

It is important to select a system that provides a wide variety of criteria for screening and has the flexibility to create effective screens. Adding more criteria to a screen or tightening the range of values allows fewer funds to pass.

The number of funds in the program’s database, the number and types of criteria that can be used for screening and sorting, and the flexibility of the conditions and values that can be specified for each criteria are all important things to consider and compare between programs.

Once a screen has been run and a handful of funds remain, investors should always spend time analyzing the individual funds before making investment decisions.

Performance Comparison

The ability to compare a fund’s performance with that of other funds, indexes and benchmarks is a powerful tool offered by many of the software and Internet services. While performance comparison is primarily done through screening, one great feature of a mutual fund screening system is the ability to present the comparison results in user-friendly charts, graphs and tables.

Sophisticated charting functions, reports for specific time periods and reports comparing funds all help make investment monitoring easier and more comprehensive. In the most powerful programs, the performance of an index, an average for a fund investment objective, and the performance of other similar funds can all be displayed in color along with the performance of a particular fund using line graphs and bar charts for any period selected. Some applications even offer basic mutual fund portfolio management capabilities.

Fund Universe

A comprehensive data set should cover the universe of non-money market mutual funds, currently exceeding 18,000. However, this total includes mutual funds with multiple class offerings. Multiple-class funds, which provide the same basic portfolio, are divided into various offerings segmented by fee structures or in some cases by minimum initial investment requirements.

The disk-based services tend to offer a larger database of funds for screening. The Mutual Fund Expert programs from Steele Systems have the largest fund universe with over 18,000, while Indexfunds.com and Business Week Online offer the smallest databases with just over 270 and 5,400, respectively. As far as data is concerned, Steele Systems Mutual Fund Expert Pro Plus offers the most data fields for screening, over 700, while Kiplinger.com has the least with 16.

Alternatively, the universe should match the universe of funds that you consider for your portfolio such as no- or low-load funds. The #Article_ID# &Page=3#1>comparison grid shows the number of funds tracked, the number of data fields available and the number of fields that can be used for screening and ranking for each service.

Frequency of Updates

Mutual fund screening programs and services are typically sold as subscriptions. Update schedules are usually monthly or quarterly, via a new CD-ROM disk mailed to you, or a password for downloading new updates on-line. How much you plan to monitor performance, your desire to screen for new funds and your budget will be the deciding factors when choosing an update schedule. A subscription with monthly updates usually costs more than one with quarterly updates.

The comparison grid indicates the update schedules available for each service along with the associated costs of each. Note that the mutual fund performance data on most on-line services is updated only monthly. Items such as price charts and net asset value may be updated daily, but most other data elements are tied to month-end figures.

SPECIAL OFFER: Get AAII membership FREE for 30 days!

Get full access to AAII.com, including our market-beating Model Stock Portfolio, currently outperforming the S&P 500 by 4-to-1. Plus 60 stock screens based on the winning strategies of legendary investors like Warren Start your trial now and get immediate access to our market-beating Model Stock Portfolio (beating the S&P 500 4-to-1) plus 60 stock screens based on the strategies of legendary investors like Warren Buffett and Benjamin Graham. PLUS get unbiased investor education with our award-winning AAII Journal. our comprehensive ETF Guide and more – FREE for 30 days

Mutual Fund Data and Information

In addition to the database size and frequency of updates, another important feature of any screening tool is the amount and type of data provided for each fund.

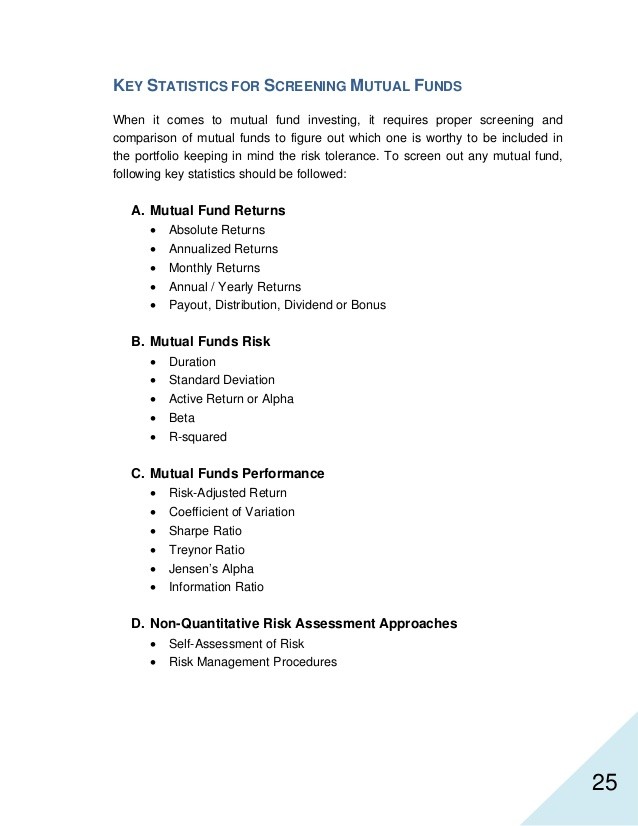

The analysis of an individual fund and the examination of fund details hinge on the amount and organization of information presented. Information tends to fall into four categories: performance, risk, fund portfolio information and fund operations and services.

Performance statistics usually include annual total returns and annualized total returns over three-, five- and 10-year periods and longer. Returns for shorter periodsusually year-to-date, one month, three months and the last 12 monthsare also common. Performance is also often reported as a difference from an index, such as the S&P 500, or from a category average. Percentile or decile ranks for performance are sometimes used to put the absolute performance differences into perspective.

Risk measures include standard deviation, beta, risk indexes and risk deciles. Risk-adjusted returns using return-to-risk ratios such as the Sharpe and Treynor ratios may be included. Alpha, another risk-adjusted performance measure, and R-squared, a measure of diversification, are usually grouped with beta. For fixed-income funds, average portfolio maturity is usually reported, while some services also report the average credit quality of the bond holdings.

Fund portfolio information can vary from one program to the next, but more often than not it is a brief synopsis. A program might offer details resembling a typical annual report along with calculated portfolio statistics that attempt to capture the portfolio manager’s investment style and approach. Portfolio breakdowns by percentages provide minimal descriptions of portfolio positions. A listing of top stock holdings with portfolio percentage representation and a portfolio breakdown by sector or industry weights is useful in understanding the fund’s investment strategy and diversification. The most comprehensive programs also include average price-earnings ratio, price-to-book-value ratio, earnings growth and dividend yield for all stocks in the portfolio. For bond funds, weighted average coupon, maturity and credit rating are reported.

Fund operations and services describe loads, fees and expenses along with fund initial and subsequent investment minimums. You may also find the fund manager’s name and tenure in addition to the fund telephone number and fund features, such as automatic withdrawal and investment programs.

Distribution Methods

For the software applications featured in this comparison, data updates either arrive on a CD-ROM disk or are downloaded from the company Web site to your computer. The data is installed and stored on your computer and screening and analysis information is at your disposal. With some applications, certain information remains stored on the CD-ROM to keep from overburdening your hard drive. Internet-based screening programs allow you to perform the screen on-line and the results are returned to you in the form of a Web pagemost often one equipped with links to quotes, news and other information.

Internet screening utilities usually offer limited screening power and somewhat reduced data sets compared to software. However, some of the recent Web-based entries from vendors provide combinations of detailed data and versatile screening tools. When comparing these options, keep in mind how much data and screening functionality you actually need.

Disk-Based Services

Although CD-ROM-based screening programs are more expensive, the depth of information and flexibility of the program can outweigh the costs for serious investors. The programs have more sophisticated screening capabilities and reporting techniques than their Internet-based counterparts because of large storage capacities.