Compare Mutual Funds With Morningstar s Comparison Tool

Post on: 23 Июль, 2015 No Comment

By Jeremy Vohwinkle 4 Comments

Morningstar is great, and it is one of my favorite investing research sites out there. They have a ton of tools available for researching stocks, mutual funds, and now options. While some of these tools do require a premium membership, there are plenty of great tools that are free and available to everyone. You may need to create a free account to login with, but one of the best tools is the Mutual Fund Compare tool. This tool allows you to compare one fund against another, or many other funds and display the results in an easy to read format.

If youd like to walk through this post by using the tool yourself I encourage you to set up your free Morningstar account . It takes just a few seconds and not only will you get the mutual fund comparison tool, but you can access even more tools and save your portfolios to be used again in the future.

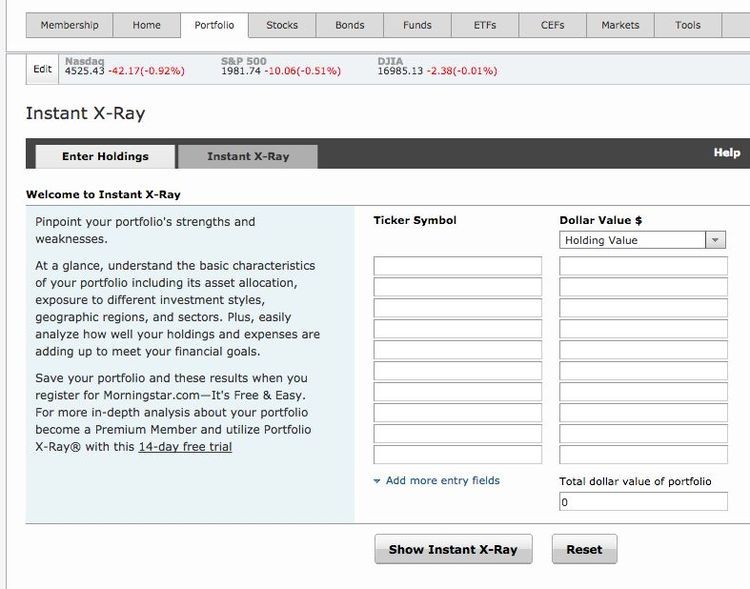

Enter Your Funds

The first thing you need to do is enter the funds that youd like to compare. For this example, Im going to compare two relatively similar Growth & Income fund offerings by both Vanguard and T. Rowe Price. Looking at the image below (clicking on any image will enlarge it to full size) you can see where you enter the fund symbol at the top and click add to list to move it to the box below. I dont know what the limit of funds you can add is, but I generally only compare a few at a time.

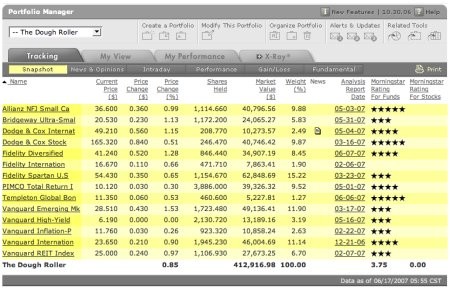

Snapshot of Results

Performance Results

If youre like most people, youre particularly interested in performance. This tool does a great job in providing an easy to read performance comparison. By changing the dropdown box up in the top left from Snapshot to Performance, youll be shown the information below. In this image I highlighted the columns that you should be focusing on. While fund rank may be an interesting tidbit of information, you really should focus on the actual returns from each fund and relative to the benchmark.

Scoring the Results

The most powerful aspect of this tool is the ability to score the results based on your own personal preferences. When you click the Score These Results button at the bottom right you bring up a customizable tool that allows you to score certain criteria based on how important it is to you. On the left you have the criteria with radio buttons ranging from 1 to 10, with 10 being the most important. So for example, if a 5-year return is very important while the YTD performance is not, you can place weighting on those items accordingly.

This will then display the graph on the right that shows which fund may be better for you based on what criteria is important. So, while the raw numbers such as expense ratios, performance, or company earnings are important, you can really begin to paint a picture as to which fund might be better for your situation.

Scoring Detail

Finally, if you want even more information on how the score was determined, you can move your mouse over the fund name or the orange bar to pop up a detailed breakdown of how the score was actually determined. Again, this could highlight one particular area that the fund excels or lags in.