Commission free ETFs (No Transaction fee ETFs) How to Maximize Investment Return 401K 403b

Post on: 22 Июль, 2015 No Comment

Commission free ETFs (No Transaction fee ETFs)

By now we know, what is an ETF(Exchange Traded Fund).

As we mentioned, many leading brokerage firms today offer a list of Commission free ETFs. However, restriction apply such as we have to hold the ETF for a minimum of 30 days to avoid the transaction fee(most brokerage firms have similar restrictions), if we do not hold for 30 days then a transaction fee is applicable (which could vary from $5-$50 depending on the brokerage firm). Make sure you understand the restrictions from your brokerage firm.

But whats the catch in these Non Transaction Fee ETFs?

Hidden costs of free ETF trades. Well if you choose to trade these ETFs then make sure they have enough liquidity (average daily volume more than 10K or 50K or 100K) depending on your comfort level.

Lets do some ground work and perform following steps:

1. Get the entire list of Commission free ETFs from our brokerage firm

Most brokerage firms will publish/advertise list of Commission Free ETFs on their website.

2. Separate Bond ETFs from above list, also separate ETNs from this list of ETFs

Most brokerage firms will also segregate the entire list into different types of ETFs. All you need is to separate them into 3 categories: Bond ETFs, ETNs and all other ETFs. If our brokerage firm does not provide ETF category then by looking at the ETF name or description on yahoo/google finance website, we can determine ETF category.

3. We will not trade ETNs so lets drop them from our list

We will remove ETNs from our list as they have additional credit risk based on ratings.

4. (Optional step)

Lets remove any ETF from our list which has average daily volume less than 5,000 or 10,000 shares. We can adjust the volume condition based on our comfort level. This will eliminate low liquidity ETFs. If a particular ETF has low volume then it is very difficult to sell shares as we cannot find enough buyers in the market.

Example would be the best way to explain this:

Lets use Commission free ETF list from Ameritrade -

- Total number of Commission free ETFs = 101

- 32 Bond ETFs

- 4 ETNs (remove them from above list, 2 ETNs are Bond ETFs)

- (Optional Step) 10 day average trading volume > 10,000 = 91

So what do we do with this ETF list?

Below excel file shows how we can sort them using Tag column. It will show us which Bond ETFs and which remaining ETFs are best performing ETFs based on our base strategy. You may want to check out How to use Funds Ranking Sheet to obtain ETF ranking.

How to apply our Technique using base strategy:

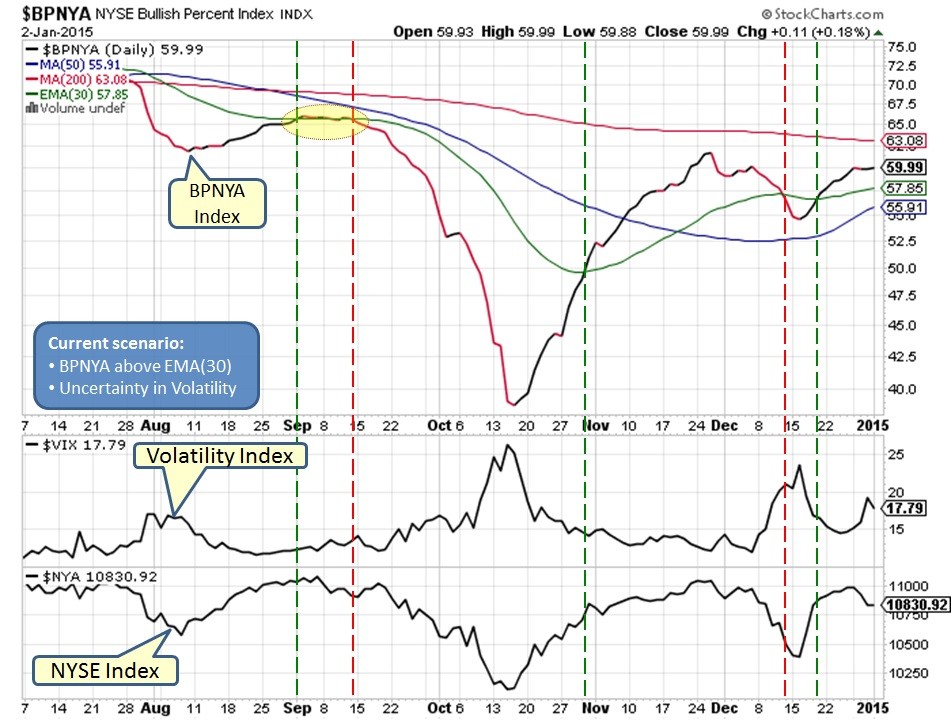

- Identify the market direction based on our market timing tool.

- If we get market entry signal then we trade best performing ETF from list of remaining ETFs (excluding 30 Bond ETFs and 4 ETN ETFs)

- If we get market sell signal then we trade best performing ETF from list of Bond ETFs (30 Bond ETFs)

- Best returns are obtained when you enter a trade after you get entry or exit signal and not midway, if you are midway then best strategy might be to wait till a signal is generated

Benefits of this technique -

- We remain invested most of the time, in other words our money is always working for us irrespective of market direction

- Bear markets, market corrections or market crashes provides us a way to be invested intelligently and make good gains

- Our losses are minimal but overall cumulative gains over longer periods are substantial

Disadvantage/Risks -

- If market direction changes quickly (within restriction period), then we may have to incur transaction fees for trading these ETFs

- Remember, these are ETFs (similar to but better than Mutual Funds) and hence slow moving financial instruments there by providing lower returns as compared to Stocks.