Closedended mutual fund ranking per NAV discount

Post on: 27 Март, 2015 No Comment

CLOSED-ENDED MUTUAL FUND RANKING PER NAV DISCOUNT

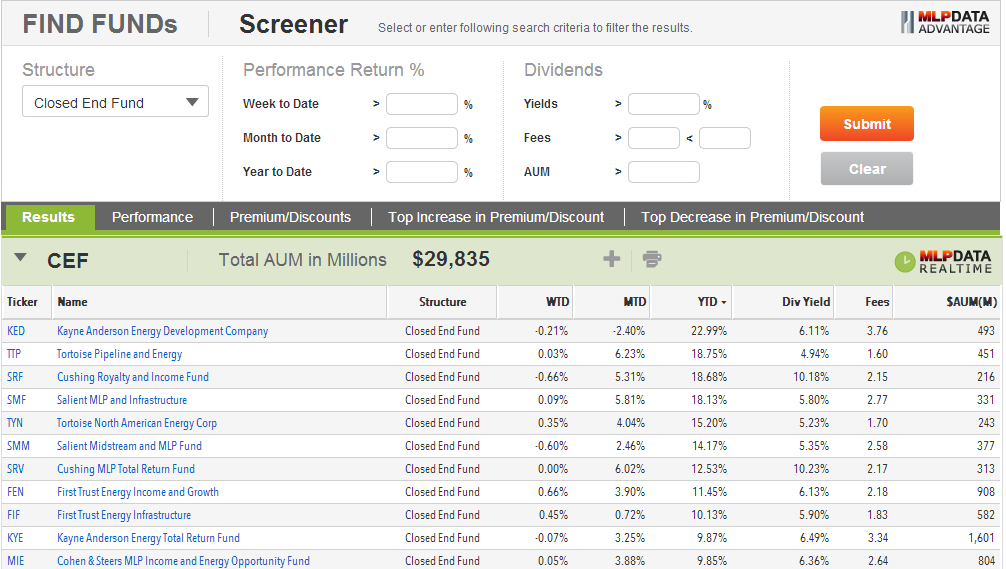

Ranking of best closed-ended mutual funds based on discount from net asset value (NAV), annual expense ratio, and plans to reduce or eliminate discount.

All open-ended mutual funds are guaranteed to perform worse than the securities that they hold. The same applies to many closed-ended mutual funds. However, there is a small group of closed-ended funds, listed below, whose performance expectation is much better than that of the securities they hold. They are not just the best buys among closed-ended mutual funds but are some of the best buys among all stocks whose expected performance can be analyzed mathematically.

Unlike other rankings that reflect past performance and are not predictors of future performance, our scientific ranking reflects probability of high future return on investment made today. Our ranking is based on two main factors that are best quantifiable predictors of future returns: NAV discount and Expense Ratio. A third criterion taken into account in our ranking is evaluations of the plans the fund has, if any, to reduce its discount in the near future.

All the funds listed below are recommended. Among them, the reader may wish chose those appearing at the top of the list. Some readers may wish to narrow down the selection further by analyzing other unquantifiable factors: investment policy, sector, dividends, and news about these funds. (We have already factored in the news that some of these funds intend to become open-ended funds or to implement another policy to expedite the reduction or elimination of their discount off NAV. A link to a list of news articles about all the funds we recommend, as well as other information, is given at the bottom of this report.)

We rank funds traded on U.S. markets; however their portfolios may be composed of stocks traded on U.S. or foreign markets. Typically, the best discounts today are obtained for U.S.-traded funds specializing in overseas markets as well as a few U.S. funds specializing in the U.S. market.

Funds with high discount off NAV are likely to reduce their discount in the future, thus offering the investor a good possibility of appreciation of the fund’s stock greater than the appreciation of the fund’s portfolio. However, funds with high Annual Expense Ratio reduce their investors’ profits. Therefore, we balance NAV discount and expense ratio in our rating, as well as funds’ intention to actively reduce their discount.

The publically-posted data is a week-old. To access daily-fresh data you may wish to