ClosedEnd Funds The Ins and Outs

Post on: 4 Июль, 2015 No Comment

Hidden in the small cap corners of the investment universe are hundreds of closed-end funds overlooked by Wall Street. These funds do it all, from private equity-style investments in small companies to leveraged junk bond investments you cant find anywhere else.

Lets look at the closed-end fund category and explore why investors might choose to invest in a closed-end fund over other funds or sector ETFs .

How Closed-End Funds Work

Closed-end funds are funds that raise capital on the stock market and then invest in other businesses, debt, and even other publicly-traded companies. Closed-end funds are generally managed by active managers who seek to deliver above average returns for their investors.

Closed-end funds differ from exchange-traded funds and mutual funds in that they do not allow new investments or withdrawals at any time. Instead, closed-end funds raise capital by selling shares on the open market, and allow for redemption only on the open market. ETFs and mutual funds are generally open-ended funds in that their owners can redeem their shares for their net asset value at any time.

The closed-end structure has upsides and downsides:

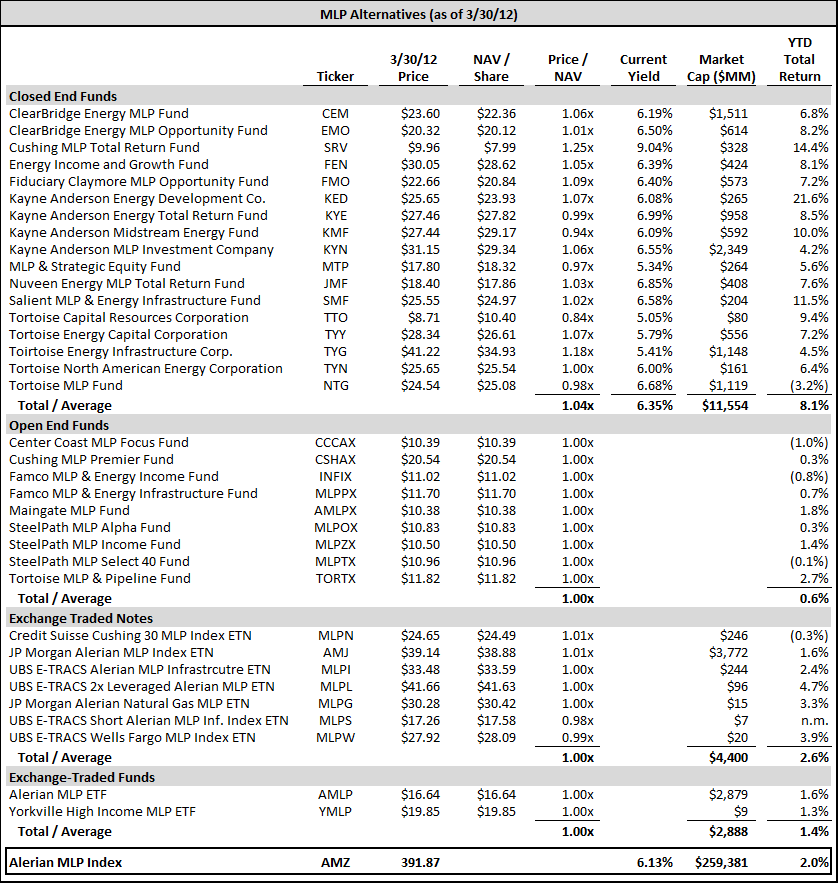

- Closed-End Funds Can Trade at a Premium or Discount to their Holdings – Because the market for a closed-end fund is made on a public exchange, closed-end funds are known to sell at prices on the open market above or below their net asset value, or the value of the assets represented by one share. This differs from exchange-traded funds, which trade openly at prices very close to their net asset values at all times. In short, you might not always be able to sell your shares for what the stated value is.

- Closed-End Funds Can Make Long-Term Investments – Similar to hedge funds or private equity funds, a closed-end fund can raise capital and invest it into less liquid opportunities, or investment opportunities that require more time to develop. The managers do not have to worry about a run on the fund, as investors can make “deposits” or “withdrawals” only by buying or selling already existing shares to or from another investor on the stock market. Investors who are willing to give up access to their money in exchange for higher returns can do so with closed-end funds.

The upside is that closed-end funds can invest for the long-haul, but at the cost of liquidity to the investor. As such, closed-end funds are most fitting for investors who are willing to buy and hold for years, sacrificing liquidity for exposure to lesser-known investments.

What to Look for in a Closed-End Fund

There are many different “flavors” of publicly-traded closed-end funds to choose from, some of which may or may not match your own investment objectives. Here are a few things to consider before investing:

- Leverage – One of the ways closed-end funds can generate larger returns is taking higher risks. Leverage is common with these funds, with many managers choosing to run what is essentially a quasi-bank by borrowing cheaply and lending more expensively to smaller private companies. Look for a fund that is conservatively financed; funds that near a 1:1 debt-to-equity ratio are about as risky as a levered fund can get. Risk averse investors should stick to funds that do not use leverage.

- Distribution Yields – One of the many reasons closed-end funds exist is to fill a gap in the high-yield corner of the market. Large distributions are common with closed-end funds, which pay out a high percentage of their annual income to attract new investors and keep their fund trading at close to net asset value. Be sure that high yields arent fictitious, however. Funds should pay out distributions from dividends, not from investment capital.

- Asset Allocation – Closed-end funds tend to specialize in a small corner of the investment universe. The First Trust Senior Floating Rate Income Fund II (FCT) fund holds senior debt, and so it would be most appropriate for the risky fixed income part of your portfolio, but not as a replacement for Treasuries. Likewise, it wouldnt be a good substitute for stock exposure, because there is little appreciation potential in fixed income investments.

- Premiums and Discounts – Investors should be aware of a funds trading pattern with respect to its value per share. Some closed-end funds are very good at using stock issuance to remove any premium and share buybacks to remove a discount. Others simply allow their stock to trade freely, and ignore any discounts or premiums. Look for closed-end funds that trade at a discount; odds are that the price of the fund should revert to the mean, but youll have to have the patience to wait it out.

All in all, closed-end funds offer an excellent opportunity for investors to utilize the benefits of leverage, capitalize on less liquid corners of the market, and enjoy higher yields from a new kind of investment. Consider making a closed-end fund part of your portfolio to amplify your exposure to an asset class youre most interested in.

Have you invested in closed-end funds before or do you currently?