Closed End Fund Discounts and Premiums

Post on: 13 Июнь, 2015 No Comment

So-called closed end fund discounts or premiums are unique features of closed end funds as they do not occur with open end mutual funds that must constantly issue and redeem shares. After all, closed end funds trade on stock exchanges just like stocks but they are also investment portfolios just like mutual funds or open end funds.

What are Closed End Fund Discounts or Premiums?

In order to understand closed end fund discounts or premiums, an investor must understand that a closed end fund’s share price will be based upon two factors:

1. The value of the investments held by the fund.

2. The premium or discount placed on the fund by the market.

Hence and if a closed end fund’s share price is higher than its net asset value or so-called NAV, which is the total value of all securities in the fund (after liabilities have been subtracted) divided by the total number of issued shares, the fund is said to be trading at a premium. However and if a closed end fund’s share price is lower than its NAV, the fund is said to be trading at a discount to its NAV.

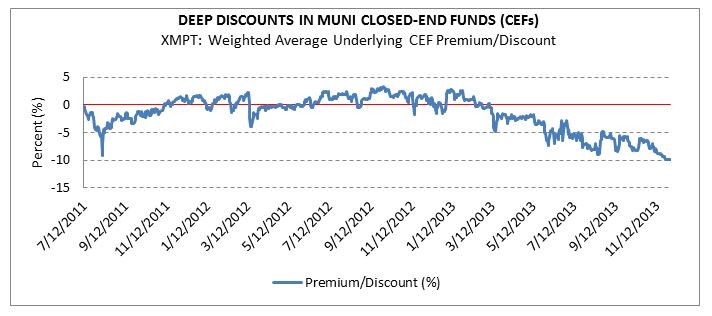

Since a closed end fund’s share price is actually determined by the market and market participants, it is possible for a closed end fund to trade at a substantial premium or discount relative to the investments held by the fund. In fact, it is not uncommon for a closed end fund to trade at a 10-20% premium or discount relative to the investments it holds.

Why do Closed End Fund Discounts or Premiums Occur?

In theory, buying a closed end fund with a closed end discount means that an investor is buying a portfolio of assets below their fair market value that upon liquidation would result in a profit for the investor. In practice though, it is unlikely that a closed end fund with a closed end discount will suddenly liquidate to allow an investor to profit from that discount. Moreover and while numerous studies and/or theories have come about to try and explain both closed end fund discounts and premiums, their existence still puzzles many academics and investment experts.

Closed End Fund Discounts or Premiums: Conclusion

Nevertheless and all else being equal, investing in a closed end fund with a closed end discount may give an investor more piece of mind than investing in a closed end fund that is selling at a premium.