Choosing an ETF with dividendpaying stocks –

Post on: 8 Июль, 2015 No Comment

Ask Matt

Sponsored Links

A: Investors are hungry for any way to make money in this tough market. And dividends are gaining popularity due to their relative predictability.

Who doesn’t like getting cut a check every year or quarter by companies? And it’s even better if those dividend checks keep getting bigger year after year.

It’s that search for increasing dividends that have some investors seriously considering grabbing exchange-traded funds that will haul dividends in for them. ETFs are mutual-fund like stocks that typically own pieces of hundreds of stocks.

COLUMN: How do you find out which stocks your ETF owns?

COLUMN: How to build a low-cost income portfolio with ETFs

ETFs are very effective tools for dividend investors. Dividend ETFs mitigate the risk a company might commit the ultimate sin: suspend or cut a dividend. By owning one ETF, which owns shares of hundreds of dividend-paying stocks, if just one company halts its dividend, the impact to the investor will be relatively small.

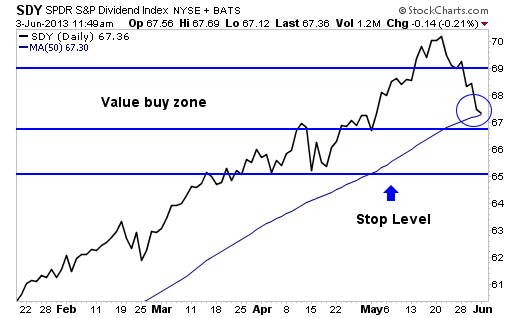

But as you point out, investors looking to buy an ETF that will generate dividend income have many choices. The two you mention are top candidates: Vanguard Dividend Appreciation (VIG ) or SPDR S&P Dividend (SDY ).

You ask a great question because it gets to the core of an increasingly important dilemma for investors. With so many ETFs available, many of which address the same types of investments, how do investors choose between them? Here are some of the key things investors should consider:

•The ETF sponsor company. As ETFs became increasingly popular, many companies piled on with new products. When considering an ETF, you want to make sure the ETF provider has the market power and resources to stay in the game. Both of the ETFs you are considering are certainly in the top tier. Vanguard is a storied firm, with some of the largest mutual funds, that’s becoming a powerhouse in the ETF field as well. The SPDR family of ETFs are provided by another industry heavy-hitter, State Street Global.

•Dividend yield. Since you’re looking for dividends from your ETFs, then yield is key. The dividend yield is the amount of the dividend you receive as a percentage of the stock’s price. The yield shows the return an investor would receive if the stock was bought at the current price. Currently, VIG is yielding 2.2%, according to USATODAY.com’s ETF page and SDY is yielding a much higher 3.4%.