China to Ease Foreign Investment Rules for New Free Trade Zones Bloomberg Business

Post on: 16 Март, 2015 No Comment

Aug. 18 (Bloomberg) — China plans to suspend some laws on foreign investment in proposed new free trade zones including Shanghai as part of Premier Li Keqiang’s drive to open up the economy to sustain growth.

The changes will provide “innovative” ways of opening up the economy, remove unnecessary administration and help transform the state’s role in the economy, according to a State Council statement after an Aug. 16 meeting led by Li.

China is boosting efforts to attract foreign companies after investment from abroad fell last year for the first time since the global financial crisis. Free trade zones that will be allowed to cut bureaucracy and test financial liberalization may offer incentives that help the government maintain economic growth of at least 7 percent a year as the export- and investment-led model of expansion runs out of steam.

“The Chinese government knows that having foreign investment is a very good thing and they want this to be an attractive market for strategic and financial investors,” Kent Kedl, managing director for Greater China and North Asia for risk consulting firm Control Risks, said in a telephone interview. “Many foreign investors are concerned about the bureaucracy and lack of clarity around regulations, that’s probably the biggest concern when they come in” to China, he said.

Foreign Investment

Foreign direct investment in China fell 3.7 percent last year to $111.7 billion from a record $116 billion in 2011, government data show. Investment rose 4.9 percent in the first half of this year to $62 billion.

The American Chamber of Commerce in China has urged the government to open more industries to overseas investors and improve the climate for foreigners, while a European Union business group has warned that optimism is declining and the regulatory environment is worsening.

The State Council will submit a draft document to the Standing Committee of the National People’s Congress, the legislature, according to the Aug. 16 statement. If approved, the State Council will be allowed to suspend some laws on foreign investment, Sino-foreign joint ventures and cooperative enterprises in the free trade areas, it said.

The statement didn’t give a time frame or additional details about the changes, which will apply to the proposed zone in Shanghai and any potential new ones.

Less Interference

While the State Council and Chinese media use the term “free-trade zone,” the meaning is more akin to a free-market zone subject to less regulation and interference rather than an area of duty-free trade.

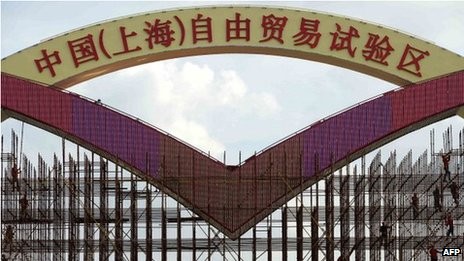

The State Council said July 3 it approved a pilot program to set up the country’s first free-trade zone in Shanghai, describing it as an important move to adapt to global economic and trade developments and further open up the economy.

Shanghai Mayor Yang Xiong said the city will accelerate the building of the trial zone in the second half of this year, including creating laws to regulate the project, the Shanghai Daily reported on July 14.

One part of the plan includes ending a 13-year ban on the manufacturing and sale of video-game consoles in China, on the condition that companies such as Sony Corp. and Nintendo Co. make their products in the new Shanghai area, the South China Morning Post reported July 10, citing unidentified sources who have reviewed documents on the policies.

Essential Step

The Shanghai free trade zone will allow the city to explore investment and trade policy innovations and expand the opening of the services industry, HSBC Holdings Plc said in a July 4 report. Trials which will involve financial reform including interest-rate liberalization and full convertibility of the yuan are seen by the State Council as an “essential step towards upgrading China’s economy,” Hong Kong-based economist Qu Hongbin and Beijing-based Ma Xiaoping wrote.

China already has a financial zone in the Qianhai district of the southern city of Shenzhen, which borders Hong Kong. The area was created by the State Council in 2010 and the government said in June 2012 it would make Qianhai a test ground for freer yuan usage and capital account convertibility.

Other Chinese cities have also expressed interest in creating free-trade areas. The southern province of Guangdong is looking at setting up a zone in its Nansha new area, the Shanghai Securities News reported July 25, citing a statement from the Guangdong government. Tianjin, a port city about 100 miles (162 kilometers) southeast of Beijing, submitted a plan to the commerce ministry last month, according to a July 10 report in the 21st Century Business Herald.

Xiamen, a port city in southeastern Fujian province is also trying to get central government approval for a zone, the official Xinhua News Agency reported Aug. 16.

To contact Bloomberg News staff for this story: Liza Lin in Shanghai at llin15@bloomberg.net

To contact the editor responsible for this story: Stanley James at sjames8@bloomberg.net