Characteristics of Accounting Fraud and Improper Manipulation

Post on: 26 Апрель, 2015 No Comment

Accounting fraud is defined as a “deliberate and improper manipulation of the recording of sales revenue and/or expenses in order to make a company’s profit performance appear better than it actually is.” [1 ] ” According to the textbook Fraud Examination by Steve Albrecht, fraud are triggered by three elements, the first being rationalization, perceived pressure, and lastly perceived opportunities.” [2 ] This essay will demonstrate the variety of ways accounting fraud can occur and how it is detected while illustrating its many outcomes through rival Enron and WorldCom experiencing the famous accounting fraud scandal.

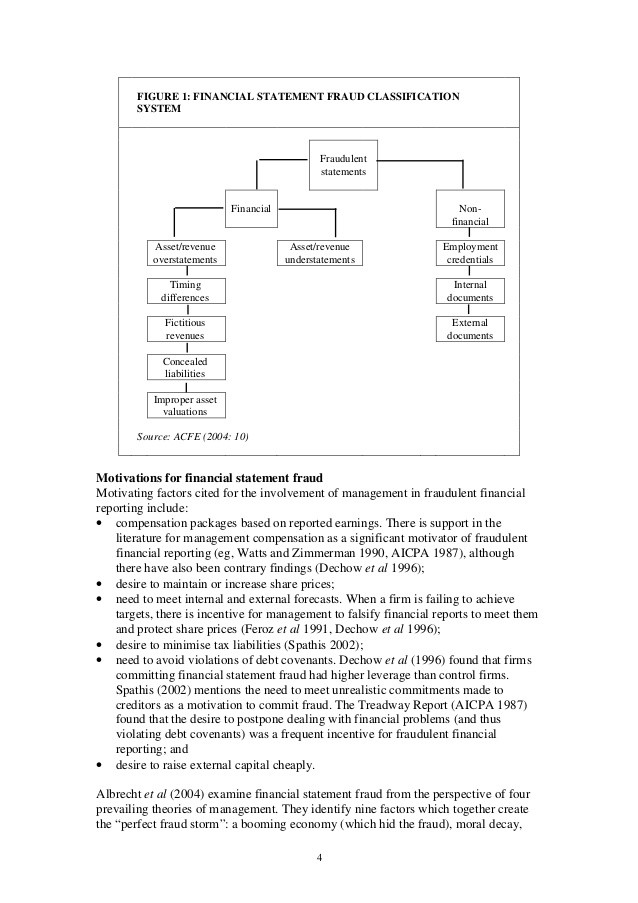

Accounting fraud is not a process that occurs overnight. It is classified into a number of categories and types that require time, planning and accomplices. It is usually characterized by understating/overstating revenues, expenses and asset values. Also accounting fraud is demonstrated by the misuse or misdirection of funds and underreporting of liabilities. [3 ]

Under-recording expenses could be expressed by not recording all the costs of goods sold during the specific time period. This way the gross margin would be higher, when the business would classify products that are delivered to customers as inventory asset. Another way is by not recording the depreciation expenses. [4 ]

Asset losses that should be recognized might be disinclined by the business. Examples would include uncollectable accounts receivable, or not writing down inventory under market rule. Also, the business might record only a part of the amount of liabilities for different expenses, understating the liabilities in the company’s balance sheet and therefore overstating the profit. [5 ]

The most common technique of accounting fraud is over-recording sales revenue. The business may be involved in channel stuffing. The products are shipped to customers when they weren’t ordered, however the business knows that the products will be returned after the end of the year. Until the returns are made, the shipments are recorded as actual sales. Also, the returned sales might not be recorded instantly in order to delay recognition of the offsets against sales revenue in the current year. [6 ]

Enron Accounting Fraud:

An accounting fraud scandal rose to rival Enron and WorldCom recently. As a result of the mutual funds and insurance fiasco of 2004, AIG is still being investigated for accounting fraud. However, “recent investigations uncovered more than a billion dollars in accounting transaction errors.” [7 ]

“The accounting fraud was done by creating the Special Purpose Entity that covers the debt and failing investment in the company and turns it into sales revenue in the financial statement.” [8 ] Basically the liabilities were turned into assets. This was accomplished by executives of Enron and by the assistance of Arthur Andersen, the chief auditor of Enron. [9 ]

An extraordinary fraud like the Enron fraud could not be detected for a long time, if no one wants to see it. Audit procedure is not designed to precisely detect fraud, but to only confirm that financial statements are misstatements free. In the case of Enron, financial controls were not reported. [10 ] This action is considered as a crime in the point of law and organizational fraud that affects the organization’s stakeholders.