Chapter 26 Principal Protected Funds

Post on: 30 Июнь, 2015 No Comment

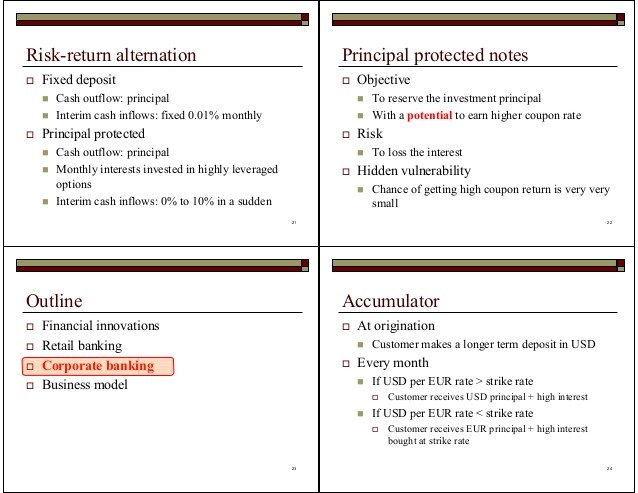

The recent bear market has many investors more concerned about protecting their investment money rather than growing it. Financial services providers have answered by marketing new kinds of mutual funds that promise to guarantee, for a predetermined period of time, that the money you invest in the mutual fund will be held safe, at a cost. These mutual funds are referred to as principal protected funds. They are also referred to as principal protection, capital preservation, or guaranteed funds. Prior to investing in a principal protected fund, it is essential to comprehend how they function and what they cost.

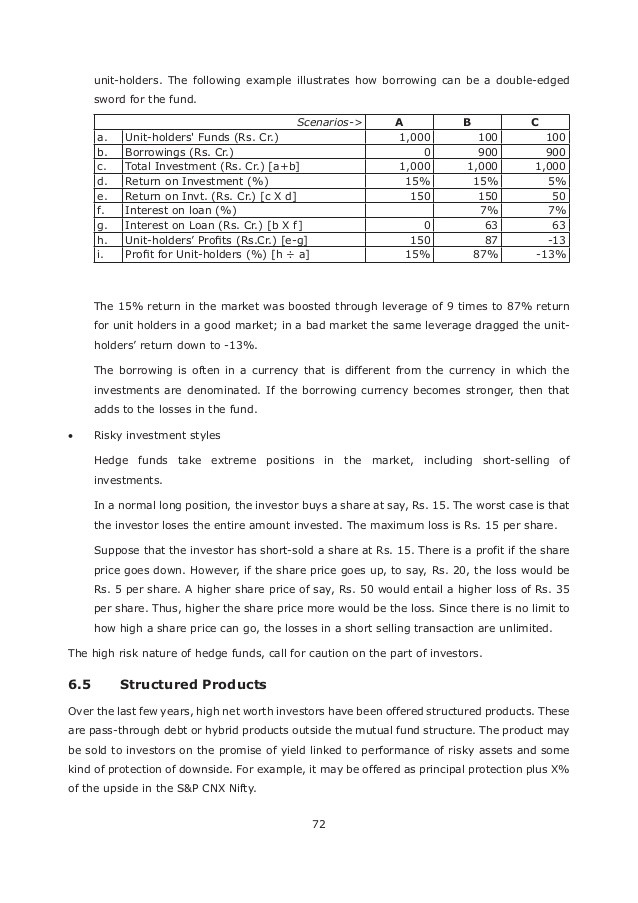

There are some prevalent features shared by these investments. The first is that they guarantee principal. The majority of principal protected funds ensure your original investment less any front-end sales charge even if the stock markets go down. In some circumstances, the guarantee is supported by an insurance policy. The second feature shared by these investments is the lock-up period. If you sell any shares in the fund before the end of the guarantee period, a period of 5 to 10 years, you fail to keep the guarantee on those shares and could lose money if the price of the shares has gone down from the time of your original investment. Another shared characteristic is that they hold a mixture of bonds and stocks. The majority of principal protected funds invest part of the fund in zero-coupon bonds and additional debt securities, and part in stocks and other equity investments. To make sure the fund can back up the guarantee, several of these funds may be almost completely invested in zero-coupon bonds or additional debt securities during times in which the stock markets are volatile and interest rates are low. Since this distribution leaves you less exposed to the markets, it may do away with or considerably lower any profits the fund can obtain from increases in the stock market. It also may raise the risk to the fund if interest rates go up, which typically makes the price of bonds go down. Zero-coupon bonds are different from the majority of bonds because they do not pay interest. Rather, you purchase them at big discounts below face value. When the bond matures, you get the face value, which depicts the principal with the addition of interest that has accumulated. Since zero coupons pay no interest until they reach maturity, their prices may be more volatile than other bonds with comparable maturities that pay interest regularly. The fourth feature shared by these investments is higher fees. Various principal protected funds bear an expense ratio, the total yearly fees taken from your assets, that is higher than that of funds that are not protected. Fees go from 1.5 percent to almost 2 percent, from which .33 percent to .75 percent generally compensates for the principal guarantee. Moreover, several funds also charge sales charges, as well as redemption/penalty fees for early withdrawals that may be notable.

Principal-protected funds generally are comprised of three stages. The first stage is the subscription or offering phase, which is a period of a few weeks or months when investors can buy shares in the fund that will be covered by the guarantee. The guarantee phase is the second stage. If you retain your investment during this 5 to 10 year period and reinvest all profits and distributions, your original investment less any front-end sales load is guaranteed. And the third stage is the post-guarantee phase. Following the guarantee phase, the fund either cashes out or performs with no guarantees. If the fund keeps performing, it may alter its investment goals and focus on an equity only approach.

Principal-protected products vary from traditional mutual funds and are distinct from one another. You should look over each prospectus thoroughly. As a rule, there are a number of determinants you should keep in mind before investing. The first is if you will need the money in the coming 5 to 10 years. If you cash out an investment in a principal protected fund sooner than expected, you may fail to keep your principal guarantee, must pay an early withdrawal penalty, and could lose money if the price of the shares has gone down from the time of your original investment. The second determinant is if you need any income from the investment. The guarantee is contingent on not requesting any redemption throughout the guarantee period as well as reinvesting all profits and distributions. However, reinvested profits and distributions will not increase the total that is guaranteed, your choice to take redemptions or acquire profits or receive distribution in cash can lower the guaranteed total. Another factor is that you have to pay U.S. income tax annually on the likely interest from the fund’s zero-coupon bond holdings as it accumulates, with the exception of it being held in a tax-deferred retirement account. This is accurate, but there are no real cash distributions compensated into your account from the zero-coupon bonds retained in the fund’s portfolio. A fourth determinant that you should keep in mind before investing is that the fund can be invested completely in zero-coupon bonds and additional debt securities in specific market circumstances, which could signify giving up all likely profits if stock prices go up. The possibility of not realizing any profits greater than your original investment is still another factor to keep in mind. In this circumstance, your performance would lag behind that of Treasury bonds bought with no yearly fees. A sixth factor is that you will only get the advantage of the guarantee on the maturity date. With the majority of principal protected funds, the guarantee is only legitimate on the fund’s maturity date, typically the last day of the guarantee, or lock-up period. If you sell your fund shares prior to or following the maturity date, you could lose money if the price of the shares has gone down. A seventh determinant that you should keep in mind is how good the guarantee is. The guarantee that is offered by the fund is only as good as the company that provides it. Although it is an unusual incident that the banks and insurance companies that generally back these guarantees are not able to fulfill their obligations, it does occur. There are many credit rating agencies that rate a company’s financial fortitude.

Avoid principal-protected fund providers that magnify the advantages of these funds; for example, a statement that the fund will surpass the performance of the S&P 500 index. Even though this may be accurate in a bear market period when the prices of stocks are going down and capital is decreasing, it is not accurate in a prolonged bull market when the prices of stocks for a wide spectrum of indexes are clearly going up. Similar to any investment, make sure you comprehend the circumstances on which performance allegations are formed.

Every investor has to look for his or her own risk tolerance and principal growth possibilities, and every kind of investment, in addition to principal protected funds, comprise of an exchange among risk and return. Although principal protected funds do offer a guarantee, you will pay for this guarantee through higher-than-average fund expenses and possibly reduced long-term principal growth. A number of variable annuities also provide a principal protected sub-account, or rider, which is also referred to as a guaranteed minimum accumulation benefit. While this alert focuses on principal protected mutual funds, a lot of the information that pertains to principal protected mutual funds is also appropriate to these variable annuity sub-accounts.