CBOE Put

Post on: 10 Май, 2015 No Comment

There are scores of reasons why the S&P 500 shouldnt go much higher in the near-term. Here are several of those reasons in no particular order: (1) Psychological resistance for the S&P 500 at the 1300 level; (2) Fibonacci retracement resistance at approx 1295; (3) Extreme bullish sentiment of investment advisers; (4) Dangerously high bullishness in the AAII Survey; (5) Tighter monetary/fiscal policies in emerging markets affect U.S. corporate earnings potential; (6) Seven consecutive weeks of dip buying and rallying; (7) New market highs are being powered by fewer and fewer individual companies.

Still, I have incrementally been adding to developed market stock ETFs. And while I have primarily focused on iShares MSCI Canada (NYSEARCA:EWC ) for new dollars, I havent exactly shied away from increasing client exposure to tech ETFs or broader-based ETFs like the iShares S&P 500 (NYSEARCA:IWV ).

The question is. If all signs point to limited upside potential prior to some consolidation and correction, why do I continue to invest in equities? Granted, I may be mitigating the risks via incremental purchasing, down-day buy orders and stop-loss protection. Nevertheless, shouldnt I wait for the buyers to get tired? The answer is. I’m waiting for the short-sellers to throw in the towel.

One of the most common bits of investing wisdom is to buy when everyone else has given up on their stock holdings. Yet this gem from Sage Investing 101 only looks at part of the market participation. the part that is afraid to hold onto long stock positions. On the dark side, there are short-sellers who endeavor to profit from falling stock prices. These folks also grow tired of losing, not to mention fearful and scared of being wrong.

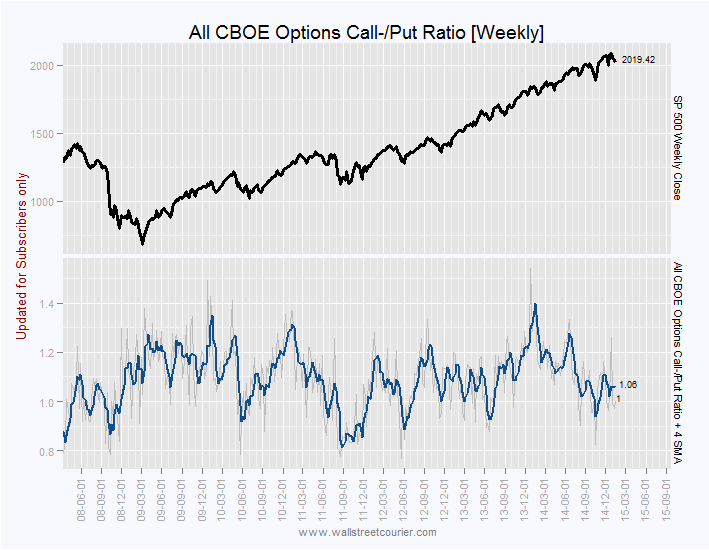

It follows that, just as it is usually profitable to buy when the herd is stampeding for the exit door, it may also be profitable to stay invested until the short-selling herd does the same. And how do we identify that? With the help of the CBOE Put/Call Ratio .

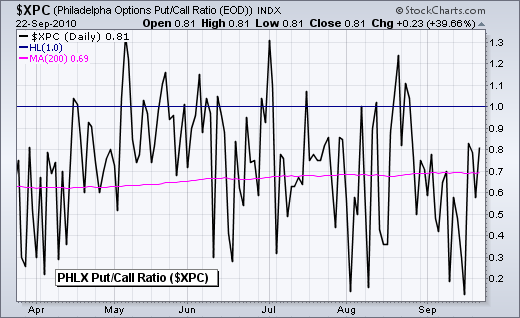

When short-sellers have become greedy or comfortable, historically speaking, you typically see as many S&P 500 puts as there are calls. A week or more of 1.0 readings is indicative of market bottoms. In contrast, when the short-sellers have become passive and/or fearful, the ratio may trade around 0.35 for a period. This is frequently associated with a market top.

At the time of this writing, the last data point available is from Friday, 1/14/2011. The CBOE Equity Put/Call Ratio registered 0.37. Honestly, I couldnt even remember seeing a number that low in 2010 or 2011.

The last readings of 0.37 or lower came more than nine months ago. on April 14 and April 15, 2010. Almost to the day, the stock market dropped 15%-16% from the S&P 500 1200 level, and required seven and a half months to recover. Thats why I will be taking some profits and tightening up stop-losses if the put/call ratio trades for a number of days in this area.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc. a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.