Canadian mutual fund investors Wake up!

Post on: 22 Июнь, 2015 No Comment

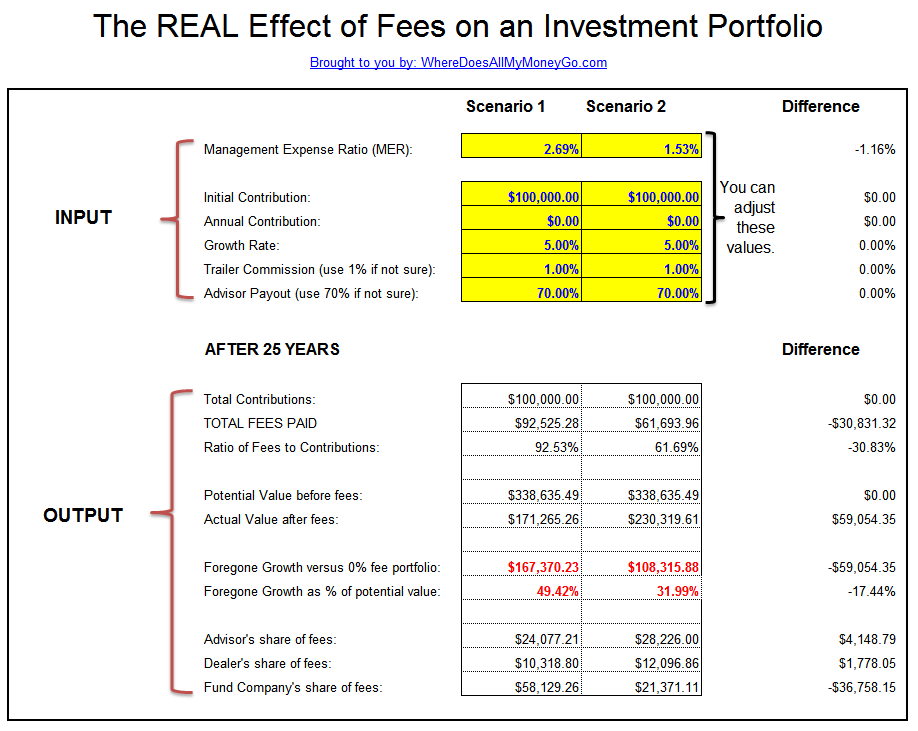

Last week, I wrote about findings from a recent Morningstar Inc. report detailing that Canada has, on average, the highest mutual funds fees in the world. Meanwhile, our American neighbours are benefiting handsomely from having access to the cheapest.

The troubling Morningstar findings struck a chord with readers, who tweeted, emailed and commented directly on my article. For instance, Sheila Keenan? shadwell123 responded: I know I should pay more attention to fees, I dont know nearly enough about them.

These two important questions were also posed: Why buy mutual funds when you can buy exchange traded funds (ETFs), which have very low management fees? Dorothy wrote. And from Lee Anne Davies @agenomics. Why dont we change?

Let’s start with the first question. The simple answer is that sometimes mutual funds just make more sense for certain people—particularly, young or novice investors with little income who want easy access to a diverse holding of funds and the benefits of professional money management. If you buy mutual funds through a bank or mutual fund sales specialist (as many investors do), you’re likely going to be charged management fees (or MERs) well above 2%—but for investors just starting out, those high fees arent going to make much of an impact on their fledgling portfolio. Others with more sizable savings may also want to go with mutual funds because they’re either completely incapable or uncomfortable with managing their own finances. Or, maybe they want all or a portion of their portfolio to have a chance at beating the markets through active management—very hard to do, but not entirely impossible. Finally, mutual funds are convenient (thanks to monthly automatic preauthorized contribution plans) and avoid transaction costs.

Regarding ETFs, yes, they’re one of the best things to happen to Canadian investors in decades, but they’re not for everyone. For starters, you normally pay commissions to buy and sell them, which makes them unsuitable for portfolios with less than $50,000 and for those who contribute every month. They’re also fairly complicated for the novice, since they’re basically bought and sold like stocks. While you can enlist professional help, advisers in Canada licensed to sell ETFs often work only with wealthy clients.

These above reasons and more serve as the preamble to a feature article, “The Smart Investors Guide To Mutual Funds,” that will be appearing in the forthcoming Summer issue of MoneySense set to hit newsstands toward the end of June. Well be providing a comprehensive overview on how to use actively managed mutual funds intelligently, and how to avoid their many pitfalls. Bottom-line: If mutual funds are a better fit for you, you don’t have to get saddled with outrageous fees provided you’re a discerning investor.

Now, on to the second question: Indeed, why dont we change? Why are Canadians, on average, paying through the nose for mutual funds? For that, I’m going to defer to former Mercer actuary Malcolm Hamilton, who retired last December after a long and distinguished career (although he’s now a Senior Fellow at the C.D. Howe Institute). The following excerpt is from his forward to MoneySense Editor Jonathan Chevreau’s book, The Wealthy Boomer: Life After Mutual Funds. in—wait for it—1998:

“American investors can find no-load mutual funds with MERs under 0.25%. Canadian investors can’t. For this, Canadians have only themselves to blame. We arent price sensitive. We either don’t know what we’re paying, or we don’t care. If the customer doesnt care what the product costs, the producer has no reason to economize. High MERs mean better incomes for investment managers. They mean bigger profits for fund companies. They mean larger trailer fees for brokers. They mean fat advertising budgets. In the long run, everyone is happy—except the customer. Until investors demand a better product by rewarding those who provide it and punishing those who don’t, Canadian mutual funds will have high MERs. And as long as MERs stay high, using mutual funds intelligently means using them less.”

Sadly, Hamilton’s very blunt and accurate assessment was as true 15 years ago as it is today. Many Canadians who use mutual funds are either investing blindly or are completely apathetic to the enormous fees they’re being charged. If that sounds harsh, just remember that losing a big chunk of your returns every year to inflated fees is far worse than some financial tough-love advice.

Canadian mutual fund investors, it’s time to wake up and start pushing back.