Can Mutual Funds Successfully Mimic Hedge Funds Financial Web

Post on: 10 Июль, 2015 No Comment

Investing in mutual hedge funds has become very popular due to the recent success of hedge funds in general. Many hedge funds have acheived record gains that have led many mutual funds try and mimic their success. Here are a few things to consider about whether a mutual fund can actually mimic a hedge fund and whether you should get involved.

Hedge Funds

In order to understand why a mutual fund would want to mimic a hedge fund, you need to understand a little bit about hedge funds and how they operate. Hedge funds are investment vehicles that are designed to grow the money of those that are already considered wealthy. In order to get involved in a hedge fund, you must be an accredited investor. Basically this means that you need to have a substantial amount of money. In order to qualify as an accredited investor, you have to prove that you have made at least $200,000 for the last two years. The other option is to have a net worth of over $1 million. This eliminates the vast majority of investors from being able to get involved in a hedge fund.

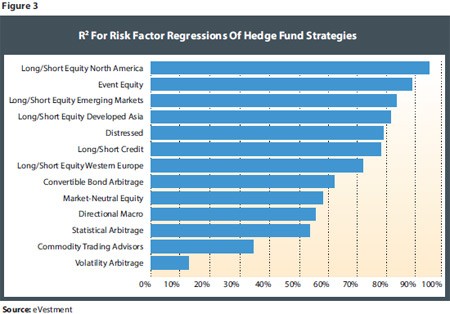

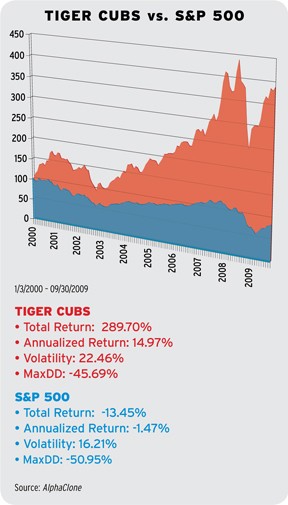

The reason that the requirements are placed are to protect consumers because hedge funds involve much risk and you must be very familiar with the market to work with them. Hedge funds are very desirable because of the unique returns that they are able to provide their investors. The returns that a hedge fund provide are often much greater than what a mutual fund can or any other type of traditional investment. Hedge funds realize these returns, independently from market correlation, by using a number of different investment strategies. This is a very advanced type of investment that is only reserved for the very experienced hedge fund managers.

Mutual Fund Mimicking

With the success of hedge funds, mutual funds have attempted to mimic some of their investment strategies. This can be very appealing to many investors because getting involved in a mutual fund does not require the same capital as a hedge fund does. This means that almost anyone can get involved in the market and try and realize higher returns that are common with hedge funds.

Regulation

While the idea behind this mutual fund strategy is nice, when you put it into practice it does not always add up. One of the major benefits that hedge funds have is that they do not have to register with the SEC. They are not bound by the same trading laws that mutual funds are. This freedom is what allows hedge funds to reap some of the larger returns that they are able to bring in.

For example, hedge funds regularly utilize leverage from the funds in their account in order to increase the gains of the total portfolio value. Mutual funds are not allowed to do this, due to SEC regulations. Therefore, one of the critical strategies that hedge funds utilize is not available to mutual funds.

As an investor, getting involved with a hedge fund may seem like the ideal portfolio addition, however, if you do not have the capital that it takes to get involved, the mutual fund could be a decent alternative.

$7 Online Trading. Fast executions. Only at Scottrade