Calculating your rate of return and disputing Dave Ramsey s claim

Post on: 23 Май, 2015 No Comment

Writing about random topics

Calculating your rate of return and disputing Dave Ramseys claim

April 13, 2011 by coolspot253

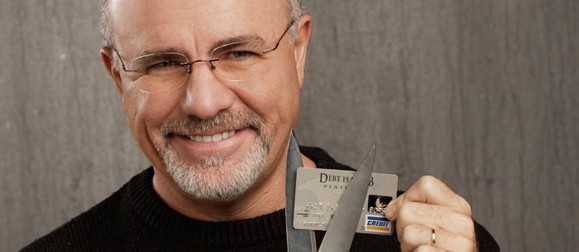

In my on-going quest to dispute Dave Ramsey’s claim that you can easily get 12% return on the markets over the long term, I have evidence that contradicts what he says.

In order to calculate your return on any investment, you need to calculate the annualized rate of return, not the average rate of return.  The best way to show this is an example.

Let’s say that at the start of Year 1, you invested $1000.  At the end of Year 5, you have $2000.  What is your average yearly rate of return?  Well, $2000-$1000 = $1000.  Divide that by 5 years and you have $200/year.  $200/$1000 = 20% rate of return per year.  Not bad, eh?

Unfortunately, 20% is not your average rate of return.  20% is higher than your actual rate of return.  Here’s why:

Year 1 = 1000, end of year 1 = 1000 + 1000 x 20% = 1020

Year 2 = 1020, end of year 2 = 1020 + 1020 x 20% = 1224

Year 3 = 1224, end of year 3 = 1224 + 1224 x 20% = 1464.80

1465

Year 4 = 1465, end of year 4 = 1465 + 1465 x 20% = 1758

Year 5 = 1758, end of year 5 = 1758 + 1758 x 20% = 2109.60

2110

What the?  A 20% average yearly return is $110 more what you actually ended up with!  How’d that happen?  It happens because the 20% return is on the amount you have at the end of the year which goes up every year, not on the original $1000.  Therefore, calculating your total return and then dividing by the time frame is not how to calculate your average return.

What about taking the average return per year?  Let’s suppose your money doubles, then splits in half (i.e. loses half its value), and repeats, and then is flat in year 5:

Year 1 = 1000, end of year 1 = 1000 + 1000 x 100% = 2000

Year 2 = 2000, end of year 2 = 2000 + 2000 x -50% = 1000

Year 3 = 1000, end of year 3 = 1000 + 1000 x 100% = 2000

Year 4 = 2000, end of year 4 = 2000 + 2000 x -50% = 1000

Year 5 = 1000, end of year 5 = 1000 + 1000 x 0% = 1000

The average rate of return is (100 + (-50) + 100 + (-50) + 0)/5 = 20% average return.  Yet at the end of five years, with this supposed 20% average return, you have the exact same amount of money you ended up with!  This is wrong because averaging out the yearly returns does not reflect your actual end value if you were to invest that amount at the start.  The numbers do not work that way.  Unfortunately, it’s also how many mutual funds report their average annual returns.

How do you calculate your average rate of return?

The answer is you have to use mathematics in order to calculate the annualized rate of return. which is the correct one.  The formula for future value, given the present value, the rate of return (or interest) and time is the following:

Future Value = Present Value x (1 + rate) time

That’s how interest on your house is calculated, or how much a savings bond will be worth.  If a bond gets 3% interest, and it matures in 10 years, then $100 now will be worth $134 then.

To calculate the rate of return, you need to use that formula and then rearrange it using the skills you learned in 10th grade math:

rate = 10 (log 10 (future value/present value)/time) – 1

[I am using log base 10, but you could use a natural log or any logarithm value]

In our example above, the future value is 2000, the present value is 1000, and the time is 5 years.  Therefore, plugging in those numbers above, the rate of return is 14.86%.  Does this work out if we do the math manually?

Year 1 = 1000, end of year 1 = 1000 + 1000 x 14.86% = 1148.70

Year 2 = 1148.60, end of year 2 = 1148.60 + 1148.60 x 14.86% = 1319.51

Year 3 = 1319.28, end of year 3 = 1319.28 + 1319.28 x 14.86% = 1515.72

Year 4 = 1515.33, end of year 4 = 1515.33 + 1515.33 x 14.86% = 1741.10

Year 5 = 1740.50, end of year 5 = 1740.50 + 1740.50 x 14.86% = 2000.00

What do you know, the numbers match exactly the way they have to match up.  Thus, when we are looking for the stock market’s historical rate of return we have to use the annualized rate of return, not the average rate of return.

And that brings me to Dave Ramsey.  In his book The Total Money Makeover. on page xv, he says that “this book is NOT going to mislead you on investment returns.”  He goes on to say the following:

Sadly, many intelligent but ignorant people seem to think that making a 12% rate of return on your money in a long term investment is impossible.  And that if I state that there is a 12% rate of return available, then I have lied to you or misled you.

The supporting data for that bold statement can be found by looking at the historical averages of the S&P 500 index.  Widely regarded as the best single gauge of the US equities market, the is an index with 500 of the largest companies in leading industries of the US economy.  The S&P 500 has averaged 11.67 percent per year for the last eighty years. as of this writing.  This includes the big drop in the 2008 market.

This book was published in 2009, so I am going to give Ramsey the benefit of the doubt and give him the year 2010 as well to include in the stock market average return.  He is definitely correct, the S&P 500 is the best gauge of the US equities market.  Anyone can go and verify his claim that the S&P has averaged 11.67 percent per year.

That’s what I did, I took the returns from the past 85 years.  And you know what?  He’s right.  I went back to this page. got the historical returns for the S&P 500 and plugged them into Excel and calculated the average returns.  The result, including 2010, is 11.87%, just what Ramsey claims.  So I guess I should shut up.

Right?

But no!  I will not shut up!  As I demonstrated above, the average rate of return is not the rate of return that matters, it is the annualized rate of return!  Just like from the example above, if you invest into a fund that averages 11.87%, that doesn’t mean you can expect to get that.

How much is the annualized rate of return of the S&P 500 since 1925?  It is 9.9%, nearly 2% less than Dave Ramsey claims it is (you can verify yourself by going to this page ).  Well, well, well.

When Ramsey says that the S&P is averaging 11.67% per year, he is quoting the average rate of return.  However, he should be quoting the annualized rate of return of 9.9% because that’s what an investor can expect to make each year going forward.  It’s like saying to someone that Canada has the world’s longest coast line.  It’s true… but irrelevant.  He does explicitly state that he is not going to mislead the reader about investment returns.  By quoting the average rate of return and not the annualized rate of return, that is misleading.  After all, in all of his examples he says that you should take your money and put it into a good growth mutual fund getting 12% and then his examples are based upon a 12% return.  Yet as we can see above, the 12% average return is not representative of what someone could expect to get in real life.

Numbers do not lie.  You can plug it into your own spreadsheet and do the math for yourself.  In order to get an annualized return of 12% per year, a mutual fund manager would have to outperform the market by 2% each year.  That’s incredibly difficult to do over the long term.

I think I am going to write Dave Ramsey a letter and see what he says.