Calculating Your Adjusted Cost Base With ETFs

Post on: 10 Июнь, 2015 No Comment

Being a DIY investor is easy when all your accounts are tax-deferred. As the April 30 tax deadline approaches, pretty much all you need to do is gather your RRSP contribution slips. But if you have nonregistered accounts, things are more complicated, even if you’re a Couch Potato who uses ETFs and index funds.

To begin with, you need to report any income you received during the year. This part is relatively easy: in February or March you should receive a T3 slip that includes a breakdown of the type of income youve received from your mutual funds or ETFs: dividends, reinvested distributions, and interest income. Just enter these amounts in the appropriate boxes on your tax return and your software—or your accountant—does the rest.

If you hold US-listed ETFs, you’ll receive a T5 slip from your brokerage: Box 15 contains the amount of foreign dividends you receive, and Box 16 will indicate the amount of foreign tax paid. Dividends from US and international companies are fully taxable as income, but you can recover the withholding tax by claiming the foreign tax credit on your return.

But theres more to the story than simply reporting income. You also need to report any capital gains you may have incurred by selling an ETF at a profit. Conversely, if you sold an ETF for less than you paid, you can claim a capital loss, which can be used to offset other gains. Your net capital gains are then taxed at half your marginal rate.

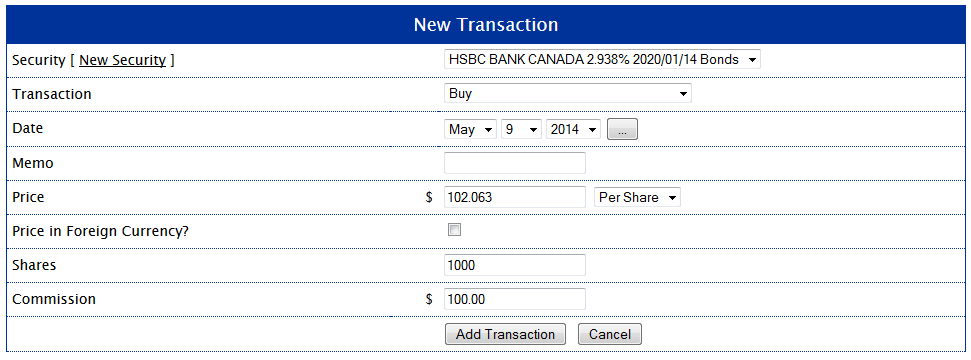

The problem is, if you sell an ETF and incur a gain or loss you dont get a T-slip in the mail with that information: youre responsible for doing the calculation and reporting it accurately on your tax return. This calculation is not easy, because you likely made more than one purchase of the ETF over many months or years, paying a different price each time. You also need to account for reinvested distributions, return of capital, and other factors. Only when you have determined your adjusted cost base (ACB) can you determine your true capital gain or loss.

If you have a large and relatively complex non-registered portfolio, it’s probably best to have an accountant or tax advisor do this for you. Another option is to use ACB Tracking. a website that does custom calculations for a modest fee. But if youre a DIY investor who enjoys this sort of thing, we want to help. Justin Bender and I have co-authored a white paper called As Easy As ACB. which walks you through the process step-by-step.

We hope you’ll download the white paper and give us your feedback. Please remember it is not a substitute for professional advice, and you are responsible for ensuring the information you report on your tax return is accurate.

Subscribe

Subscribe to our e-mail newsletter to receive updates.