Calculating Tax Equivalent Yield Municipal Bonds

Post on: 17 Апрель, 2015 No Comment

Please refer to our privacy policy for contact information.

Are Municipal Bonds Right for You?

Knowing how to calculate the tax equivalent yield on municipal bonds is a key element of determining whether munis are right for you. Most muncipal issues are tax-exempt on the federal and state levels, which sounds like a great deal at first. After all, why pay taxes on your investment income when you have the option not to?

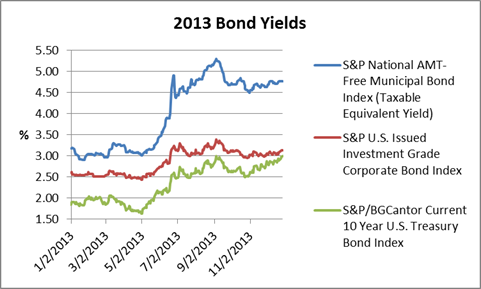

Unfortunately, it isn’t that simple. For investors in lower tax brackets, it may in fact pay to invest in taxable securities, since taxable issues typically offer higher pre-tax yields than municipal bonds. Knowing how municipal bonds’ tax equivalent yield (TEY) is calculated is the first step in determining whether munis are right for you.

The good news: it’s not difficult. Here’s how to calculate tax equivalent yield in a few simple steps:

First, find the reciprocal of your tax rate, or in other words, 1 – your tax rate. If you pay 25%. the reciprocal is simply 1 — .25, or .75 (75%).

Second, divide this into the yield on the tax-free bond to find out the tax-equivalent yield. If the bond in question is yielding 3%, the equation is: 3.0 divided by .75, or 4%.

Now that you have this information, you can make an apples-to-apples comparison between the taxable and tax-free issues. If a taxable bond of equivalent credit quality and time until maturity yields more than 4%, then you would be better off investing in a taxable bond. If you plug different tax rates into the equation above, you will see that the higher your tax rate, the higher the tax-equivalent yield – illustrating how tax-free bonds are best suited to those in higher tax brackets.

Keep in mind, municipal bonds issued within your state of residence may be tax-free on both the federal and state levels – which is referred to as “double tax free.” In this case, be sure to factor in your state tax rate when calculating the reciprocal in Step 1. In other words, if your federal tax rate is 25% and your state tax rate is 3%, the appropriate math in Step 1 would be 1 – .28 = .72

Current tax brackets can be viewed here .

There are two additional wrinkle to consider:

First, U.S. Treasuries are tax-free on the state level. If you’re comparing a municipal bond to a Treasury issue, you need to take the yield to maturity of the Treasury at the time of purchase and multiply by (1 – your state tax rate).

Second, keep in mind that if you sell an individual bond before it matures, or if you buy a bond fund and sell it with a gain, you will be on the hook for a capital gains tax. Even though the income is tax free, the capital gains are not. Learn more about how mutual funds are taxed here .

The bottom line: always be sure to do this simple math before you buy a municipal bond or muni bond fund. Tax-free income sounds like a great idea on paper, but you may be passing up the chance to earn higher after-tax income.

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Be sure to consult investment and tax professionals before you invest.