Calculating Capital Gain or Loss When Selling Fund Shares

Post on: 10 Июнь, 2015 No Comment

Calculating Cost Basis and Capital Gains on Mutual Fund Shares

Mutual Funds and Capital Gains

You will need to calculate capital gains on each share of the fund you are selling. If you have invested in a fund over a period of time, then you will have different cost basis for your initial investment, additional investments, and any purchases made through reinvested dividends. Each investment has its own cost basis and its own holding period.

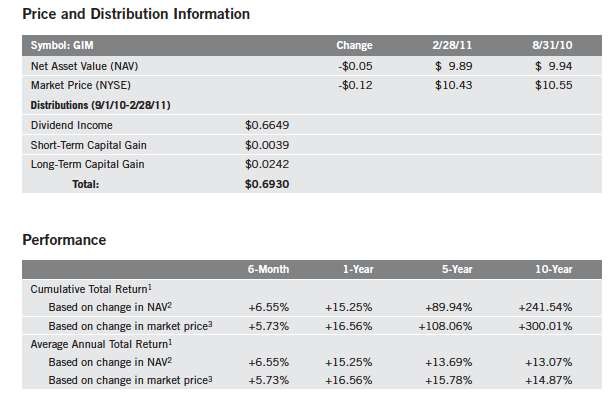

Capital Gains Distributions

Mutual funds often sell profitable investments at certain times throughout the year. The funds then distribute the profits to shareholders in the form of a capital gain distribution. Capital gains distributions are reported on Form 1099-DIV, which shows dividends and capital gains distributions paid throughout the year. Capital gains distributions are taxed at

long-term capital gains tax rates. no matter how long you have personally owned shares in the mutual fund.

Capital gain distributions can be reported directly on Form 1040 if you have no other capital gains to report. Otherwise, capital gain distributions are reported on Schedule D along with your other gains and losses.

Capital Gains When Selling Mutual Fund Shares

You will calculate your capital gain or loss for every mutual fund share you are selling. If you have invested in a fund over a period of time, you will have a different cost basis and different holding period for each share you own.

The IRS allows you to use four different accounting methods for calculating your gain. You can use the method which is most advantageous to you. However, once you choose your accounting method for a particular mutual fund, you must stick with that method. You can choose different accounting methods for each mutual fund you own. The four allowable accounting methods are:

- Actual cost basis using specific identification,

- Actual cost basis using first-in, first-out identification,

- Average cost basis, single-category method, and

- Average cost basis, double-category method

Specific Identification of Mutual Fund Cost Basis

Specific identification enables the investor to choose which shares to sell for the greatest possible tax benefit. An investor may want to sell the most profitable shares to offset other losses, or may want to sell the least profitable shares to minimize the capital gains tax.