Calafia Beach Pundit Service sector surprises on the upside

Post on: 23 Август, 2015 No Comment

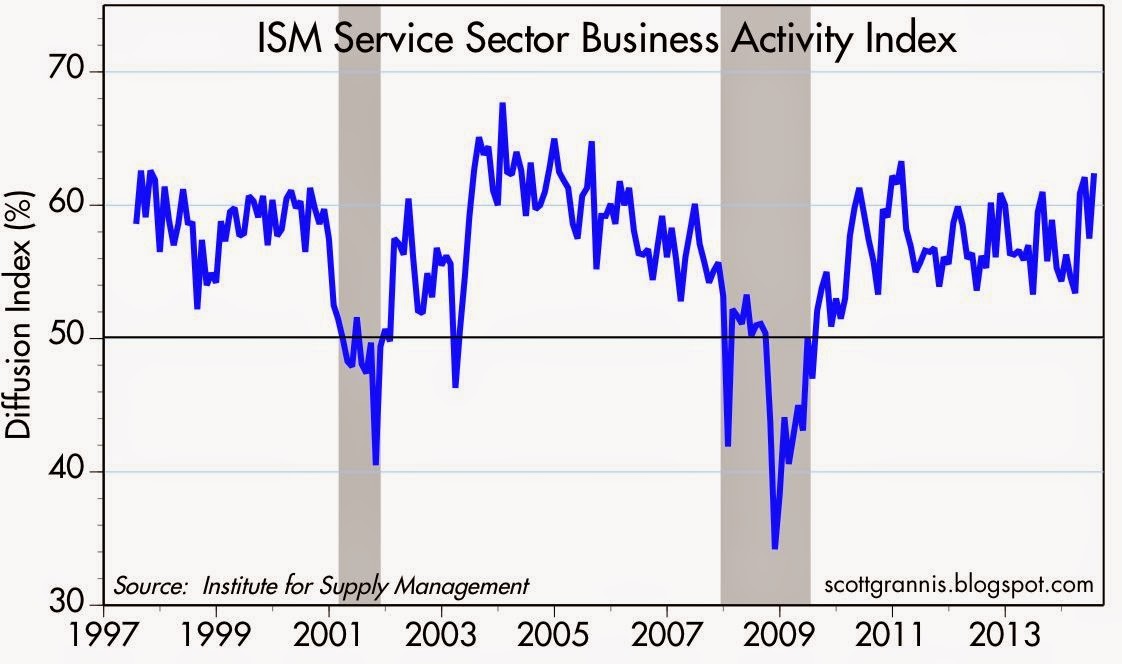

Service sector surprises on the upside

3 comments:

TrimTabs: Record inflow into U.S. equity funds in July

Of the $40.3 billion total going into equity funds in July, $31.6 billion went into U.S. equity ETFs, while $8.7 billion flowed into U.S. equity mutual funds, TrimTabs reported.

The record inflows came a month after investors had dumped bonds at a record pace in June. A record $69.1 billion was pulled out of bond funds in June, followed by an outflow of $21.1 billion in July, according to TrimTabs data.

Still, cash remains king. with the latest data suggesting more of the money that has come out of bonds this summer has gone into cash. In the latest eight weeks ended July 22, $110.9 billion poured into savings deposits, while $32.5 billion flowed into retail money market funds.

The combined inflow into cash of $143.4 billion is nearly three times the $54.1 billion that flowed into all equity mutual funds and ETFs in June and July. TrimTabs said.

www.reuters.com/article/2013/08/04/us-trimtabs-equity-idUSBRE9730BM20130804

The PCE inflation index is at 1 percent and falling. So, the Fed is well below even its somewhat low 2 percent inflation target, and economic growth remains weak. I cant see why QE should end now, or maybe even for several years.

Also, it is wrong to think of QE as doing something and not doing QE as being neutral.

If the Fed has its polished wing-tipped shoe on the throat of the economy, thus cutting off the monetary air supply, that is doing something also.

Many economists, such as David Beckworth in writing in for The National Review, suggest the Fed is now passively tight.

The problem is, the Fed cannot cut rates. We are in or near ZLB.

So, while QE looks activist it is really only enough to prevent the Fed from actually tightening the money supply. Not doing QE would be tightening the money supply. We need that now like we need a Portosan on the front lawn of the White House.

Given the direction of inflation, the Fed may actually be tightening as we speak, even with the current level of QE. We may need to taper up.

Unit labor costs in nonfarm businesses fell 4.3 percent in the first quarter of 2013, the combined effect of a 3.8 percent decrease in hourly compensation and the 0.5 percent increase in productivity—the BLS.

If unit labor costs are falling. how do we get inflation?

Office rents are soft, industrial rents are soft.