Buyout Cycle Boosts Biotech ETFs

Post on: 21 Апрель, 2015 No Comment

Summary

- Recent acquisitions in the biotech field have led to fantastic gains for investors.

- Many niche industry-level ETFs offer an opportunity to capitalize on these buyouts without taking on individual business risk.

- Composition of ETF indexes makes a big difference when comparing similar products by various fund companies.

The recent buyout of Idenix Pharmaceuticals (NASDAQ:IDIX ) by drug maker Merck & Co. (NYSE:MRK ) is another high-profile example of the race to scoop up promising biotechnology companies before they hit it big. Drug companies know the pipeline for new products must constantly be refreshed by cutting-edge innovations that can lead to billions in future profits.

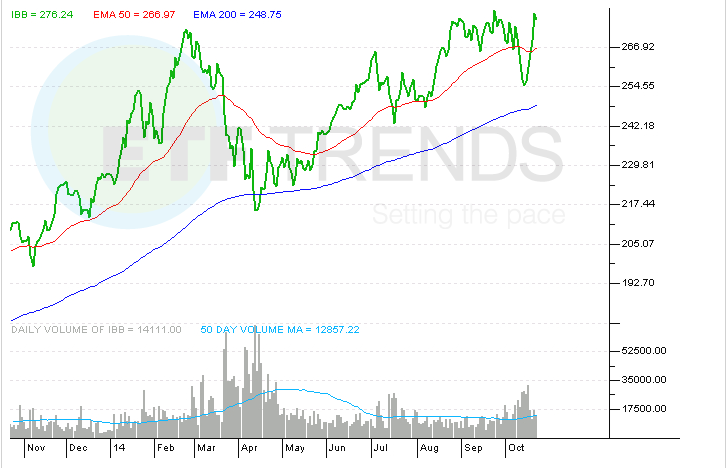

The 230% single-day gain that IDIX experienced as a result of the buyout had a huge impact on the SPDR Biotech ETF (NYSEARCA:XBI ), which rose more than 6% that day. Because XBI is a modified equal-weighted index, IDIX had a much larger impact on the total returns than a market-cap weighted fund such as the iShares Nasdaq Biotechnology ETF (NASDAQ:IBB ).

IDIX previously represented just 1.5% of the underlying holdings in XBI, but the recent jump has catapulted its total weight within the index to 4.5%.

This acquisition also sparked a strong rally in companies with competitive products, such as Achillion Pharmaceuticals (NASDAQ:ACHN ), which is developing a similar hepatitis C treatment.

The latest round of M&A activity in the biotechnology arena got me thinking about how these buyouts can positively impact ETF indexes, in addition to the direct equity holders. From a fundamental perspective, the attractiveness of smaller firms that can be bought out for billions of dollars by heavy-hitters is a win for many niche industry-level ETF participants.

When most indexes are constructed, underlying stocks are added or removed based on their market cap or fundamental merits according to the constraints of the index provider.

In more broad-based equity indices such as the S&P 500 Index, each participant is evaluated on a regular basis by a board of trustees. Any stock that is added or removed from the index is usually done with modest fanfare and little net gain to the overall performance of the group.

However, with more focused groups such as XBI, you have the potential for fireworks when an acquisition is announced. The removal of one stock ultimately paves the way for another company to be added in its place as well. This continual cycle of refreshment can breed further gains within the ETF, assuming the overall uptrend remains intact .

This is why it’s critical to pay attention to index construction when selecting an ETF to add to your portfolio. While there are oftentimes competing products with similar names, the underlying asset allocation or security selection methodology can be radically different. This can lead to significant divergences in total return over time.

In addition, the merits of both broad-based and narrow-focused ETFs should be evaluated in the context of cost, liquidity, diversification, performance, and volatility.

The bottom line is that investors can still benefit from significant acquisitions, speculative activity. or company mergers using select ETFs that are positioned to reap the rewards of these circumstances. In addition, the built-in diversification qualities of an ETF help mitigate individual business risks if the end results fail to meet shareholders’ expectations.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: David Fabian, FMD Capital Management, and/or clients may hold positions in the ETFs and mutual funds mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell, or hold securities.