Building an AllETF Portfolio

Post on: 20 Апрель, 2015 No Comment

Building an All-ETF Portfolio 5.00 / 5 (100.00%) 1 vote

When thinking of investing in ETFs (Exchange Traded Funds), there are more than 1,000 ETFs to choose from. ETFs track various asset classes such as stocks, commodities, or bonds, and are traded on stock exchanges just like normal stocks. Building an all-ETF portfolio is considered an excellent way to diversify your investment instead of investing in one or two stocks.

Benefits of Investing in ETFs

The biggest reason why investing in ETFs is a good idea is because the investors gets instant diversification. Investing in a biotech ETF gives the investors ownership of many more stocks for the same amount of money than buying one or two stocks. This kind of wide diversification protects the investor from excessive volatility since poor performance by three or four stocks is not very likely to have a big impact on an ETF that contains 50 or more stocks.

So, why should an investor choose to invest in ETF while there are many actively managed mutual funds out there? The biggest reason is cost. ETFs are mostly passive unlike mutual funds, and therefore carry much less management fees. There are of course some mutual funds with excellent track records of consistently beating the market. If the investor, however, decides to hand pick their own stocks to create a portfolio of 10 to 20 stocks, chances are that they will not beat a passive index.

Additionally, ETFs offer the investor access to many other asset classes such as currencies and commodities, thus allowing the investor to play the forex and futures markets.

Building an All-ETF Portfolio

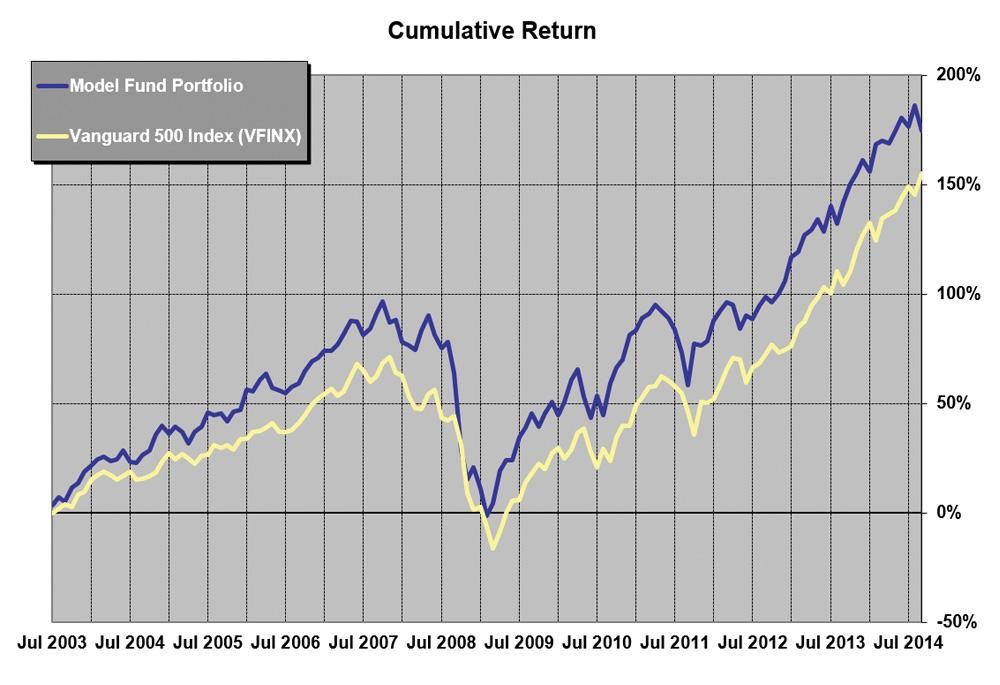

The first step that you should take when building an all-ETF portfolio is past performance. Although good past performance does not always guarantee similar performance in the future, it certainly helps to assess how two or more ETFs have performed in the past. You will sometimes find that two closely related ETFs, such as ETFs made of water stocks, have widely varying performances. This is sometimes the case due to the different approaches taken by the ETFs when investing in the niche sector. For instance, one ETF might be heavy on water infrastructure stocks, while the other majors in water utilities. Although the two are closely related, their respective performance might be miles apart.

You should also consider factors such as amount of assets under management, daily volume, and the ETFs bid/ask spread. An ETF with a small amount of assets under management could be risky because it increases the danger of the ETF closing. Low average daily volume means that an investor who wants to trade large volumes is likely to significantly alter the bid or ask price. A large bid/ask price is usually a sign of low liquidity, which makes such an ETF costly.

When building an all-ETF portfolio, its advisable to include all asset classes to increase your level of diversification. For instance, you can invest in three ETFs that concentrate on various sectors such as healthcare, finance, and technology.

The second approach involves investing in commodity ETFs. Depending on your risk, you might prefer investing in ETFs that track many commodities instead of a single commodity. ETFs that track a single commodity tend to be more volatile than those that track multiple commodities.

The third approach involves investing in international ETFs that cover both the developed and emerging markets. International ETFs can track a single country such as China, or an entire region such as Latin America.

Building an all-ETF portfolio is not hard once you have a firm grasp of the basics. Evaluate the performance of your portfolio each quarter to see if it offers the best reward-to-risk ratio. If it does not, sell it and build another portfolio that meets your needs.

3A%2F%2F1.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D52&r=G /%