Bonds Riskfree returns or Returnfree risk

Post on: 20 Май, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

So long as people perceive bonds as low-risk, investors will continue to flock in their direction. According to BCA Research, mutual fund flows reflect that retail investors still prefer lower yielding corporate and government bonds over equities. In fact, BCA states that “recent data suggest that outflows from equity mutual funds have amounted to US$27 billion, and inflows into bond funds have shot up to more than US$40 billion in the last quarter.” According to GaveKal, many investors have been more concerned with the recent twenty percent advance in equities over the past five months without a significant correction, while many are far less concerned with the twenty percent upward move in bonds over the past year. Interestingly, the move in bonds is much more unusual based on data from the previous twenty years. GaveKal points out that the equity market has had similar gains on eight different occasions over the past twenty years only to be followed by “nothing more painful than a slowdown.” Bonds. on the other hand, have not been this overbought since 1995. In the five occasions where the twelve-month returns on bonds were roughly fifteen percent or greater, each period was “followed by memorable bond meltdowns.” One such period was in 1994 when the Federal Reserve had increased the fed funds rate from 3.0% early in the year to 5.5% in November. Over the same time, the 30-year U.S. Treasury bond yield jumped more than 150 basis points to nearly 8%, and in turn caused many bond investors to suffer losses of 20% or more in their portfolios. Fast forward to today; although the Fed maintains that they will keep short-term rates low, the yield curve could easily steepen should a shift in inflation expectations occur given our current point in the economic cycle. An increase in long-term rates would force bond prices to implode.

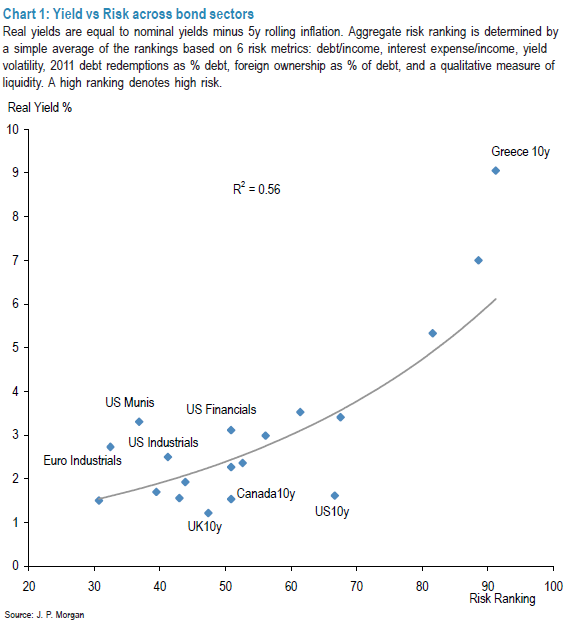

When bonds revert to the mean and prices spiral downward, retirees will have to adjust their investment portfolios, as will banks that have enjoyed the “risk-free” status of bonds. When this shift occurs, large cap dividend paying equities will benefit tremendously. The secular dividend theme remains intact given the current demographic trends and the increasing need for meaningful yield. Per market strategist Dave Rosenberg, interest income has declined by three percent over the past year as the Fed continues to enforce their near-zero interest rate policy. Even more significantly, he adds that “since the Fed embarked on this massive rate-cutting campaign in late 2007, interest income for the household sector has collapsed $350 billion or by more than 25%.” Dividends are going to become more and more compelling particularly if bonds start to depreciate in the face of investors receiving these ultra-low current yields. Also, according to JPMorgan equity strategist, the relative valuation of equities is much more attractive when compared to bonds. Currently, equities have a price-to-earnings ratio of 12.4x, which is much more favorable than high-yield bonds at 13.7x, or high grade credit at 25x, or treasury bonds at a staggering 50x P/E multiple! Needless to say, bonds appear more likely to offer “return-free” risk than “risk-free” returns. As well-known investor John Mauldin points out in his recent book, renowned economist Hyman Minsky stated that “stability leads to instability. The longer a given condition or trend persists (and the more comfortable we get with it), the more dramatic the correction will be when the trend fails. Thus, says Minsky, the longer the period of stability, the higher the potential risk for even greater instability when market participants must change their behavior.”

Rosenau/Paul is a team of investment professionals registered with HighTower Securities, LLC, member FINRA, MSRB and SIPC & HighTower Advisors, LLC, a registered investment advisor with the SEC. All securities are offered through HighTower Securities, LLC and advisory services are offered through HighTower Advisors, LLC.

This document was created for informational purposes only; the opinions expressed are solely those of the author, and do not represent those of HighTower Advisors, LLC or any of its affiliates. In preparing these materials, we have relied upon and assumed without independent verifications, the accuracy and completeness of all information available from public and internal sources. HighTower shall not in any way be liable for claims and make no expressed or implied representations or warranties as to their accuracy or completeness or for statements or errors contained in or omissions from them.

This is not an offer to buy or sell securities. No investment process is free of risk and there is no guarantee that the investment process described herein will be profitable. Investors may lose all of their investments. Past performance is not indicative of current or future performance and is not a guarantee. Carefully consider investment objectives, risk factors and charges and expenses before investing.