Bond Funds Come In All Types And Risk Levels

Post on: 30 Май, 2015 No Comment

What they are

Bond funds are mutual funds that invest exclusively in debt issued by corporations, governments, government-sponsored enterprises or government agencies.

They typically follow a certain investment objective while sticking with a minimum credit quality and similar maturities. The maturities may not be exactly the same; they may span a range. For instance, short-term bond funds may hold issues with maturities ranging from one to three years.

How they work

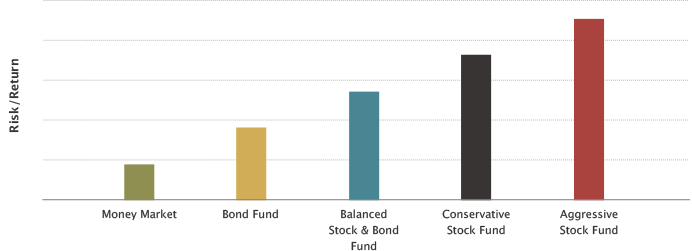

Like equity mutual funds, bond funds can be narrowly focused on high-quality, safe investments or they can be all over the map, pulling in bonds from emerging markets, asset-backed securities, high-yield and investment-grade corporate bonds.

Advantages and disadvantages

Investors who would otherwise have a difficult time entering the bond market get professional management of a diverse set of fixed-income securities. The disadvantage is that fund managers can buy and sell securities without holding them to maturity, so investors have little protection against interest rate risk.

When the Federal Reserve increases interest rates, then the price of existing bonds drops. This doesn’t bode well for bonds held in mutual funds. The value of those bonds drops as interest rates rise, so the value of the mutual fund as a whole also declines.

Today’s uncertain rate environment points to the need to stay toward the short end of the yield curve, as longer-dated bonds will be more impacted by interest rate increases.

We should be essentially medium-term on average in the bond funds we use, and as interest rates rise we should be ready to shorten that up even further, says Robert Fragasso, CFP, chairman and CEO of Fragasso Financial Advisors in Pittsburgh.

Warning

For the past 30 years, bonds have enjoyed a great run, but experts predict that a change may be on the horizon.

I’m avoiding anything with a government guarantee because the central bank is buying that debt and artificially pushing those (yields) down, says Larkin.

The yields are too low on mortgage-backed securities, U.S. agencies and U.S. Treasuries. In a 5 percent inflation environment, things could change very abruptly, and some of the losses could be quite substantial, he says.

For investors who cannot risk losing any principal, Larkin suggests earning close to zero is preferable to investing in bond funds.

The risks are rising that the change might be coming, he says.

Considerations

For a small portion of their fixed-income portfolio, investors may want to consider bond funds with an unrestrained strategy — they typically fall into the Morningstar category of multisector bond funds. These funds go further afield than a traditional bond fund, picking up currencies and derivatives such as futures contracts and swap agreements. Plus they hold bonds of varying credit quality from corporations in the U.S. foreign countries and emerging markets.

Using one of these funds for a piece of your portfolio could add some diversity and let professionals do the legwork.