Bond ClosedEnd Funds Good Or Bad

Post on: 24 Апрель, 2015 No Comment

by Harry Sit on May 19, 2014 4 Comments

Reader Rosemarie asked me to comment on closed-end funds. because they are sort of a stepchild that everybody ignores in favor of the more popular open-end mutual funds and ETFs. A few weeks ago TIAA-CREF announced it was buying Nuveen, which is a large player in muni bond closed-end funds. Does that mean closed-end funds are having a comeback?

Last summer muni bond ETFs were selling at a large discount (2-3%). I sold from a Vanguard muni bond fund and bought into an iShares muni ETF. A reader commented that muni bond closed-end funds were selling at an even larger discount. The example given was Nuveen Premium Income Municipal Fund 2 (ticker NPM), which invests in long-term muni bonds. It traded at a 10% discount to its net asset value.

Im going to use NPM as an example to show how closed-end funds work and how they are better or worse than the traditional open-end mutual funds and ETFs.

Managed Investment Pool

Like open-end mutual funds and ETFs, closed-end funds invest in a pool of individual investments. This creates diversification. NPM for example invests in more than 400 muni bonds from issuers all over the country.

Traded On Exchange

Like ETFs, closed-end funds trade on the stock exchange. You place orders through a brokerage account. You trade with existing shareholders of the fund, not with the fund itself as you do in an open-end mutual fund. Unlike ETFs, the prices of a closed-end fund can deviate from its net asset value by a large margin for a long time.

Premium and Discount to NAV

Part of the appeal of a closed-end fund is that its possible to buy assets on the cheap. You can pay 90 cents on the dollar but have 100 cents earning interest for you. If the 10% discount narrows to a 2% discount or it turns into a premium, as it sometimes happens, you get an extra boost.

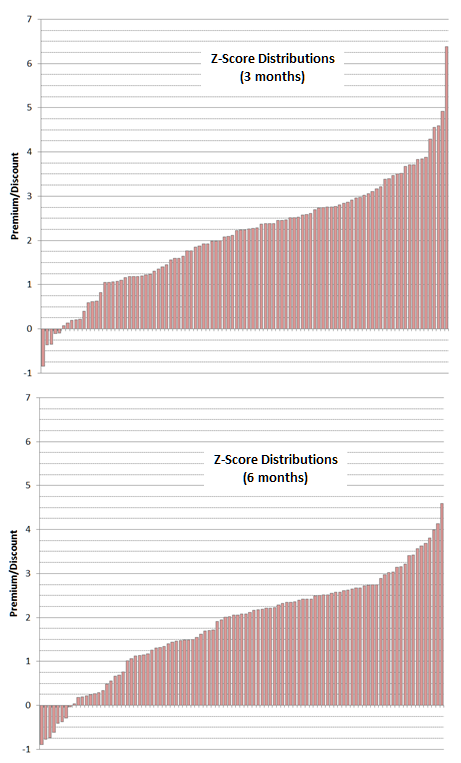

This chart shows the premium/discount on NPM since 1992:

It makes you want to buy when its trading at a large discount and sell when the discount narrows.

High Distribution Yield

Another appeal of a closed-end fund is the high distribution yield. NPM has a 6% distribution yield, tax free. By comparison the distribution yield on Vanguards long-term muni bond fund is only 4%.

Leverage

How does a closed-end fund get a 6% distribution yield when a similar open-end fund only gets 4%? It invests borrowed money.

NPM borrows money at short-term variable rates. It invests the borrowed money in long-term muni bonds. About 30% of the fund is borrowed. Short-term rates are low and long-term rates are high. The difference is paid to the fund investors as the extra yield.

Leverage of course increases risk. If long-term bonds are down, you are down more. The borrowing cost can increase at the same time, giving you a double whammy.

High Management Fees

Closed-end funds typically have a higher management fee. NPM has a 1.02% expense ratio, whereas Vanguard charges 0.12% on its long-term muni bond fund. When you pay extra 0.9% to the manager every year, your 10% discount to net asset value wears off over time.

Good or Bad?

Are closed-end funds good or bad? For what its worth, I dont invest in any.

On the other hand, Professor Burton Malkiel, author of the investing classic A Random Walk Down Wall Street. likes them. He said buy them when the discount to net asset value is large enough.

The discount to net asset value introduces an element of risk and opportunity. If you buy at a large enough discount and the discount is smaller when you sell, you benefit. However, you never know whether the large enough discount will become larger when you sell.

You pay a higher management fee while you hold the fund. If you are going to buy-and-hold the fund for a long time, its unlikely that the discount on the initial purchase will be large enough to overcome the higher expense ratio for years on end. You are back to timing the discount on your trades. Good luck with that!

The leverage produces a positive return most of the time. Risky assets have a higher expected return than the short-term borrowing cost. Chances are the fund can borrow at a lower cost than you can. With mental accounting, you can pair the higher management fee with the lower borrowing cost and call it a wash. You are paying them to help you borrow short and lend long.

The question is whether you want to invest borrowed money to begin with. Theres nothing wrong with it if you want the risk. Investing other peoples money for a higher return to yourself is a classic way to make money. Even Microsoft and Apple sell bonds to fund their business. Just remember it also magnifies your losses.

NPM had a higher return and a higher risk than Vanguards long-term muni bond fund in the last 10 years. It lost 21% in 2008 when the Vanguard fund lost only 5%. It made 40% in 2009 when the Vanguard fund made only 14%. The larger gain in 2009 made up for the larger loss in 2008.

I stick with the less exciting open-end mutual funds and ETFs, but thats just me. If you dont mind the thrill ride, theres a chance for a higher return.

[Photo credit: Flickr user Mary St George]

See All Your Accounts In One Place

Track your net worth, asset allocation, and portfolio performance with free financial tools from Personal Capital .